The nomination of the Federal Reserve Chairman is imminent, and a dovish candidate may ignite a Christmas rally in the crypto market.

Author: Yuuki, Deep Tide TechFlow

Original Title: Who Would Be the Most Beneficial Federal Reserve Chair for the Crypto Market? Analysis of Candidate List and Key Timelines

The current term of Federal Reserve Chair Jerome Powell will expire in May 2026. Yesterday, U.S. Treasury Secretary Bessent revealed that Trump is highly likely to announce the nominee for the next Federal Reserve Chair before Christmas. The monetary policy stance of the Fed Chair will largely influence the pace and endpoint of future rate cuts. As the crypto market is the most sensitive to liquidity and interest rates, whether the next Fed Chair is dovish or hawkish is crucial. This article provides an overview of the policy stances of the current popular candidates, the impact of their selection on the crypto industry, their likelihood of being chosen, and key timelines.

1. Kevin Hassett: The Most Dovish Candidate, Trump’s Economic Advisor (Most Bullish)

Hassett is the former Chairman of the White House Council of Economic Advisers and a core economic advisor to Trump, making him a candidate who could bring Trump’s will for rate cuts into the Federal Reserve. He has publicly expressed support for deeper and faster rate cuts to stimulate economic growth; at the same time, he has a friendly attitude toward the crypto market, viewing bitcoin as a tool to hedge against inflation, and may promote relaxed regulation for the crypto market. If Hassett is elected Fed Chair, it would be an absolute positive for the crypto market, which is highly sensitive to high interest rates. Rapid and significant rate cuts would bring the next liquidity bull market for risk assets.

2. Kevin Warsh: The Most Hawkish Candidate, Supports CBDC and Opposes Decentralization (Most Bearish)

Warsh is a former Federal Reserve Governor and a fellow at the Hoover Institution. His monetary policy stance has long been hawkish, favoring tightening and prioritizing inflation control (and advocating for reducing the central bank’s balance sheet). If he takes office, he may delay or restrict a rapid decline in interest rates, thereby suppressing the valuation and capital inflow of crypto risk assets. Warsh has also publicly supported the development of a U.S. CBDC (central bank digital currency). For crypto fundamentalists who pursue decentralization and censorship resistance, Warsh’s appointment would also be bearish.

3. Christopher Waller: Steady Candidate, Supports Stablecoins (Neutral)

Waller is a current Federal Reserve Governor with a moderately dovish monetary policy stance, supporting gradual rate cuts. He has publicly stated that digital assets can serve as a supplement to payment tools and believes that, under proper regulation, stablecoins can enhance the status of the U.S. dollar. Waller’s steady style may limit the occurrence of significant easing. If he takes office, the evolution of future interest rate paths would require further analysis of the overall composition of voting members.

4. Rick Rieder: Neutral to Dovish, Bullish for BTC and Other Mainstream Assets (Bullish)

Rieder is BlackRock’s Global Chief Investment Officer of Fixed Income, directly controlling the allocation of trillions of dollars. His monetary stance is neutral to dovish, emphasizing that the Fed should remain cautious and flexible after reaching a neutral interest rate. He also believes that in an environment where traditional asset correlations are converging, cryptocurrencies have unique hedging and risk-averse value, calling bitcoin the gold of the 21st century. If he takes office, it may attract institutional capital allocation to the crypto market, smooth out crypto market volatility, and benefit BTC and other mainstream crypto assets.

5. Michelle Bowman: Hawkish Candidate, Rarely Comments on the Crypto Market (Bearish)

Bowman is a current Federal Reserve Governor. Her hawkish monetary policy stance is even stronger than Warsh’s. Despite widespread market expectations for rate cuts and pressure from the Trump administration, she has explicitly advocated for maintaining high interest rates for a longer period and has repeatedly stated that further rate hikes are not ruled out. If she takes office, it would undoubtedly be a substantial negative for the crypto market and risk assets.

