Why ZEC Is Soaring as Institutional Attention Increases

- Zcash (ZEC) surged 461% in a month, driven by institutional demand for privacy-focused assets and post-2023 banking crisis shifts toward self-custody. - Cypherpunk Technologies' $18M ZEC purchase and Grayscale's Zcash Trust reopening highlight growing institutional validation of zk-SNARKs-based privacy. - Regulatory clarity (e.g., U.S. GENIUS Act) and ZEC's shielded pool (4.1M ZEC) underscore demand for censorship-resistant capital flows amid centralized risk exposure. - ZEC's $750 milestone and projecte

The Value of Privacy: What Sets ZEC Apart

Zcash’s standout feature—shielded transactions powered by zk-SNARKs—has always distinguished it from other cryptocurrencies. This advanced cryptography lets users confirm transactions without exposing the sender, recipient, or transaction amount, establishing a robust "censorship-resistant" framework

Major players such as

Institutional Interest: Moving Into the Mainstream

ZEC’s shielded pool, which now secures over 4.1 million ZEC in private transactions, exemplifies this transition. While these transactions are hidden from public analysis, the uptick in shielded usage

Regulatory Developments and Capital Flows

Changes in regulations throughout 2025 have further propelled ZEC’s rise. The introduction of spot

Institutional examples involving ZEC are telling. Grayscale’s decision to reopen Zcash Trust subscriptions and the

Market Trends: ZEC’s Distinct Path and Future Prospects

ZEC’s latest rally has diverged from Bitcoin’s price movements. While BTC hovered around $108,000 in October 2025,

Some analysts believe ZEC could eventually reach $10,000, though this

Conclusion: The Rise of Privacy in Crypto

ZEC’s impressive rally is a direct response to broader economic and technological changes. As organizations increasingly value privacy and direct control over assets, Zcash’s zk-SNARKs and shielded pools provide a model for secure, censorship-resistant financial transactions. While obstacles remain, the convergence of regulatory progress, institutional interest, and technical innovation positions ZEC as a noteworthy example of blockchain’s evolving landscape.

For those considering investment, the real question is not whether ZEC’s growth will last, but whether they are prepared to benefit from a market that is fundamentally transforming financial norms.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Are Digital Asset Treasuries (DATs) Just a Fading Fad?

