"Sell-off" countdown: 61,000 BTC about to be dumped—why is it much scarier than "Mt. Gox"?

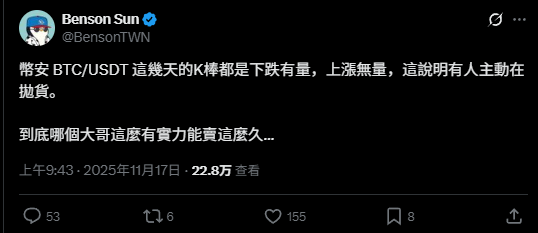

"The recent K-lines all show volume on the way down and no volume on the way up, which means someone is actively dumping."

On November 18, this comment circulating on the X platform precisely captured the shared sentiment of all traders recently. The market has fallen into a strange "suppressed" state, with every rebound appearing "weak and feeble," as if an invisible hand is continuously and mechanically selling off.

The market is panicking about the "Mt. Gox" ghost, but they may have identified the wrong "dumping culprit."

A new in-depth report based on November court documents reveals a more structural source of selling pressure that the market has overlooked: the UK government.

In the case of "Crypto Queen" Qian Zhimin, UK authorities have successfully seized and taken control of over 61,000 bitcoins. Now, all evidence suggests that the UK government is actively preparing to "liquidate" these assets, not for "value investing," but to fill its tens of billions of pounds "fiscal gap".

Unlike the Mt. Gox "HODLers" creditors, a rational, profit-driven, "nation-level whale" holding 61,000 BTC is about to become a long-term "resistance level" for the market.

Intent Confirmed: The UK Is "Tendering" for Liquidation

There were once "romantic" fantasies in the market about the fate of these 61,000 BTC.

Industry groups and commentators have publicly called for the UK government to follow El Salvador's example and include this "digital gold" in the "national strategic reserve."

However, the UK Treasury has explicitly rejected this proposal, citing "concerns about volatility."

The UK government's intention is very clear: to sell.

They are not just talking. Reports reveal that the UK Home Office, through its commercial services agency BlueLight Commercial, has issued a formal tender worth up to £40 million to £60 million.

The purpose of this tender is to establish a "cryptocurrency storage and realisation framework."

The wording in the tender documents is straightforward, seeking a "SaaS-based custody and trading service" to achieve the "sale" (realisation) of seized assets.

All speculation can end now. Liquidation is the only path being executed.

Motivation Analysis: The £5 Billion "Fiscal Gap"

Why is the UK government so eager to sell?

The answer is simple: they need money.

Analysis points out that the UK government is facing a massive £5 billion to £20 billion "fiscal gap." Chancellor Rachel Reeves is "closely watching" this "windfall."

These 61,000 bitcoins, worth only about £300 million when seized in 2018, have now soared in value to about £5 billion to £5.5 billion.

This "windfall" has become a highly tempting direct source to fill the budget deficit.

Even more "ingenious," the UK government seems to have found a legal path to "legitimately appropriate" this massive appreciation. The core dispute in this case is that the UK Crown Prosecution Service (DPP) has proposed a "custom compensation plan" to the High Court.

This plan is very likely to rule that the 128,000 Chinese victims are only entitled to recover their "original 2018 fiat losses" (about £640 million).

This means that the UK Treasury will legally "retain" more than £4.5 billion in "appreciation gains".

With such a strong "fiscal incentive," the UK government's orderly, high-priced "sale" of these bitcoins is a foregone conclusion.

Core Comparison: Why Is It Much Scarier Than "Mt. Gox"?

The mainstream market narrative is currently that the "Mt. Gox selling pressure has been digested." But market analysis warns that comparing the UK government (UKGov) sell-off to Mt. Gox is completely wrong.

Their market dynamics are entirely different:

1. Mt. Gox:

- Assets: About 142,000 bitcoins.

- Recipients: Long-term creditors.

- Motivation: These creditors are "believers" who have endured a decade-long legal battle. They ultimately chose to be compensated in bitcoin (rather than yen). Ideologically, they are united as "HODLers" (long-term holders).

- Market Impact (Forecast): Low. Analysts generally expect only a "small portion" of creditors to sell immediately. The market can easily absorb this "marginal" selling pressure.

2. UKGov (Qian Zhimin Case):

- Assets: About 61,000 bitcoins.

- Seller: UK government (Treasury/Home Office).

- Motivation: Fiscal needs (filling the budget gap).

- Market Impact (Forecast): High (sustained). This constitutes pure, inorganic sell pressure.

The Mt. Gox bitcoins are being transferred from one "cold wallet" to another group of 'cold wallets'. The UK government's bitcoins, however, are being transferred from a "cold wallet" directly to 'exchange hot wallets', with the sole purpose of "realising fiat."

German Precedent: The "Stress Test" of 50,000 BTC

How will the UK government sell? They will not "foolishly" copy the US Marshals Service's (USMS) inefficient "public auction" model from 2014-2015.

Reports point to a more recent and likely template: the German government's sale of 50,000 bitcoins in 2024.

The German government took a more modern approach, selling the large sum in batches through mainstream exchanges such as Kraken, Coinbase, and OTC market makers.

The market impact was immediate. Reports say this move caused "tremendous" and "violent" short-term selling pressure, severely shaking the market.

But ultimately, the market successfully absorbed this supply.

The German precedent proves two things:

- The market is capable of absorbing a supply of 50,000-60,000 bitcoins.

- The absorption process will be extremely painful and accompanied by severe volatility.

Conclusion: Not a "Flash Crash," but a "Pressure Ceiling"

Now we can answer the question circulating on the X platform: "Which big player has the strength to sell for so long?"

The answer is: The UK Treasury.

For the market, the core question—"Will it crash the market?"—is already clear:

It will not be a devastating 'flash crash.' The UK government's "realisation framework" tender already suggests this is a professional, long-term (possibly up to 3-4 years), controlled liquidation aimed at "maximising fiat returns."

But it will be a 'long-term resistance level.'

The market must digest this fact: a major Western government (the UK) is about to become a rational, profit-driven, large-scale seller holding 61,000 bitcoins.

This "inorganic selling pressure" will act as a "ceiling," continuously suppressing the market's upside potential for years to come. With every rebound, traders will have to estimate: "How much will the UK government sell today?"—until all 61,000 bitcoins are absorbed by the market.