Aster Price Speculation Raises Bullish Elliott Wave Signals

- Aster price reflects bullish signals despite no official confirmation.

- Market speculation drives narrative without primary source validation.

- Community sentiment is mixed amidst observed volatility.

No primary source has confirmed Aster’s potential bullish Elliott Wave structure or bottom development. Reports are based on independent analysts, like TraderSZ and Crypto Tony, whose opinions drive the narrative without official project or institutional endorsement.

Aster’s price speculation reveals potential bullish Elliott Wave signals, yet lacks official confirmation or statements from its project leaders or major exchanges as of November 25, 2025.

Speculative analysis suggesting an Elliott Wave formation in Aster could influence trading decisions, though market lacks substantial confirmations from authoritative sources.

Aster’s recent price rumors center around an unconfirmed Elliott Wave structure that is discussed primarily by crypto news outlets and traders. No primary sources from Aster’s project team have made official statements confirming a bullish stance.

Prominent figures like TraderSZ and Crypto Tony have independently expressed insights pointing at potential bullish retracement and price targets. These views, however, remain as individual interpretations rather than project-backed analyses.

“Opened a swing long on $ASTER, targeting $2.50, $3.00, and $3.50 on the upside. Watching for higher lows and bullish structure confirmation.” — TraderSZ, Crypto Trader, November 22, 2025

The market’s psychological effect from these analyses shows mixed results among traders. Despite temporary spikes in trading interest, no significant institutional backing or regulatory developments impact Aster at this time.

Speculation-driven moves may only provide short-term market fluctuations until more robust data or official communications from the Aster team emerge. Historical trends indicate past rallies were driven by external sentiment, illustrating the influence of speculative KOL analyses. The market awaits official updates for substantial confirmation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP ETFs Draw $600M in Investments, Yet Price Remains Stuck Under $2.20 Barrier

- XRP ETFs approved by NYSE, including Franklin Templeton's XRPZ and Grayscale's GXRP , attracted $600M in combined inflows as institutional demand grows for Ripple's token. - Regulatory milestone enables structured institutional access to XRP, with Franklin Templeton's $62.59M and Grayscale's $67.36M inflows highlighting traditional asset managers' crypto appetite. - XRP price remains trapped below $2.20 resistance at $2.13 despite ETF inflows, with technical analysts noting a rising wedge pattern and cri

XRP News Today: XRP Drops to $2.20 as ETF Investments Face Off Against Major Whale Sell-Offs and Derivatives Market Liquidations

- XRP fell below $2.20 despite $164M ETF inflows, showing institutional demand-price disconnection amid whale selling and derivatives liquidations. - Whale activity sold 200M XRP post-ETF launch, while RLUSD's 30-day volume surged to $3.5B, contrasting with broader crypto outflows. - Technical analysis highlights $2.20 support and $2.26 resistance, with JPMorgan forecasting $14B in XRP ETF inflows due to cross-border payment adoption. - XRP's 0.50% ETF exposure lags Bitcoin/Ethereum's 6.54%/5.5%, but deriv

Bitcoin News Update: Medium-Sized Investors Help Steady Bitcoin During ETF Outflows and Broader Economic Challenges

- Bitcoin (BTC-USD) rose above $90,000 for the first time in nearly a week, but remains down 19% month-to-date amid macroeconomic headwinds and ETF outflows. - Mid-sized holders (10–1,000 BTC) accumulated 365,000 BTC, stabilizing prices as institutional liquidity re-entered via a rare $238M ETF inflow. - Technical indicators suggest a fragile rebound, with BTC below its 365-day moving average and CryptoQuant's Bull Score Index at 20/100, signaling prolonged bearish sentiment. - Analysts highlight conflicti

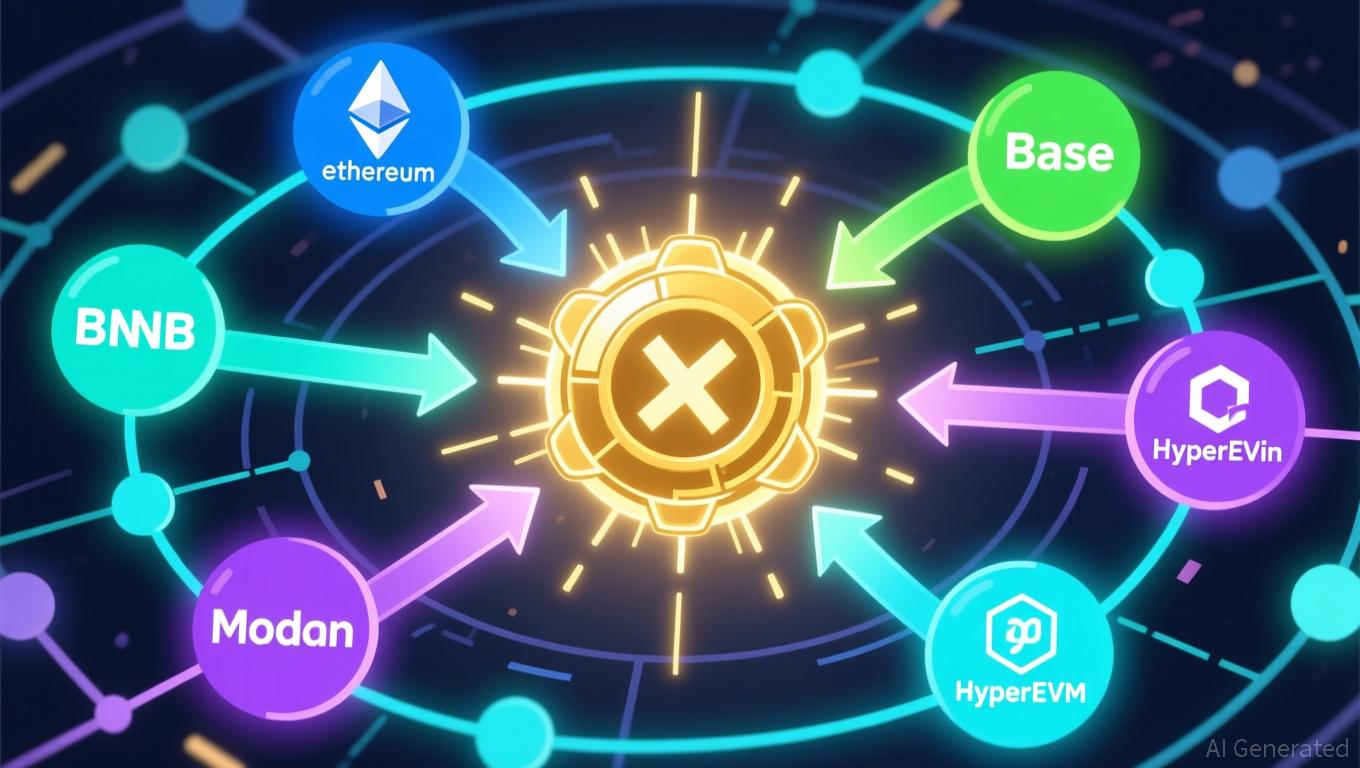

Avail’s Nexus Mainnet Brings Liquidity Together to Address Blockchain Fragmentation

- Avail launches Nexus Mainnet, a cross-chain execution layer unifying liquidity across Ethereum , BNB Chain, and other major blockchains. - The platform uses intent-based routing and multi-source liquidity aggregation to address blockchain fragmentation and inefficiencies. - Developers gain SDKs/APIs for cross-chain integration, while users benefit from simplified transactions and reduced reliance on traditional bridges. - AVAIL token coordinates the network, with future Infinity Blocks roadmap aiming to