News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

If the prospects of AI falter, the financial system may face a "2008 crisis-style" shock.

Behind the simultaneous sharp decline in the US stock and cryptocurrency markets, investors' fears of an "AI bubble" and the uncertainty surrounding the Federal Reserve's monetary policy are creating a double blow.

$37 million in funding + $2.5 billion in deployment rights: Can Obex become Sky’s growth engine?

The danger of stablecoins lies precisely in the fact that they appear to be very safe.

We view casino cash flows as similar to software's recurring revenue.

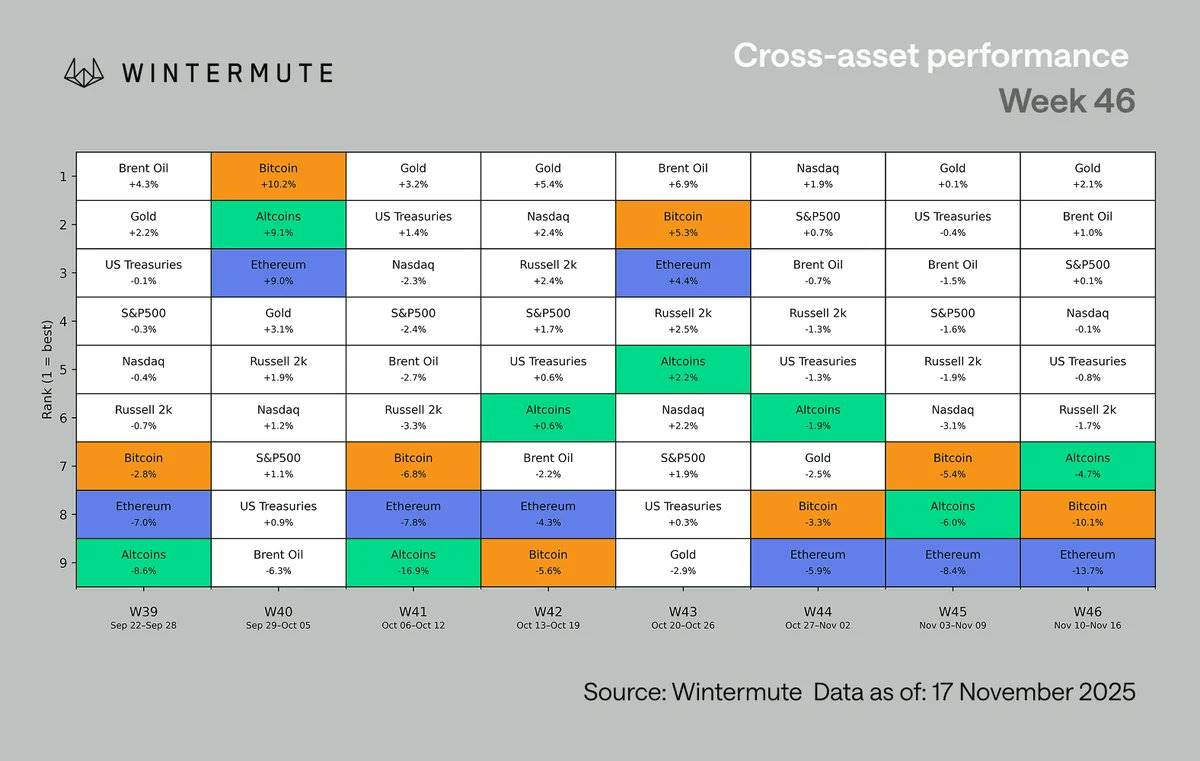

Position adjustments make the market clearer, but stable sentiment still depends on the performance of major cryptocurrencies.

- 10:18QCP: The current US economy is closer to a late-cycle phase rather than a recession, and this week's data will determine bitcoin's future direction.According to ChainCatcher, QCP released its daily market observation, stating that this week, bitcoin continued to decline, once falling below the key $90,000 mark. The reason was that market expectations for interest rate hikes tightened and continued ETF outflows dampened market sentiment. Thin liquidity further amplified this round of decline, showing that bitcoin is becoming increasingly sensitive to changes in the macro environment. This pullback occurred against the backdrop of a rapid repricing of Federal Reserve expectations—the market shifted from an almost certain rate cut to a roughly balanced probability. This put pressure on interest rate-sensitive assets like bitcoin, while the stock market remained relatively stable due to solid corporate earnings, especially strong profits and record AI-driven capital expenditures reported by large technology companies. With the U.S. government reopening, official data is being released, providing the market with necessary insights into the momentum of economic fundamentals. This week, the market is highly focused on labor market data and the Conference Board's Leading Economic Index, which now incorporates the latest job vacancy data. This information will help determine whether labor market tightness or inflation will dominate the Federal Reserve's policy response. Beneath the surface, the U.S. economy still shows a K-shaped divergence: spending by high-income households remains resilient, while pressure on lower-income groups is increasing. Federal Reserve Chairman Powell reiterated a cautious stance, noting that rate cuts are "not a given." Overall, current economic conditions are closer to late-cycle rather than recessionary. Although fiscal constraints and labor market divergence pose ongoing risks, the resilience of household balance sheets and corporate capital expenditures continues to provide a buffer against the downside. This week's data will determine whether bitcoin's pullback is a temporary position adjustment or the beginning of a broader decline in risk appetite.

- 10:12Data: On-chain BTC whale bulls suffer a complete defeat with maximum unrealized losses of 870%; bears are fully in profit, with take-profit targets set below 89,000.ChainCatcher News, according to monitoring and analysis by HyperInsight, among the 26 whales on Hyperliquid with BTC positions exceeding 20 million USD, there are 12 long positions and 14 short positions. All members of the long camp are experiencing varying degrees of unrealized losses (ranging from approximately -14% to -870%), while all members of the short camp are seeing varying degrees of unrealized gains (ranging from approximately 14% to 647%). In addition, according to incomplete statistics, the stop-loss/take-profit ranges for the above whales are as follows (excluding outliers and addresses with excessive margin): Long camp: Stop-loss order range: 82,000 USD—89,000 USD; liquidation range: 74,100 USD—84,900 USD, average 79,300 USD; average position price: 102,190 USD Short camp: Take-profit order range: 75,000 USD—89,000 USD; liquidation range: 98,000 USD—136,000 USD, average 116,000 USD; average position price: 104,920 USD According to Coinglass data, if BTC rises to 92,800 USD, the total liquidation amount for short positions across the network will reach 475 million USD. If BTC falls to 89,480 USD, the total liquidation amount for long positions across the network will reach 873 million USD.

- 10:12Data: The European Stoxx 600 Index is now up 0.1%, erasing earlier losses.According to ChainCatcher, citing Golden Ten Data, the European Stoxx 600 Index recently rose by 0.1%, successfully erasing its previous losses.