Visa and AquaNow Upgrade Payment Infrastructure through Stablecoin Integration

- Visa partners with AquaNow to expand stablecoin settlement in CEMEA via USDC , aiming to cut costs and settlement times. - The initiative builds on a $2.5B annualized pilot program, leveraging stablecoins to modernize payment infrastructure. - Visa's multicoin strategy aligns with industry trends, as regulators and competitors like Mastercard also explore stablecoin integration. - Regulatory progress in Canada and risks like volatility highlight evolving opportunities and challenges in digital asset adop

Visa Inc. (NYSE: V) has broadened its stablecoin settlement services across Central and Eastern Europe, the Middle East, and Africa (CEMEA) by joining forces with AquaNow, a digital asset platform focused on liquidity and infrastructure. This partnership brings together AquaNow’s technology and Visa’s global payments network, allowing financial institutions to complete settlements using approved stablecoins such as

This collaboration builds on Visa’s 2023 pilot, which enabled clients to settle in USDC. Since its launch, the program has reached an annualized transaction volume of $2.5 billion. Godfrey Sullivan, Visa’s Head of Product and Solutions for CEMEA, noted that this marks progress in updating the “back-end rails of payments,” reducing dependence on legacy systems and equipping institutions for the future of money transfers

Visa’s overall approach involves supporting a range of stablecoins and blockchains within its settlement platform. Rubail Birwadker, Visa’s Global Head of Growth Products and Strategic Partnerships, highlighted the company’s aim to build a “multicoin and multichain foundation” to meet the needs of partners worldwide. This strategy was echoed during Visa’s Q3 2025 earnings call, where CEO Ryan McInerney spoke about the rising demand for stablecoins in cross-border payments and the significance of

This partnership also mirrors a broader industry movement, with major firms like Mastercard exploring stablecoin adoption. AquaNow’s experience in Canadian crypto infrastructure, especially its work connecting trading platforms to global markets, makes it a pivotal player in this transition.

Regulatory progress further highlights the sector’s momentum. For example, Canada’s QCAD Digital Trust has recently secured approval for a compliant Canadian dollar stablecoin, reflecting a more mature regulatory environment for digital assets

With stablecoins expected to transform global payments, Visa’s latest expansion underscores its dedication to innovation. The company’s infrastructure now accommodates more than 25 fiat currencies worldwide, strengthening its leadership in digital money movement. As Sullivan remarked, the partnership with AquaNow is a “key step” in redefining how institutions engage with the changing financial landscape

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fluence-TON Agreement Eliminates "Cost Barrier" for Blockchain Entrepreneurs

- Fluence Energy joins TON's Grant Program to offer blockchain/AI developers high-performance compute credits, slashing infrastructure costs by up to 85% via AMD Zen5 and NVIDIA GPUs. - The initiative supports three credit tiers ($2k–$10k) with 6–12 month validity, targeting early-stage projects while Fluence reports $2.3B FY2025 revenue and 50% 2026 growth forecast. - Leveraging Fluence's enterprise-grade global infrastructure, the partnership optimizes compute-intensive tasks like TON node operations and

Top 5 Altcoins to Buy in December 2025

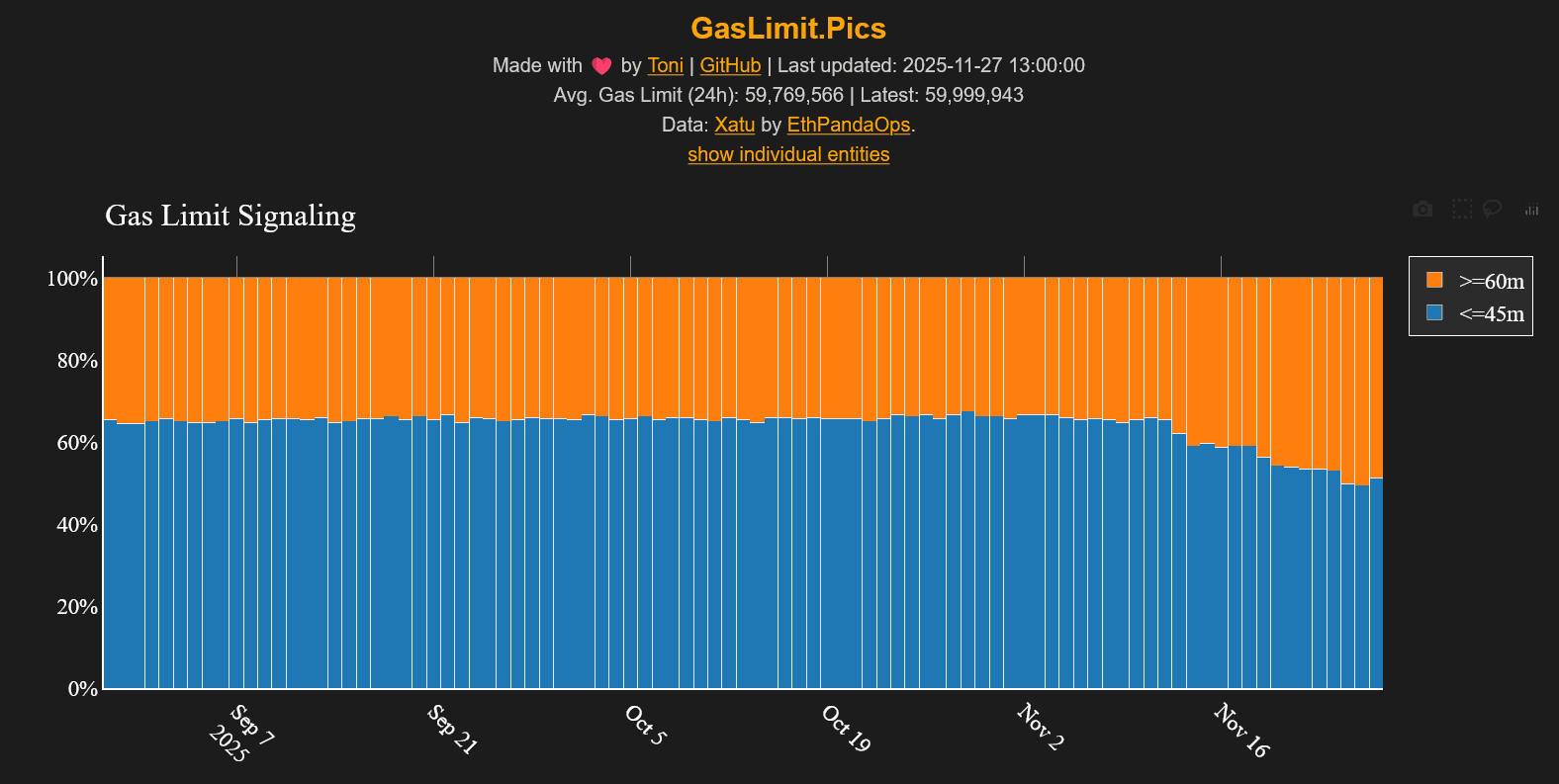

ETH Gas Limit Jumps to 60M and the Timing Is Wild

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v