Spot Bitcoin ( BTC ) exchange-traded funds (ETFs) have seen eight-figure trading volumes in just three days since their United States launch.

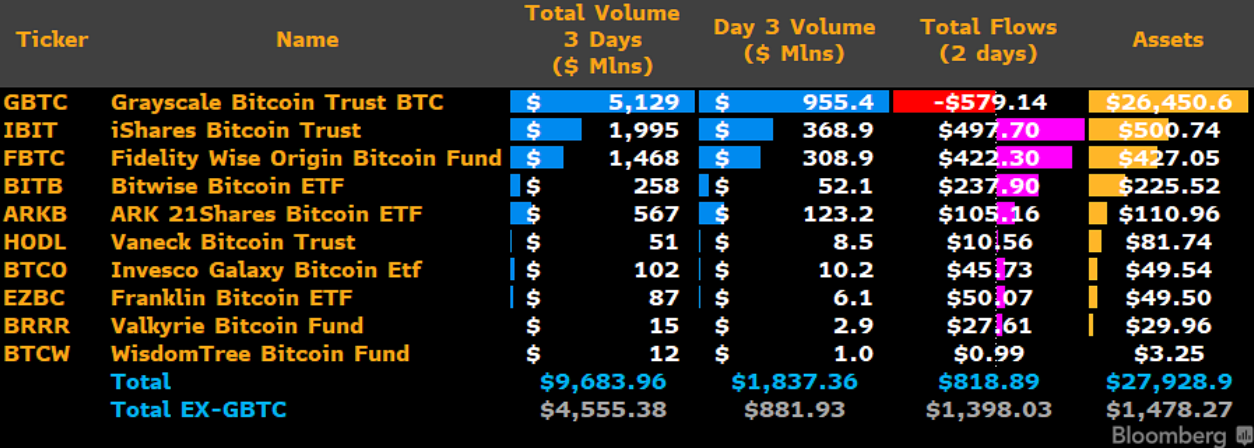

Data from Bloomberg Intelligence analyst James Seyffart uploaded to X (formerly Twitter) shows that as of Jan. 16, spot ETF volumes had passed $10 billion.

Spot Bitcoin ETFs smash ETF norms

Bitcoin’s newest ETFs have caused controversy since their Jan. 11 debut , with frenetic trading activity having little tangible impact on BTC price growth.

While some are wary as a result, fellow Bloomberg analyst Eric Balchunas argues that the raw figures speak for themselves.

“Let me put into context how insane $10b in volume is in first 3 days,” he commented on Seyffart’s post.

“There were 500 ETFs launched in 2023. Today, they did a COMBINDED $450m in volume. The best one did $45m. And many have had months to get going. $IBIT alone is seeing more activity than the entire '23 Freshman Class.”

