Bolivia’s Digital Currency Bet: Navigating Volatility with Stable Solutions

- Bolivia's government permits banks to custody cryptocurrencies and offer crypto-based services, reversing a 2020 ban to combat inflation and dollar shortages. - Stablecoin transactions surged 530% in 2025, with $14.8B processed as Bolivians use USDT to hedge against boliviano depreciation (22% annual inflation). - State-owned YPFB and automakers like Toyota now accept crypto payments, while Banco Bisa launches stablecoin custody to expand financial inclusion for unbanked populations. - The policy faces c

Bolivia has made a significant move to incorporate cryptocurrencies and stablecoins into its official banking sector, ending a ten-year ban on digital currencies. On November 26, 2025, Economy Minister Jose Gabriel Espinoza revealed that banks will now be allowed to hold cryptocurrencies for clients and provide crypto-related services such as savings accounts, credit cards, and loans. This policy, introduced as a response to persistent inflation, a shortage of US dollars, and the drive for economic modernization, places Bolivia as

This change in direction comes after the June 2024 repeal of a 2020 ban on crypto transactions, which sparked a rapid increase in usage. From July 2024 to June 2025, Bolivians conducted $14.8 billion in stablecoin and crypto transactions,

Both businesses and government agencies are adjusting quickly. YPFB, the state-owned energy firm, has announced intentions to use crypto for importing energy, while carmakers such as Toyota and BYD

The adoption of stablecoins is also viewed as a way to boost financial inclusion. With 86% of recent crypto transactions involving individuals rather than companies, the new policy is designed to give unbanked citizens access to stable, dollar-linked assets

Although the initial rollout centers on stablecoins, the government has not yet granted legal tender status to more volatile cryptocurrencies like Bitcoin. Espinoza stated that any future expansion will depend on regulatory progress and the outcomes of this first stage

This initiative highlights a wider global trend where countries are turning to crypto to address economic uncertainty. For Bolivia, embracing stablecoins is both a practical solution to current challenges and a bold step toward modernizing its financial sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fluence-TON Agreement Eliminates "Cost Barrier" for Blockchain Entrepreneurs

- Fluence Energy joins TON's Grant Program to offer blockchain/AI developers high-performance compute credits, slashing infrastructure costs by up to 85% via AMD Zen5 and NVIDIA GPUs. - The initiative supports three credit tiers ($2k–$10k) with 6–12 month validity, targeting early-stage projects while Fluence reports $2.3B FY2025 revenue and 50% 2026 growth forecast. - Leveraging Fluence's enterprise-grade global infrastructure, the partnership optimizes compute-intensive tasks like TON node operations and

Top 5 Altcoins to Buy in December 2025

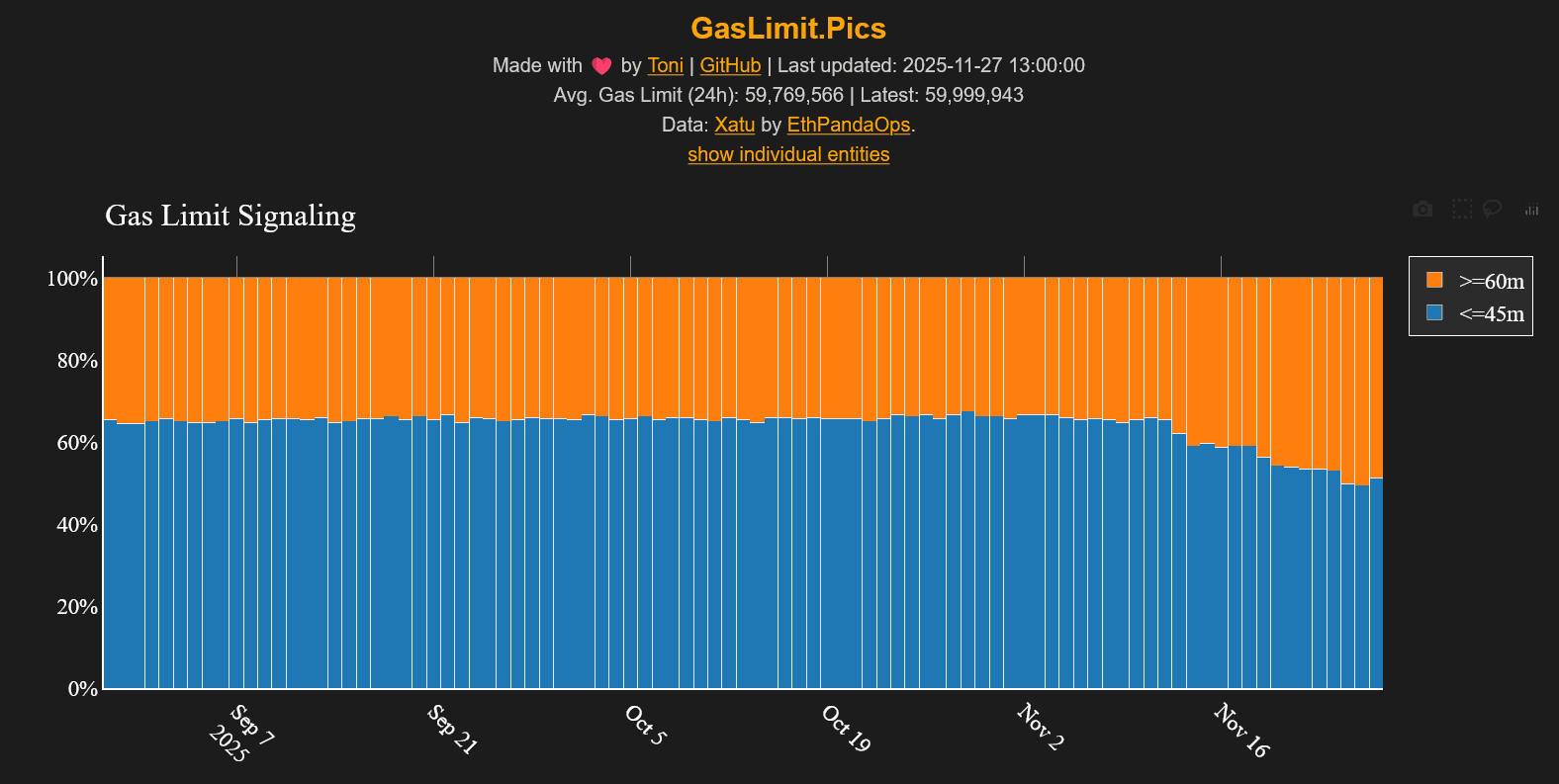

ETH Gas Limit Jumps to 60M and the Timing Is Wild

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v