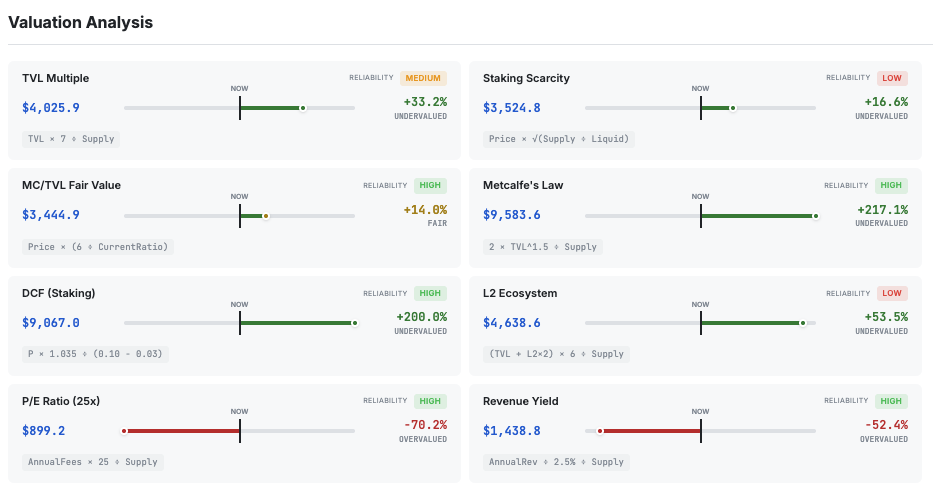

Hashed’s Simon Kim Says Ethereum Is 57% Undervalued

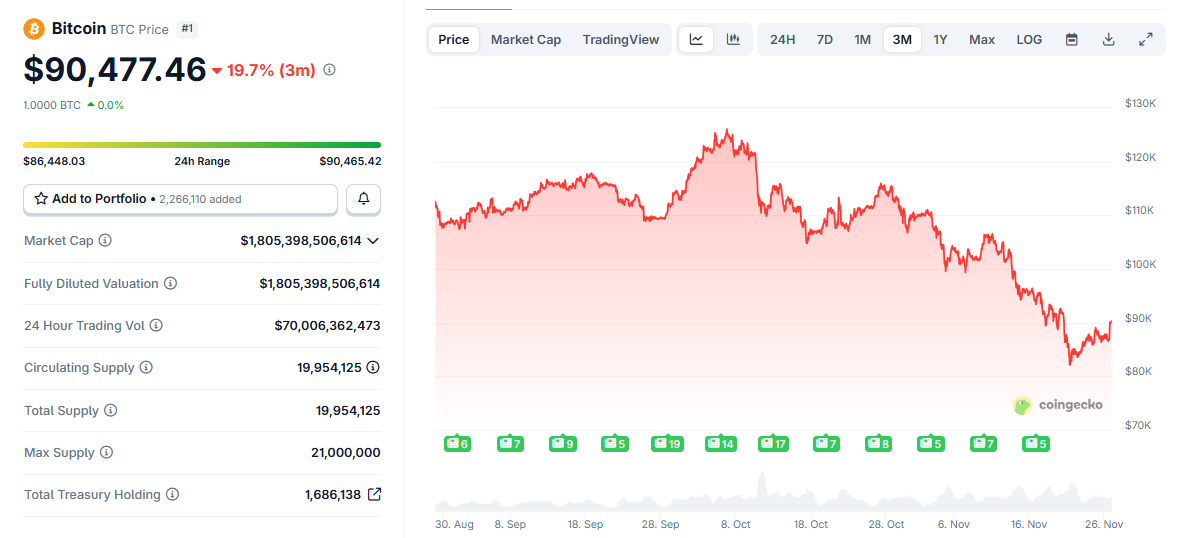

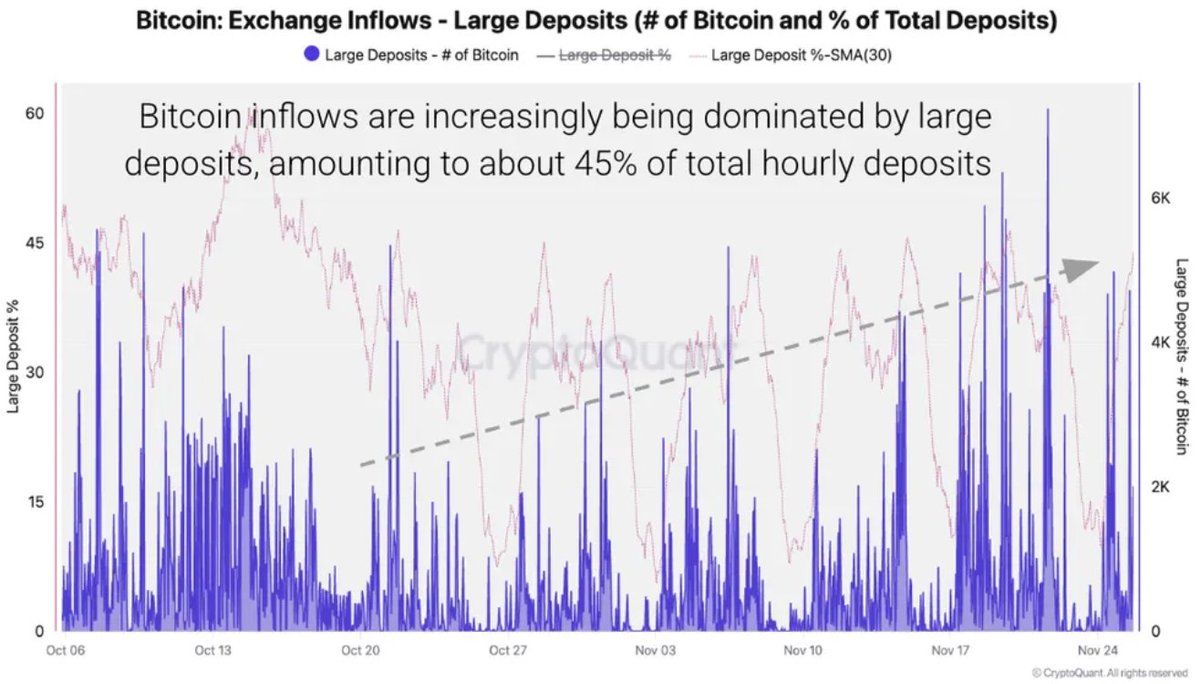

Bitcoin Breaks $90K but Exchange Data Shows Rising Selling Pressure

Global Exchanges Urge SEC to Curb Broad Crypto Exemptions, Warn on Tokenized Stock Risks