Rekt Capital: 5 Phases of The Bitcoin Halving

5 Phases of The Bitcoin Halving

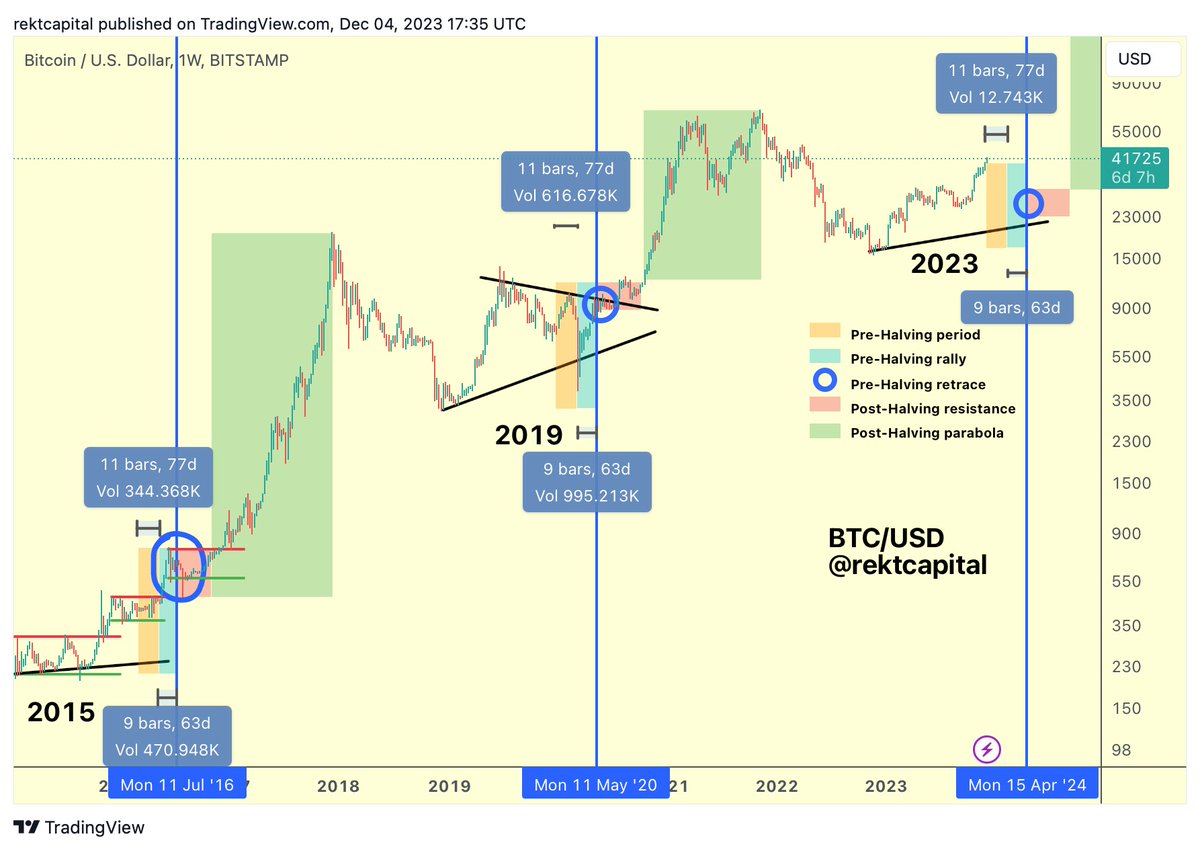

Pre-Halving period Approximately 4.5 months remain until the Bitcoin Halving in April 2024 Historically, any deeper retraces that occur during this period tend to generate fantastic Return On Investment for investors in the several months after the Halving

Pre-Halving rally Then ~60 days before the Halving, a Pre-Halving rally tends to occur (light blue) In anticipation of the Halving, investors "Buy the Hype" in an effort to "Sell the News"

Pre-Halving retrace A Pre-Halving retrace tends to occur around the Halving event itself (dark blue circle) In 2016, this Pre-Halving retrace was -38% deep In 2020, this Pre-Halving retrace was -20% deep This Pre-Halving retrace makes investors question whether the Halving was a bullish catalyst on price after all

Re-Accumulation The Pre-Halving retrace is followed by multi-month re-accumulation (red) Many investors get shaken-out in this stage due to boredom, impatience, and disappointment with lack of major results in their BTC investment in the immediate aftermath of the Halving

Parabolic Uptrend Once Bitcoin breaks out from the re-accumulation area breakout into the parabolic uptrend (green) It is during this phase Bitcoin experiences accelerated growth on its way to new All Time Highs

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: How Europe Wants to Enforce Its Version of the SEC

Stablecoin : Western Union plans to launch anti-inflation "stable cards"

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.

a16z: Inefficient governance and dormant tokens pose a more severe quantum threat to BTC.