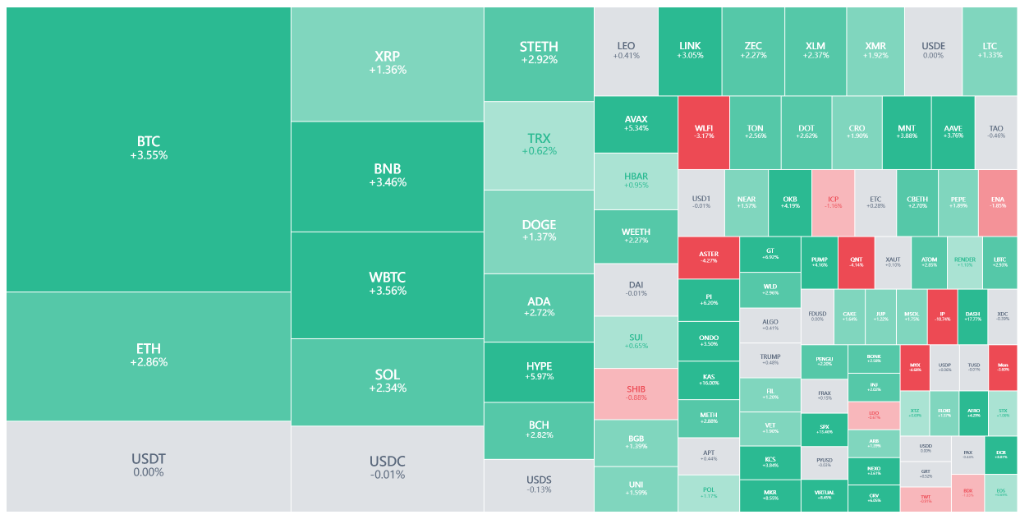

Historical data shows that in the past seven years, Bitcoin has declined before Thanksgiving in six of those years. However, this year, a sudden bullish candle broke this “tradition.” “Bitcoin returns to the $90,000 mark!” On the eve of Thanksgiving 2025, this news quickly spread among crypto asset investors.

Meanwhile, Ethereum also rose 3.5% to $3,026, and major cryptocurrencies such as Solana, XRP, and Dogecoin followed suit.

This surge was unexpected, as Bitcoin had just experienced its “worst week” not long ago, plunging more than 30% from its all-time high of $126,080 in early October, and even briefly dipping to a low of $81,000.

I. Breaking Tradition: The Mysterious Pre-Thanksgiving Rally

● Market participants have noticed that Bitcoin’s performance this year is completely different from previous years. Historical data shows that the Wednesday before Thanksgiving is usually a “weak day” for Bitcoin. From 2018 to 2024, Bitcoin declined on this day in six out of seven years, with “large-scale drops” especially notable in 2020 and 2021.

● However, this historical pattern was broken in 2025. Not only did Bitcoin rebound before Thanksgiving, but it also staged a strong recovery from recent lows. On Wednesday afternoon in the US, Bitcoin briefly touched a high of $90,331, finally stabilizing near $90,050, with a single-day gain of 3.2%.

● Counting from last Friday’s “panic bottom” near $80,000, Bitcoin has rebounded by about 12% in just a few days. This rebound stands in sharp contrast to tradition and has attracted widespread attention in the market.

II. Market Background: A Breather After the Crash

This Bitcoin rebound is not an isolated event, but occurred after the entire cryptocurrency market experienced a severe downturn. Not long ago, pessimism pervaded the market.

● In mid-November, Bitcoin fell to $80,600, marking its worst single-week performance since February. At that time, many analysts predicted that the sell-off might continue around Thanksgiving.

● This pessimistic outlook was not unfounded. Calculated from the all-time high of $126,080 in early October, Bitcoin fell by more than 30% in just over a month. This plunge also wiped out all of Bitcoin’s gains since 2025. Market sentiment plummeted to freezing point, and investors scrambled for safe havens.

