- Solana: Institutional interest rises, DeFi inflows grow, and network upgrades support potential 2x–3x gains.

- Sei Network: Native USDC integration and TVL growth signal expanding DeFi adoption and liquidity.

- Hedera: AI partnerships and real-world tokenization boost enterprise utility and speculative market optimism.

Investors are turning their attention to altcoins showing strong institutional interest and real-world utility. Solana, Sei, and Hedera have caught the eye of traders seeking high-risk, high-reward opportunities. Recent developments in network upgrades, DeFi adoption, and enterprise partnerships signal potential gains. With smart money positioning ahead of broader market moves, these Layer-1 protocols may offer 2x to 3x returns.

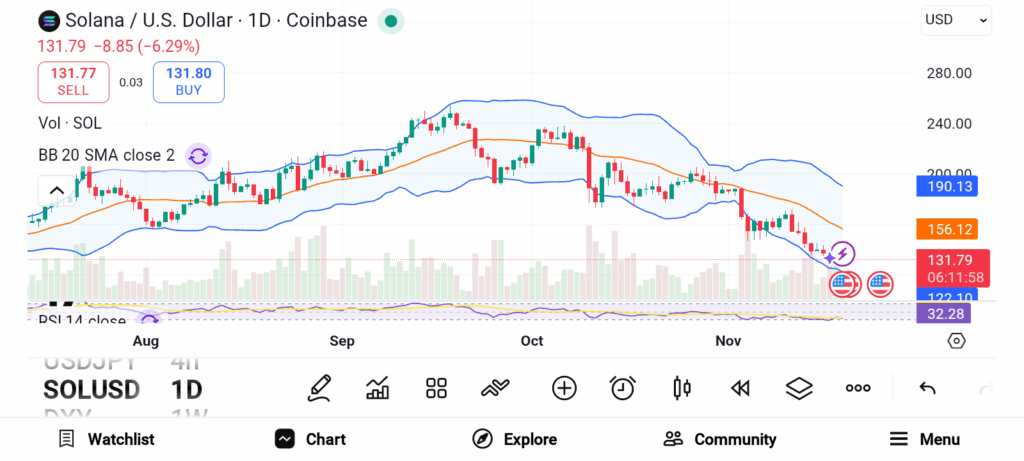

Solana (SOL)

Source: Trading View

Source: Trading View

Solana Network has seen renewed attention from institutions, fueled partly by talk of a U.S.-based spot ETF. Developer participation has reached the highest levels since late 2022. This increase coincides with improved network stability and lower transaction costs. Rising inflows into Solana-based DeFi protocols indicate growing confidence among investors. Some firms are projecting returns of six times as upcoming network upgrades take effect. With Layer-1 competition heating up, Solana’s performance metrics are becoming increasingly significant.

The network’s ecosystem supports consumer-facing dApps, NFT marketplaces, and payment solutions. Solana Pay adoption and ecosystem expansion continue to attract developer and investor interest. Technical upgrades and increased throughput strengthen the case for further institutional engagement. Traders see a combination of fundamental improvements and speculative narratives driving potential short- to mid-term gains.

Sei Network (SEI)

Source: Trading View

Source: Trading View

Sei Network has gained attention after integrating native USDC, allowing faster and cheaper stablecoin settlements. The development enhances the network’s capacity for high-frequency trading and liquidity movement. Total value locked on Sei has jumped 188% quarter-over-quarter, reflecting growing DeFi adoption and developer activity. Institutional participation also supports this growth trend.

The network’s architecture positions it for broader adoption as real-time settlement networks gain traction. Native stablecoins on the chain help streamline DeFi applications and cross-border liquidity. Traders are viewing Sei as a potential sleeper pick with strong fundamentals supporting future gains. Growth in TVL and expanding ecosystem activity suggest continued upside potential for the token.

Hedera (HBAR)

Source: Trading View

Source: Trading View

Hedera’s enterprise-focused network benefits from partnerships in artificial intelligence and real-world asset tokenization. ISO 20022 compatibility adds to optimism about future integration into mainstream financial infrastructure. The network’s over $2 billion in TVL demonstrates significant adoption. Quantum-proof technologies and modular scalability features are under development, highlighting a focus on long-term sustainability.

Speculative exposure linked to ETF narratives also boosts market interest. Hedera continues to attract developers and institutions seeking scalable, enterprise-grade blockchain solutions. Analysts note that growth in DeFi and real-world asset tokenization could drive further adoption and support price appreciation. The combination of technical innovation and practical use cases gives HBAR potential for strong returns.

Solana shows strong institutional activity, developer engagement, and network upgrades supporting potential gains. Sei strengthens stablecoin infrastructure, TVL growth, and DeFi adoption indicate upside. Hedera expands AI partnerships, real-world tokenization, and scalable enterprise solutions for future growth.