Spot Bitcoin ETF volumes. Source: James Seyffart/X

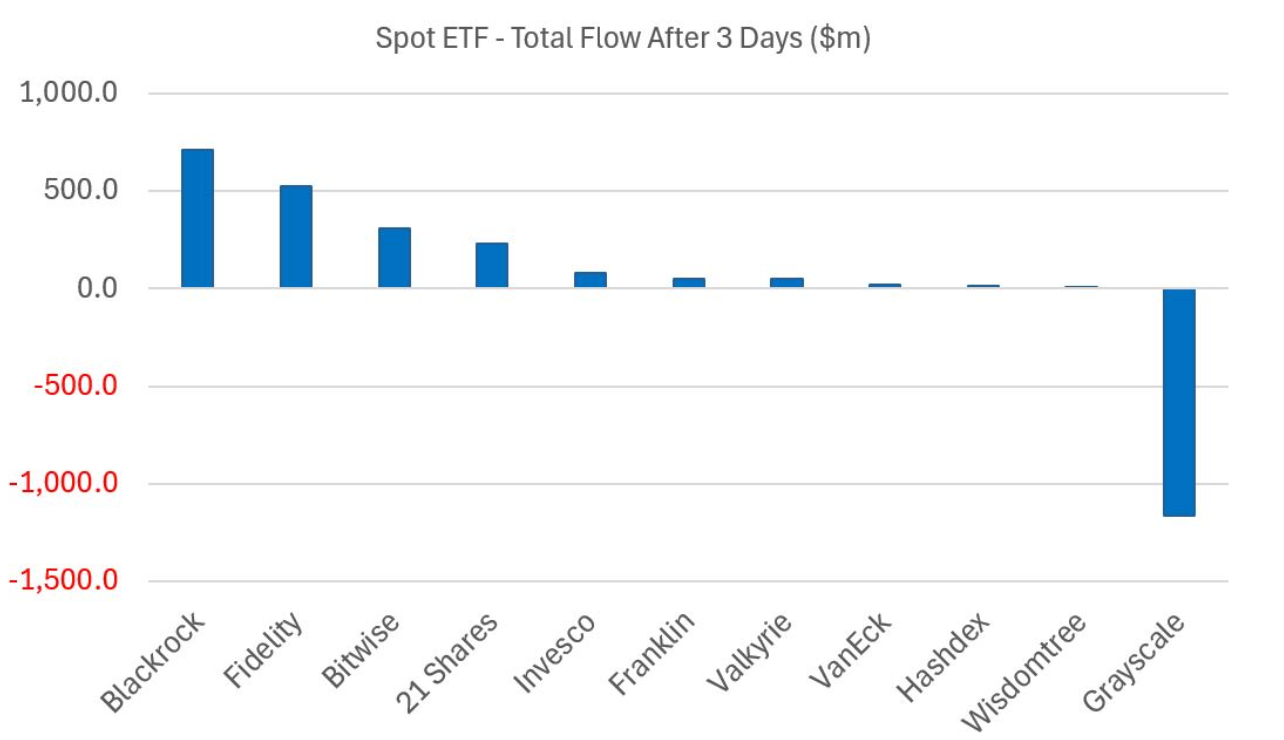

In terms of net inflows and outflows, the picture continues to show sales from the Grayscale Bitcoin Trust (GBTC), itself newly converted to an ETF.

According to data from BitMEX research, the most significant net gains belong to BlackRock’s iShares Bitcoin Trust (IBIT) — up $700 million over three days.

GBTC meanwhile has seen net outflows of more than $1.1 billion — a phenomenon attributed to investors swapping between ETF products due to the product’s higher fees .

“GBTC total outflows are now at $1.18 billion vs. spot Bitcoin ETF inflows of $2B. It would be extremely encouraging if we continued this pace for the first month of trading,” James Van Straten, research and data analyst at crypto insights firm CryptoSlate, wrote in part of a response to the numbers.

Spot Bitcoin ETF netflows. Source: BitMEX Research/X

JAN3 CEO Samson Mow meanwhile predicted a return to ETF equilibrium following a period of flux post-launch.

“Time is needed for everything to recalibrate,” he told X subscribers on Jan. 13.

“G

BTC sell pressure won’t be a long drawn out process. Many just cannot sell because the tax hit is too big, and eventually Grayscale must capitulate on the fees. This is likely to be sooner rather than later.”

BTC price range still king

In the meantime, however, few anticipate a BTC price surge beyond the well-established trading range in place since the start of December last year.

While some remain confident in market strength at the current $43,000, doubts linger over Bitcoin’s ability to avoid a fresh capitulation.

“Still see room to fall, regardless of a shorter-term pop,” popular social media trader JT argued about the weekly chart.

“Once we get to the bottom of the long-standing range, we can reevaluate.”

![]()

BTC/USD annotated chart. Source: JT/TradingView

$41,500 has so far formed the floor for January price action, seeing repeated tests since 2024 began, per data from Cointelegraph Markets Pro and TradingView .

![]()

BTC/USD 1-day chart. Source: TradingView

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.