Volume 161: Digital Asset Fund Flows Weekly Report

Repost from CoinShares Blog By James Butterfill: “Volume 161: Digital Asset Fund Flows Weekly Report” The full report and all related findings are available on the official website of CoinShares Blog.

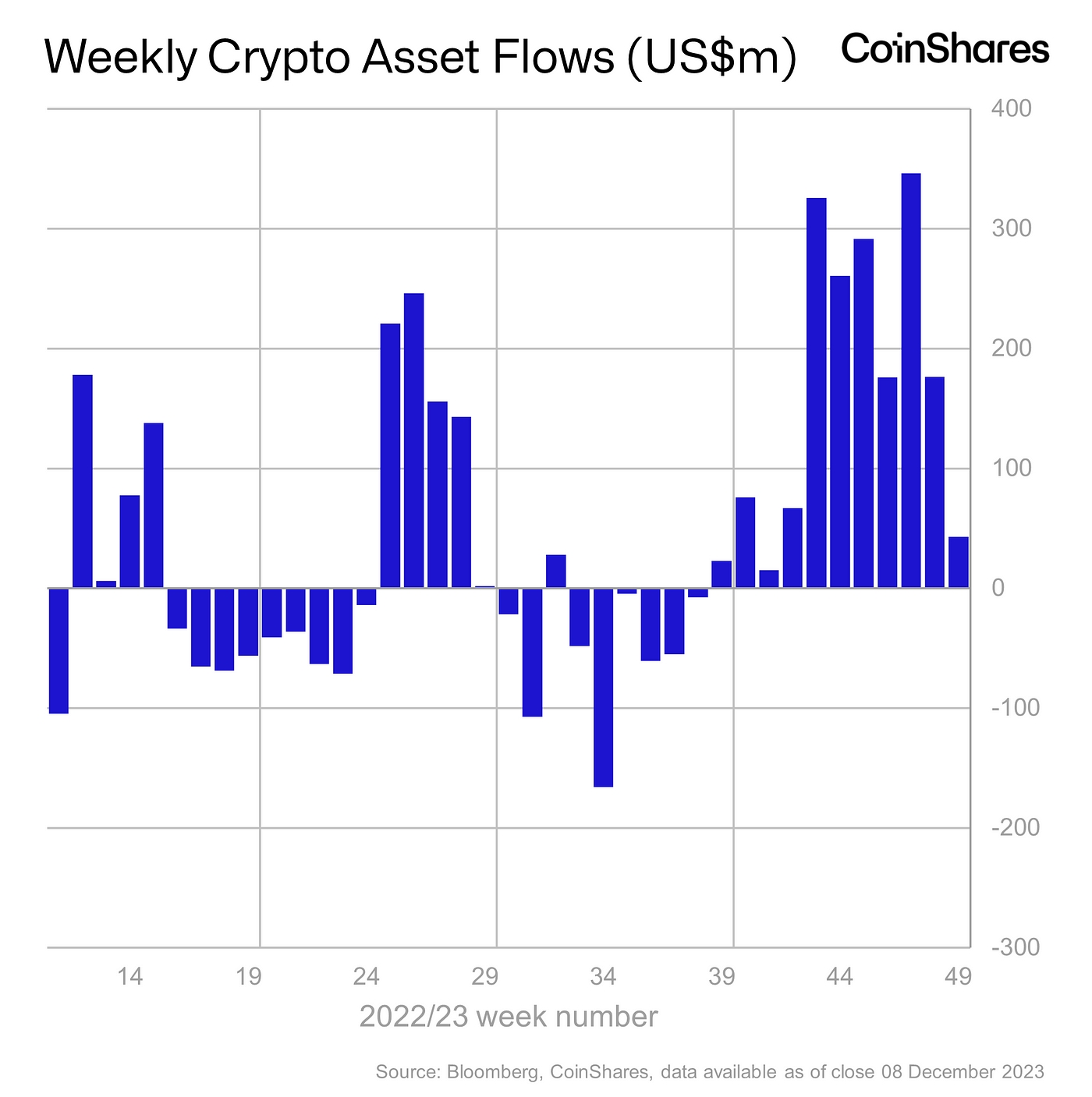

Continued inflows at US$43m, Blockchain equities see largest inflows on record

- Digital asset investment products experienced their 11th straight week of inflows at $43m, with a notable increase in short position inflows due to recent price appreciation and perceived downside risks.

- Regionally, Europe led with $43m inflows, the US followed with $14m (half in short positions), while Hong Kong and Brazil saw outflows of $8m and $4.6m, respectively.

- Blockchain equities saw their largest weekly inflows on record at US$126m.

Digital asset investment products saw inflows totalling US$43m, the 11th consecutive week of inflows, but a marked decline relative to prior weeks. Recent price appreciation has also led to significant inflows into short positions as some investors see price downside potential.

Regionally, Europe continues to dominate the inflows, seeing US$43m of inflows, while the US saw only US$14m of inflows, with half of that being inflows into short positions. Hong Kong saw its second week of outflows totalling US$8m, Brazil also saw minor outflows of US$4.6m.

Bitcoin remains the primary focus of investors, seeing US$20m inflows, bringing year to date inflows to US$1.7bn. While short-bitcoin saw US$8.6m inflows, presumably as a proportion of investors see the current price rises as unsustainable.

In a remarkable turn-around this year, Ethereum saw its sixth week of inflows totalling US$10m. Just 7 weeks ago, Ethereum has seen outflows year to date of US$125m, this has now recovered to inflows totalling US$19m.

Solana and Avalanche saw inflows of US$3m and US$2m respectively, remaining firm favourites in the altcoin space.

Meanwhile, blockchain equities saw their largest weekly inflows on record at US$126m.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?