III. Driving Forces: Macro Factors and Market Structure

The unusual surge in Bitcoin this time is the result of multiple factors working together.

Warming Macro Market Sentiment

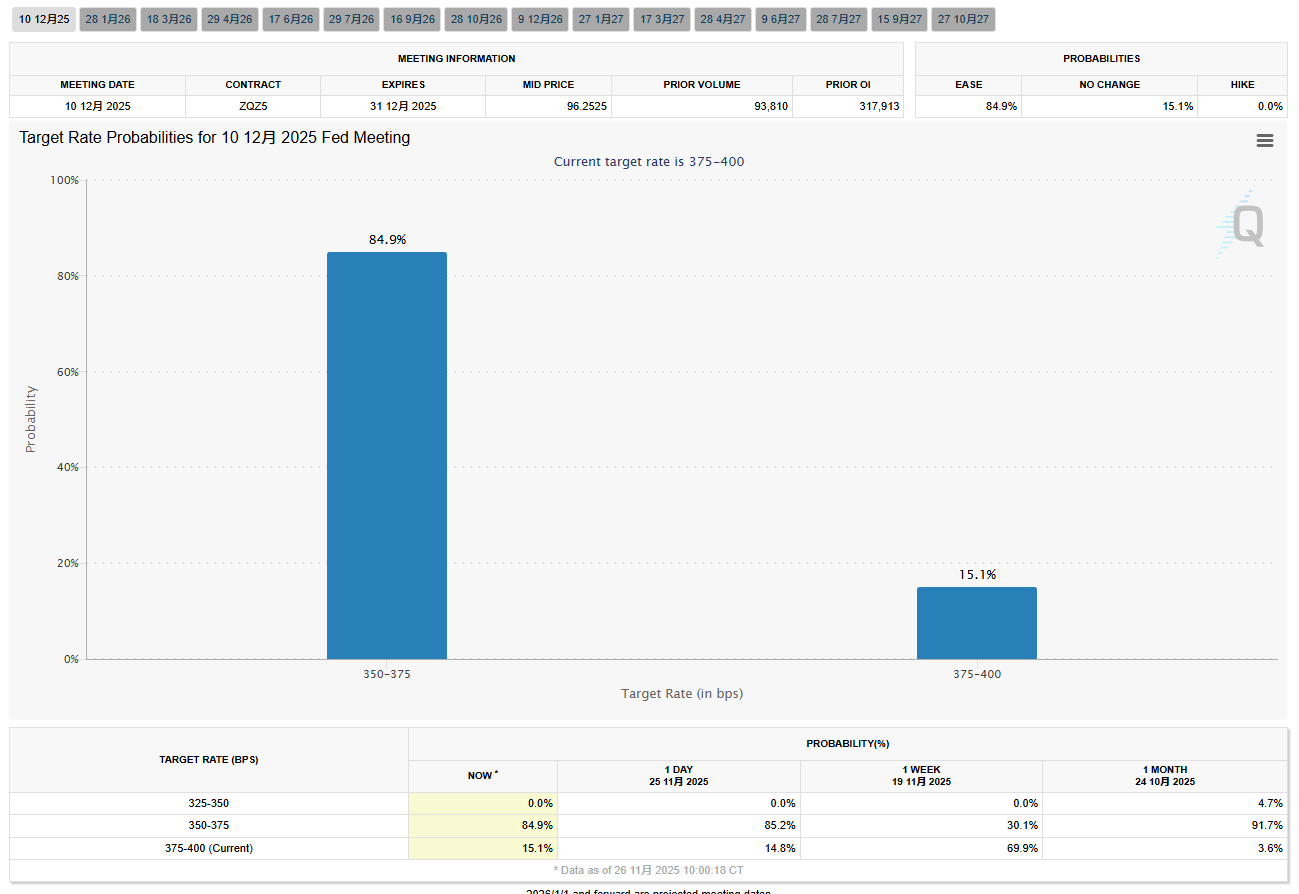

● Bitcoin’s rebound occurred in sync with the US stock market, especially tech stocks. Behind this phenomenon is the market’s growing expectation that the Federal Reserve will cut rates again in December, with the current probability forecast at 84.9%. When the Fed cuts rates, cryptocurrencies usually perform well. However, there are still disagreements in the market about whether the Fed will actually make a third rate cut in December.