Current Likelihood of Each of the Five Candidates Being Selected

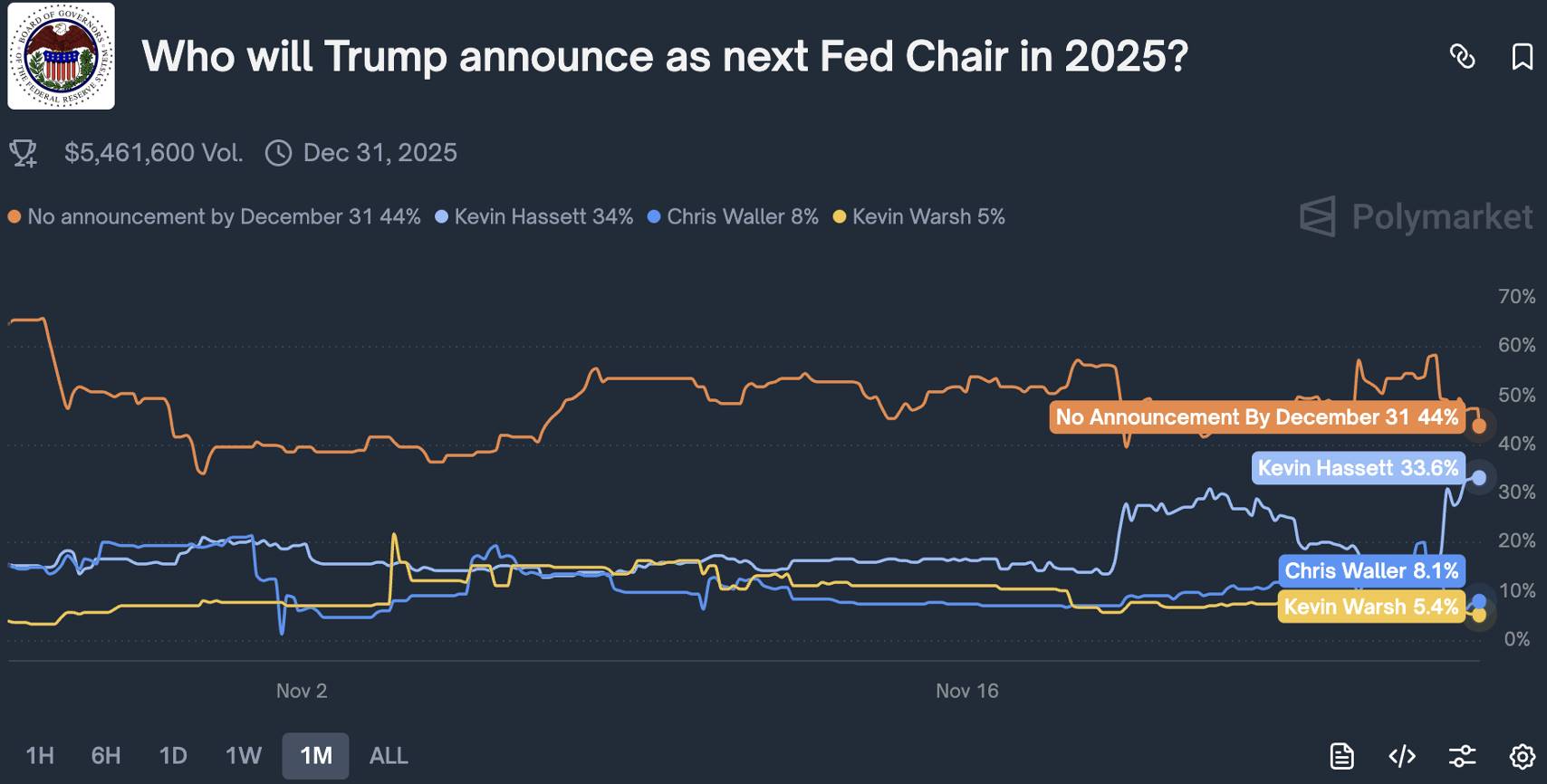

This event is currently at the presidential nomination stage. On the prediction market Polymarket, Kevin Hassett leads with a 52% probability of nomination, and Bloomberg’s exclusive report also names Hassett as the frontrunner. Second is Christopher Waller with a 22% probability; third is Kevin Warsh with a 19% probability; followed by Rick Rieder at 2%; and Michelle Bowman at 1%.

Key Timelines to Watch

The replacement of the Federal Reserve Chair requires two stages. The first stage is for Trump’s team to interview and screen candidates and determine the final nominee—there will only be one nominee. According to Treasury Secretary Bessent, Trump will officially announce the nominee before Christmas. If Hassett is nominated, the crypto market is highly likely to see a Christmas rally. The second stage is for the nominee to be confirmed by a Senate vote; the Senate is expected to hold hearings in January–February 2026, with committee and full votes in March–April. It is worth noting that there is still a 32% probability on Polymarket that Trump will not officially announce the nominee in December.

Summary: Currently, Hassett leads in probability of being selected, but this has not yet been reflected in bond yields and risk asset prices. Continued attention to the progress of this event is needed. In the short term, if Trump confirms Hassett’s nomination before Christmas, the crypto market is highly likely to see a Christmas rally; in the long term, the monetary policy stance of the next Federal Reserve Chair will directly affect the price performance of risk assets over the next four years.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Russia Plans to Ease Digital Asset Investment Thresholds, Expanding Legal Participation of Citizens in the Crypto Market

Russia plans to relax the investment threshold for digital assets, Texas allocates $5 million to Bitcoin ETF, an Ethereum whale sells 20,000 ETH, Arca's Chief Investment Officer says MSTR does not need to sell BTC, and the S&P 500 Index may rise by 12% next year. Summary generated by Mars AI. The accuracy and completeness of this summary produced by the Mars AI model are still being iteratively updated.

x402 The most crucial piece of the puzzle? Switchboard aims to rebuild the "oracle layer" from scratch

Switchboard is an oracle project within the Solana ecosystem and proposes to provide a data service layer for the x402 protocol. It adopts a TEE technology architecture, is compatible with x402 protocol standards, supports a pay-per-call billing model, and removes the API Key mechanism, aiming to build a trusted data service layer. Summary generated by Mars AI. The accuracy and completeness of this content, generated by the Mars AI model, is still in an iterative update phase.

Who would be the most crypto-friendly Federal Reserve Chair? Analysis of the candidate list and key timeline

Global markets are closely watching the change of Federal Reserve Chair: Hassett leading the race could trigger a crypto Christmas rally, while the appointment of hawkish Waller may become the biggest bearish factor.