Switzerland's Postponement of Crypto Tax Highlights Worldwide Regulatory Stalemate

- Switzerland delays crypto tax data sharing until 2027 due to ongoing political negotiations over OECD CARF partner jurisdictions. - Revised rules require crypto providers to register and report client data by 2026, but cross-border data exchange remains inactive until 2027. - Global alignment challenges exclude major economies like the U.S., China, and Saudi Arabia from initial data-sharing agreements. - Domestic legal framework passed in 2025, but partner jurisdiction negotiations delay implementation u

Switzerland will not start sharing cryptocurrency tax information with foreign authorities until 2027, even though the legal framework is scheduled to be in force from January 2026, according to the Federal Council’s announcement on Wednesday. The postponement is due to ongoing political discussions to determine which partner countries will be included under the OECD’s Crypto-Asset Reporting Framework (CARF). These new regulations are designed to subject crypto assets to the same international tax transparency requirements as traditional financial accounts, but their rollout depends on resolving cross-border coordination challenges.

The updated ordinance, which received approval from the Federal Council, requires crypto service providers to register, conduct due diligence, and report client information if they have substantial ties to Switzerland. These obligations are consistent with the OECD’s 2023 AEOI standards for crypto assets, which

This postponement highlights the broader difficulties in achieving global consistency for crypto tax regulations. Switzerland intends to exchange information with 74 jurisdictions—including all EU countries, the UK, and most G20 members—but the U.S., China, and Saudi Arabia are not included at this stage due to either non-adherence to CARF or the absence of reciprocal agreements. Since 2024, the Federal Council has been in talks with 111 jurisdictions, but full mutual alignment has yet to be reached. For crypto businesses, the revised regulations introduce a transition phase: service providers must comply with new requirements by 2026, even though data sharing will not begin until 2027.

The postponement illustrates the challenges major economies face in synchronizing crypto transparency measures. Switzerland’s domestic AEOI legal framework was passed by the Federal Assembly in 2025, but parliamentary discussions regarding partner countries will not finish until 2026. This delay highlights the difficulty of balancing strict regulation with diplomatic considerations in the crypto industry. Meanwhile, the OECD’s expanded AEOI program, which builds on existing financial account reporting standards, has been adopted by more than 100 countries, marking a move toward coordinated global crypto tax oversight.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fluence-TON Agreement Eliminates "Cost Barrier" for Blockchain Entrepreneurs

- Fluence Energy joins TON's Grant Program to offer blockchain/AI developers high-performance compute credits, slashing infrastructure costs by up to 85% via AMD Zen5 and NVIDIA GPUs. - The initiative supports three credit tiers ($2k–$10k) with 6–12 month validity, targeting early-stage projects while Fluence reports $2.3B FY2025 revenue and 50% 2026 growth forecast. - Leveraging Fluence's enterprise-grade global infrastructure, the partnership optimizes compute-intensive tasks like TON node operations and

Top 5 Altcoins to Buy in December 2025

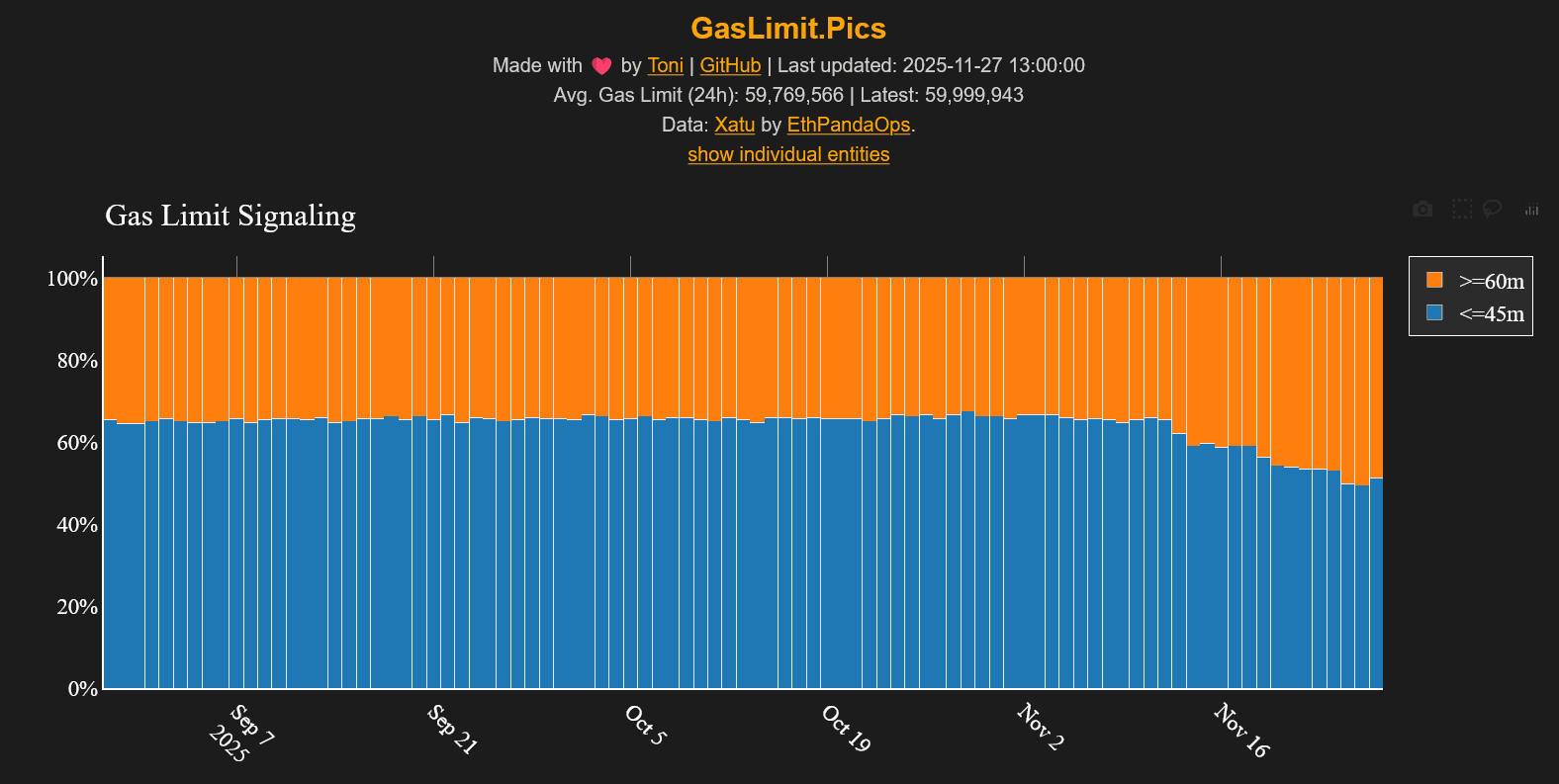

ETH Gas Limit Jumps to 60M and the Timing Is Wild

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v