Liquidity Characteristics and Market Structure

● During the Thanksgiving holiday, while traditional stock markets are closed, the cryptocurrency market continues to trade around the clock. Liquidity is relatively low during holidays, which means smaller amounts of capital can drive larger market swings.

● Adam Morgan McCarthy, head of research at crypto data provider Kaiko, pointed out: “If investors continue to close positions before the holiday, further draining liquidity, this could exacerbate price volatility.”

Technical Rebound

● From a technical analysis perspective, this rally also has the characteristics of an oversold rebound. Counting from last Friday’s low, Bitcoin has already rebounded by about 12%.

● Analysts at financial research firm Sevens Report had warned that if selling pressure continued to intensify, market concerns could turn into “full-blown panic.” Fortunately, this worst-case scenario did not occur.

IV. Market Reaction: Optimism and Caution Coexist

Signals from the Options Market

Data from the options market shows that many traders expect Bitcoin to trade within a relatively narrow range.

● Jasper De Maere, trading strategist at Wintermute, observed: “The market seems more willing to take the opposite side at both ends, rather than positioning for a breakout.” This stance sets the tone for the long weekend, during which lighter trading volumes usually limit major price moves.

Analysts’ Cautious Views

● Unlike the market’s optimism, 10x Research takes a more cautious stance. They point out: “The best fourth quarters for Bitcoin only occur when there is a clear catalyst.”

● The firm emphasizes that while seasonal factors alone may justify a bullish default stance, they “cannot identify any catalyst strong enough to support this view for 2025.”

V. A Rocky Road Ahead: Potential Risks and Challenges

Despite Bitcoin’s rebound before Thanksgiving, the market still faces multiple challenges.

Uncertainty in Macro Policy

● The direction of the Federal Reserve’s monetary policy remains the biggest variable. 10x Research believes the market may be overly focused on the probability of rate cuts while overlooking the complexity of the macro backdrop. They point out that a third consecutive rate cut without dovish forward guidance could disappoint the market.

Liquidity Pressure

● Structural issues within the cryptocurrency market itself cannot be ignored. The October crash liquidated a record $19 billions in open interest, putting enormous pressure on the market. This liquidity pressure may not have fully eased, especially with light trading volumes during the holidays.

VI. The Truth About the Thanksgiving Rally

Bitcoin’s performance around Thanksgiving has always been full of variables. Looking back at the past four years, Bitcoin’s price has experienced varying degrees of volatility during Thanksgiving, highlighting the impact of seasonal factors and sentiment on the crypto market.

● However, the Thanksgiving rally is not a reliable bullish catalyst. Historical data shows that Bitcoin’s year-end performance is mixed, and any significant rally requires substantial positive drivers, not just seasonal patterns.

● 10x Research emphasizes: “During Thanksgiving and Christmas, Bitcoin’s performance is very unstable, unlike the US stock market, which usually rises steadily during this period.” This view provides important context for understanding this year’s unusual Bitcoin rally—it may just be an exception, not the start of a new pattern.

Looking at Bitcoin’s development over more than a decade, its price movements have always been unpredictable. Some analysts remain skeptical about holiday rallies. 10x Research wrote in its report: “Although the fourth quarter is usually Bitcoin’s strongest period, every major year-end rally has been driven by a real catalyst, not just seasonal patterns.”

Looking ahead, whether Bitcoin can usher in the traditional “Santa Claus rally” in December or continue its maverick trend remains to be seen, depending on further clarity in key factors such as Federal Reserve policy and institutional capital flows.