Will Fed Uncertainty Cap XRP’s Upside in 2026?

XRP price has spent the last few months hovering around the $2 mark, caught between hopes of broader crypto recovery and caution sparked by shifting macro policy signals. With the Federal Reserve entering 2026 sharply divided on interest-rate direction, traders are beginning to wonder: will uncertainty at the top of the world’s most powerful central bank stall XRP’s next breakout?

XRP Price Prediction: The Fed’s Mixed Signals and Market Mood

The Federal Reserve’s latest projections paint a conflicted picture. Some officials want more rate cuts to support slowing growth, while others warn that easing too fast could reignite inflation. The split is wide enough that no single direction dominates. As Jerome Powell’s term nears its end and a new chair potentially aligned with the Trump administration steps in, the entire committee could see a reshuffling of priorities.

For risk assets like XRP, this kind of uncertainty is rarely bullish in the short term. Crypto tends to thrive on clear macro narratives — either strong liquidity inflows during easing cycles or risk-off panic during tightening phases. The Fed’s divided stance leaves markets guessing, which usually translates into sideways movement or reduced volatility until a new consensus forms.

XRP Price Prediction: Compression Before Expansion

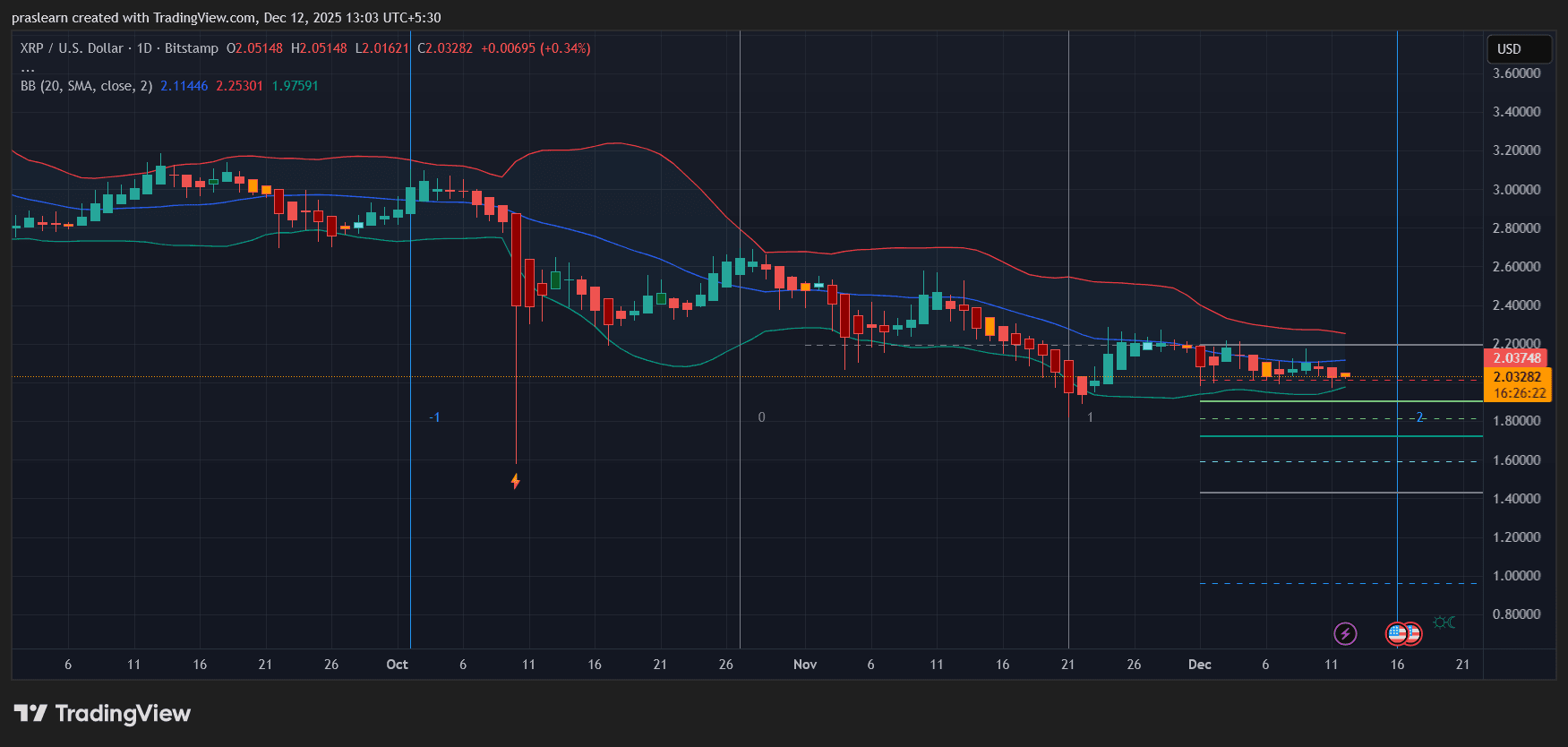

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView On the daily chart, XRP price trades near $2.03 , locked between $1.95 support and $2.25 resistance as shown by the Bollinger Bands (20, 2). The narrowing band width signals volatility compression, often a precursor to a strong directional move. However, the current setup leans slightly bearish — the price sits below the midline (SMA 20), and every attempt to break above $2.20 has been rejected.

Momentum has flattened, suggesting traders are waiting for macro confirmation. If XRP breaks below $1.95, it could quickly slide toward $1.80 and $1.60, where liquidity clusters from previous corrections sit. On the upside, reclaiming $2.25 with volume could trigger a retest of $2.50 and $2.80, but that requires renewed conviction — likely from clearer Fed signals or a broader crypto rally.

Why the Fed Matters for XRP Price Prediction

Fed policy indirectly controls crypto liquidity. When the Fed signals confidence and keeps rates steady or low, risk assets get room to breathe. But mixed messaging — one group favoring cuts, another pushing caution — keeps institutional capital cautious.

In 2026, the likely scenario is a slower easing cycle. Economists expect GDP growth of 2.3%, inflation easing toward 2.5%, and unemployment stabilizing near 4.4%. Those are “soft landing” numbers, meaning the Fed may not feel pressured to pump liquidity aggressively. That could limit upside potential for speculative assets like XRP, at least in the first half of the year.

XRP Price Prediction: 2026 Could Be a Year of Frustration and Accumulation

Unless a decisive macro catalyst hits — such as a faster-than-expected Fed pivot or major Ripple adoption news — XRP price may continue to trade range-bound through early 2026. A prolonged compression phase could build a larger accumulation base between $1.80–$2.50, setting up a possible breakout later in the year once market clarity returns.

The longer XRP holds above $1.90, the stronger the base for a later uptrend becomes. If global liquidity improves by mid-2026, XRP could challenge $3.00 again, but until then, macro hesitation will likely keep rallies capped.

The Fed’s divided stance creates a foggy outlook for all risk assets, and XRP price is no exception. With policy signals conflicting and traders unwilling to commit, XRP is stuck in consolidation. The technicals hint at potential volatility ahead, but the macro backdrop says patience will be key.

In short, 2026 may start slow for $XRP — but compression like this rarely lasts forever. The real breakout, when it comes, will likely align with a shift in Fed policy or a major market liquidity wave.