Crypto Traders Eye $6.8B Bitcoin and Ether Options Expiry

Dealers are stuffed with record negative gamma in BTC. With only a little move in the spot price, "we could witness fireworks," one observer said.

The bullish buzz returned to the crypto market last week as bitcoin (BTC), the leading cryptocurrency by market value, jumped more than 15% in its best performance since March. Now a significant event looms on the horizon.

On Friday at 08:00 UTC some 150,633 bitcoin options contracts worth $4.57 billion and 1.23 million ether contracts valued at $2.3 billion will expire on Panama-based Deribit exchange, which controls over 85% of the global options activity. The bitcoin contracts due for settlement account for 43% of the total open interest, according to .

In bitcoin's case, investors have call options with strike prices at and above $30,000. As a result, that level has the highest open interest – or the number of active contracts – and market makers/dealers, who create order book liquidity by taking the other side of the investors' trades, hold a significant amount of "negative (short) gamma" exposure.

Options are derivative contracts that give the purchaser the right to buy or sell an asset at a predetermined price at a later date. A call gives the right to buy, a bullish position, and the put confers the right to sell, a bearish position. Being short (negative) gamma means holding a short or sell position in the call or put options.

The large build up of open interest at $30,000, means the spo t price to around that level in the lead up to the expiry. Bitcoin is currently trading just above $30,000, according to CoinDesk data.

Meanwhile, dealers' negative gamma positioning means a slight move away from $30,000 could translate into an explosive rally or price slide. That's because, dealers, when holding net-negative gamma exposure, "buy high and sell low" when the underlying picks up a bullish or bearish momentum in order to maintain a neutral market exposure.

In other words, if bitcoin builds momentum above $30,000 as expiry approaches, dealers will buy the cryptocurrency in the spot and futures markets. That, in turn, could lead to an exaggerated price rally, often called a gamma squeeze, or sling-shot effect. On the flip side, dealers will be forced to sell on a potential decline below $30,000.

"This [bullish] flow is heavily impacting dealers' positioning, and ahead of Friday's expiration, we expect a historic record (since we started tracking) of negative gamma," Greg Magadini, director of derivatives at Amberdata, said in the latest edition of the weekly newsletter. "With only a little spot move, we could witness fireworks."

Options gamma is the rate of change in delta, which is the degree of options' sensitivity to a change in the underlying asset's price. Gamma shows how directional risk exposure changes with the fluctuations in the underlying asset and rises as expiry nears.

Market makers provide liquidity to an order book and profit from the bid-ask spread by constantly hedging their gamma exposure to keep the book direction, or delta, neutral.

According to crypto derivatives trader Christopher Newhouse, the impact of potential dealer hedging could be stronger than usual this time.

"With several of the topside call strikes set to expire this week in large size and gamma concentrated around the $30,000 [level] and bitcoin trading near $30,000, dealer hedging flows as we approach expiry may have more of an exaggerated impact on spot prices than some of the smaller weekly expiries – especially as price coils near previous highs and potential short liquidation levels," Newhouse told CoinDesk.

"By strike, the $30,000, $35,000 and $40,000 strikes are some of the most popular call strike targets with many of these bets being taken only a few days prior as bullish exuberance starts to overwhelm some of the short-term market flows," he said.

In ether's case, market makers have accumulated long gamma positions in the ether (ETH) market, and hence the risk of a gamma squeeze in Ethereum's native token is relatively low.

"Since market makers hold a large amount of positive gamma, their hedging will keep ETH relatively stable during settlement," Griffin Ardern, volatility trader from crypto asset management firm Blofin, said.

Edited by Sheldon Reback.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vanguard Breaks Conservative Tradition, Opens to Crypto ETFs

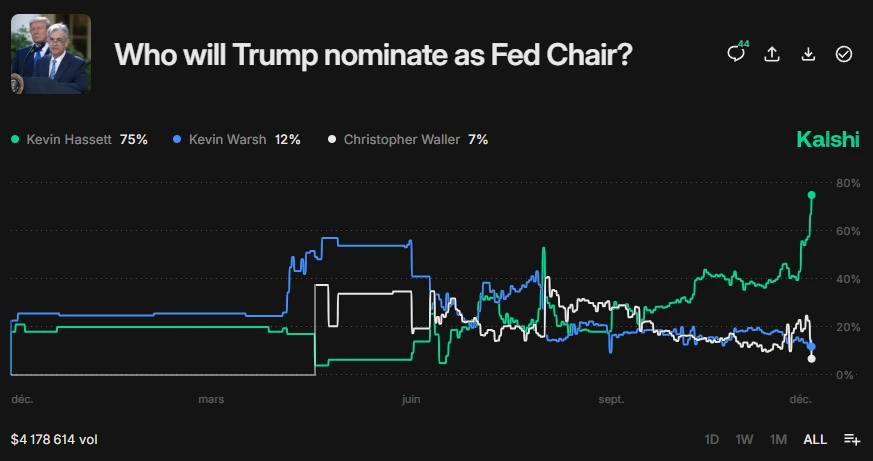

Trump’s Fed Chair Announcement Likely This Week: Is It the Needed Crypto Bullish Catalyst?

XRP Price News: Breakout or Breakdown?

Huione Pay Halts Withdrawals After Run on Banks, Users Fear Major Losses