Ethena Labs, the issuer of fast-growing stablecoin USDe, is throwing its hat into the ring to issue Hyperliquid’s upcoming USDH stablecoin, and it is doing so with heavyweight backing.

The company has partnered with BlackRock’s BUIDL fund through USDtb, a token issued with Anchorage Digital Bank, to position itself as a frontrunner in one of the most closely watched races in crypto.

Leading decentralized exchange, Hyperliquid, is preparing to launch USDH as its native stablecoin. The decision over which issuer will oversee its minting and redemption has attracted a slate of major players.

In August, Hyperliquid processed around $400 billion in perpetuals trading volume and has a stablecoin market cap of over $5.7 billion, so the stakes are high. Whoever wins the mandate will have access to one of the largest stablecoin liquidity bases in the market, and Ethena’s proposal shows it really wants to emerge as the winner.

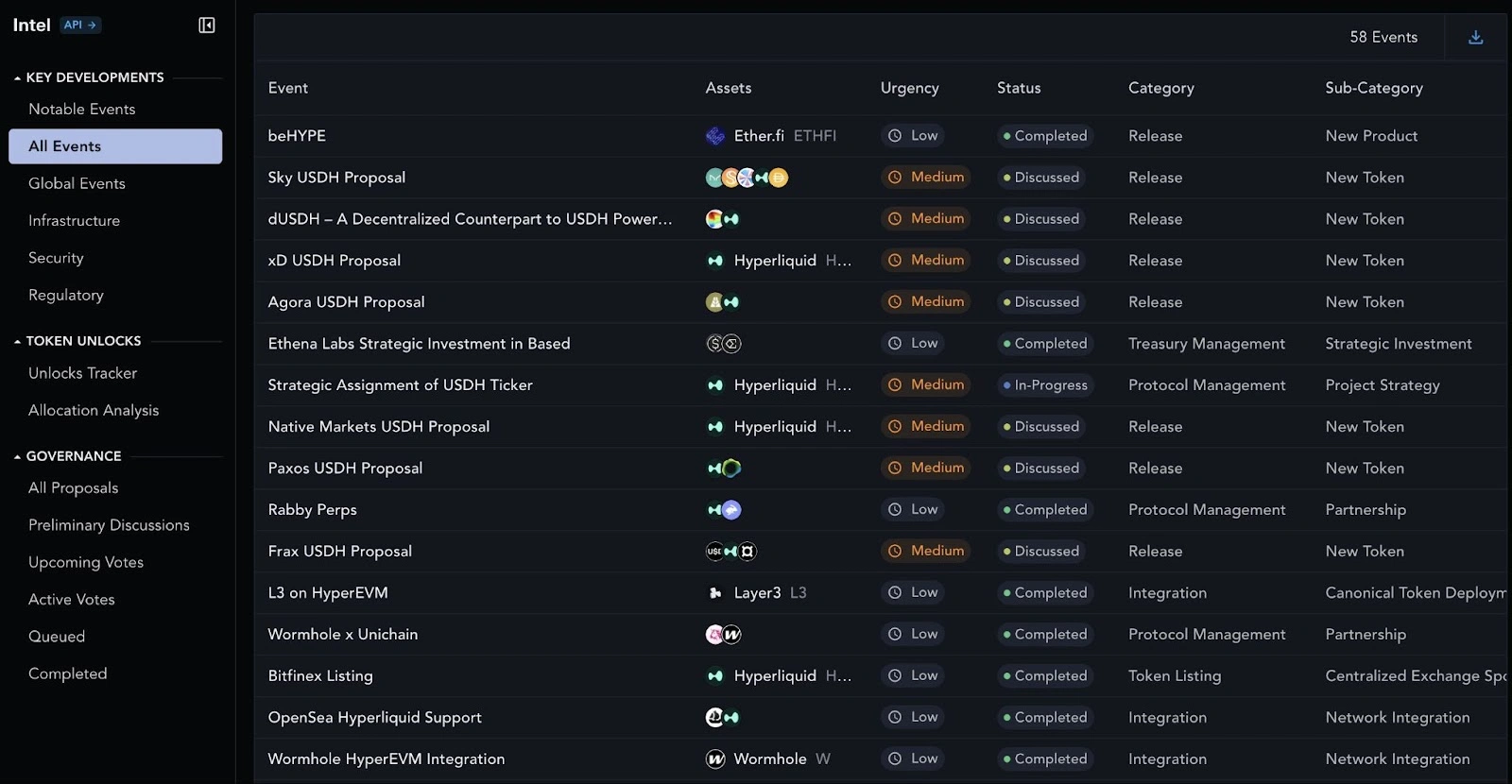

Proposals for Hyperliquid’s USDH. Source: Messari

Proposals for Hyperliquid’s USDH. Source: Messari

Ethena pitches revenue-sharing, migration, and security

Ethena is offering a package designed to appeal to both Hyperliquid validators and its community. Central to its proposal is a pledge to redirect 95% of net USDH reserve revenues back to the ecosystem. The company said this would be done through the purchase and distribution of HYPE tokens, validator rewards, and ecosystem development funding, among other means preferred by the community.

Ethena has also promised to shoulder the costs of migrating existing USDC trading pairs to USDH.

Security is another pillar of the plan as Ethena proposed introducing a guardian network of Hyperliquid validators, including infrastructure partners like LayerZero, to oversee USDH operations.

Part of the goal is to avoid a single point of failure and ensure transparent governance of the new stablecoin. “We want to play a role in supporting this story regardless of whether the community grants us the privilege and responsibility of delivering USDH,” Ethena wrote in its proposal.

Ethena wants to offer more than an ordinary USDH stablecoin

Ethena’s ambitions go beyond simply issuing USDH. The company laid out plans for hUSDe, a Hyperliquid-native synthetic dollar product that builds on its existing USDe model. To jumpstart adoption, Ethena has earmarked $75 million in incentives, with the potential to expand that figure to $150 million as the ecosystem scales, to support market development under the HIP-3 proposal.

The incentive program would fund new markets, front-end integrations, and liquidity initiatives that tie together USDH, USDe, and hUSDe under a single umbrella. The company also said it will integrate with Securitize to enable tokenization of real-world assets and bring USDtb, the BlackRock-backed token, onto HyperEVM.

That integration would allow for seamless minting and redemption flows, giving institutional users a clearer path to tap into Hyperliquid’s ecosystem.

The field is competitive

Since the announcement, Hyperliquid’s native token HYPE has been on the rise. At the time of writing, it sits at $53.55 per token, having risen by over 6% in 24 hours, with a market cap of $14.39 billion according to data from Messari.

Ethena’s bid brings it into a crowded field of suitors . Paxos, known for its regulated custodial model, has pitched itself as the most compliant option. Frax has proposed integrating its algorithmic stablecoin model into Hyperliquid, while Sky, Native Markets and Agora, among others have also submitted competing frameworks.

Each proposal focuses on a different philosophy on how to balance transparency, scalability, and user adoption.

The outcome will be decided by Hyperliquid’s validators, who are expected to vote on September 14. With billions of dollars in potential liquidity at stake, the decision will likely shape the trajectory of Hyperliquid’s growth in the coming years.

For Ethena, winning the mandate could cement its position as one of the most influential players in the stablecoin market.

Join Bybit now and claim a $50 bonus in minutes