First Mover Asia: Bitcoin Holds Above $30.5K at the End of a Quiet, Long Weekend

PLUS: Dismissing the very real prevalence of Ponzi schemes in GameFi isn't a good look for Web 3.

Good morning. Here’s what’s happening:

Prices: With a continued long weekend in the U.S., and plenty of economic data coming in this week, markets are quiet.

Insights: Animoca's Yat Siu is hurting GameFi's cause by dismissing its Ponzi problems.

Quiet Long Weekend Keeps Bitcoin Above $30K

As the U.S. has been off for an extended long weekend, markets are soft as Asia begins its Wednesday trading day.

Bitcoin is down 1.1% to $30,807, while ether is down 0.8% to $1,939. The , a measure of crypto markets performance, is down 0.9% to 1,262.

shows that while open interest continues to sustain itself at the $14.38 billion market, trading volume across the board is down, with major exchanges reporting declines between 15-20%. Liquidation volumes reflect this, with only $148,000 in positions liquidated during the last four hours, and $7.2 million liquidated in the last 12 hours.

CoinGlass’ long/short ratio shows that long traders still have a slight edge over shorts, but its polling of trader sentiment reveals a mixed bag, with a large cohort of neutral traders splitting the bullish and bearish crowd.

As CoinDesk has previously reported, liquidity , with fiat liquidity on the decline, which might weigh heavily on risk assets like tech stocks and crypto. With plenty of economic data coming down the pipe this week, let’s see how traders react.

Animoca Co-Founder Siu Shouldn’t Dismiss GameFi’s Ponzi Problem

The GameFi industry is working hard to rid itself of the perception that it’s a cesspool of Ponzi schemes.

During an interview at the Collision web conference in Toronto, Yat Siu, the co-founder and executive chairman of Animoca Brands, blew up this effort.

“The narrative around GameFi as a Ponzi is an American narrative. If you go to Asia or the Middle East, you wouldn’t hear any of that,” Siu said in response to a question from YouTuber A.Cole. “That’s due to a misunderstanding of what GameFi really is.”

Ponzi schemes are investment scams promising high rates of return where old investors are paid by new ones, rather than legitimate sustainable business activities. To its critics, GameFi’s Play to Earn model is a ponzi scheme because of its reliance on a wealth transfer from new to old players rather than legitimately engaging gameplay.

Siu continued by arguing that GameFi isn’t about creating financial value, but rather opening up the finances of games to transparency.

Siu isn’t wrong about this part. Games have had economies of scale for quite some time; U.S. political gadfly Steve Bannon operating a World of Warcraft virtual gold trading desk in Hong Kong.

But he’s being incredibly dismissive about the real problem GameFi has with Ponzis – which others have recognized as something holding the industry back.

In a outlining its investment theses, Vader Research, a Web3 gaming market research shop, argued that the current wave of web3 games are not designed for fun-seeking traditional gamers but are “designed for ponzi-return seeking crypto degens and gold farmer scholars.”

“We believe Ponzis will slow down web3 gaming adoption,” they wrote. “[Many projects] use complex tokenomics to camouflage their Ponzinomics nature will take web3 gaming a few years back in terms of real gamer adoption.”

Vader points to GameFi projects offering of “unrealistic returns,” which they believe not only jeopardizes long-term crypto adoption but also hinders the growth of genuine Web3 gaming.

And a year later, there is some vindication to this idea, as we see what happens when the inflow of resources no longer exceeds the outflow.

Axie Infinity, which was marketed more as a rather than a genuinely fun game, saw its by 55% during the last year. The number of players on the platform during the last month from a high of around 2.7 million in January 2022. For many players it hasn’t been profitable for a long time, and its army of Filipino gamers

shows that Animoca Brands’ basket of tokens is down 18% over the last 6 months, or, over a longer time horizon, down 17% over three years. In comparison, many other investors are well into the green for either of these time frames considering the mini-bull market of 2023 and the broader growth of crypto over long time horizons.

A16z, for instance, is up 20% over the last six months, or 375% in the last three years.

Perhaps the industry would be better off if it listened to Sith Lord-branded research houses and not those that defend Ponzinomics by saying it’s all misunderstood.

8:30 a.m. HKT/SGT(12:30 a.m. UTC):

9:45 a.m. HKT/SGT(1:45 a.m. UTC):

In case you missed it, here is the most recent episode of on :

"The Hash" discussed today's top stories, including Elon Musk announcing Twitter setting up new "temporary limits" on the number of tweets users can read per day. Plus, Atrium Founder and CEO Supriyo Roy joined the show to discuss releasing an animated film funded by a DAO that brings NFTs to life. And, an update on Azuki a week after the Elementals NFT mint.

The bill, introduced in September, now enters its final stages in Parliament.

Still, bitcoin miners’ inventory sales climbed to a record as they took advantage of the cryptocurrency’s strong performance, the report said.

Copies of several meme coins have popped across the board in a trend that’s likely to die out within weeks.

It would be unusual for bitcoin to stay bullish when fiat liquidity measures are pointing lower, one portfolio manager said.

Edited by James Rubin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

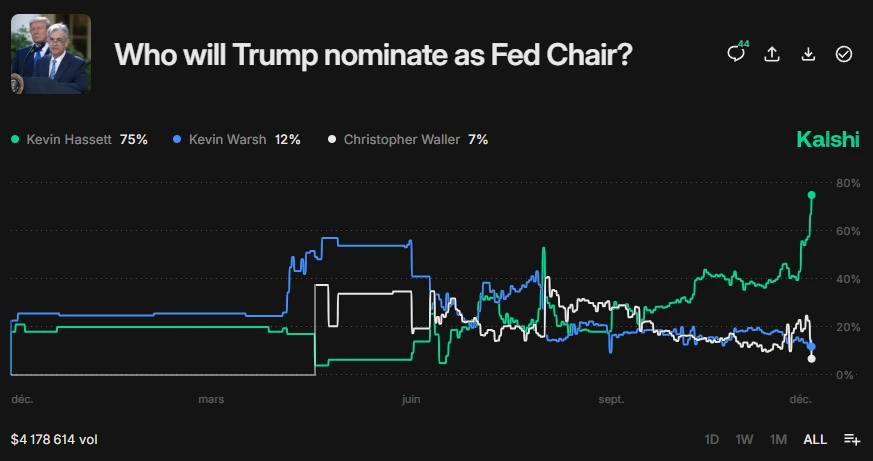

Trump’s Fed Chair Announcement Likely This Week: Is It the Needed Crypto Bullish Catalyst?

XRP Price News: Breakout or Breakdown?

Huione Pay Halts Withdrawals After Run on Banks, Users Fear Major Losses

Bitcoin News Update: Vanguard Shifts Stance on Crypto Amid Growing Demand and Regulatory Clarity

- Vanguard Group, managing $11 trillion, will let clients trade regulated crypto ETFs from Dec 2, 2025, reversing long-term skepticism toward digital assets. - The firm supports Bitcoin , Ethereum , and major crypto ETFs but excludes memecoins and won't launch its own crypto products, prioritizing low-cost, regulated offerings. - This shift reflects growing retail/institutional demand and maturing regulatory frameworks, aligning with SEC-approved spot crypto ETFs showing liquidity and stability. - By joini