Bitcoin ( BTC ) has spent nearly 150 days in a $5,000 BTC price corridor as its stubborn range stays put.

New analysis from James Van Straten, research and data analyst at crypto insights firm CryptoSlate, reveals “characteristic” BTC price behavior.

Bitcoin price "buckets" show that the range is king

Bitcoin has seen two-year highs in 2024 , but along with lows of $38,500 , these have failed to endure or spark a broader price trend.

Instead, BTC/USD has settled within a trading range just $5,000 wide.

Taking daily close levels in account, the largest cryptocurrency has adhered to the range rigidly for almost 150 days as of Feb. 2.

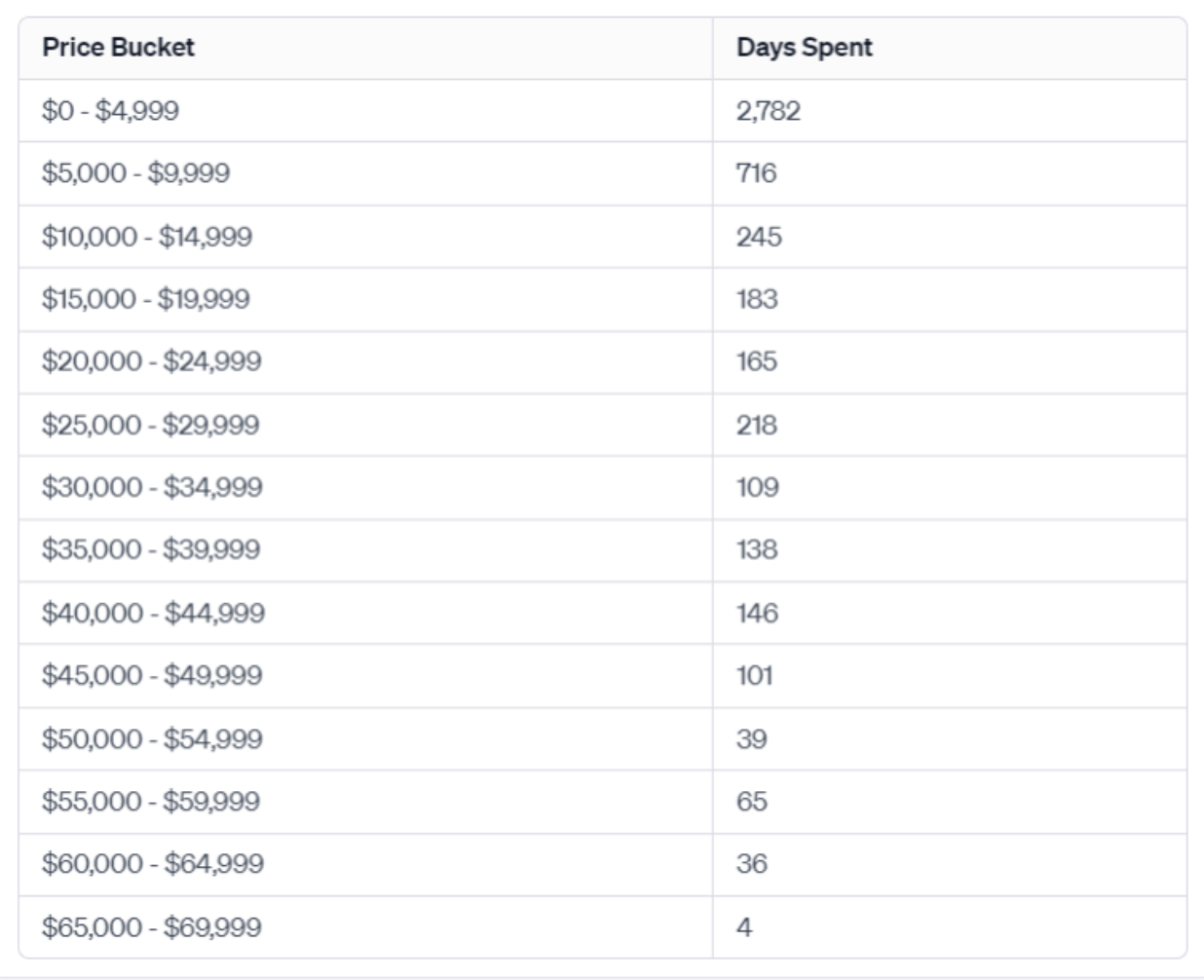

“Digging deeper, the price analysis in $5,000 increments reveals a pattern,” Van Straten writes.

“Bitcoin has been trading within the price range of $40,000 to $44,999 for 146 days. This duration has recently overtaken its previous stint in the $35,000 to $39,999 range, which spanned approximately 138 days.”

While arguably frustrating for bulls and bears alike, such price action is in fact nothing out of the ordinary, Van Straten notes.

Analyzing the time Bitcoin has spent in various $10,000 price "buckets" shows that such rangebound stints can last considerably longer.

“When assessing price increments from $10,000 and upwards until $49,999, it becomes apparent that Bitcoin typically trades within these ranges for a period between 100 and 250 days,” he concludes.

“Thus, the current sideways price action aligns with Bitcoin’s historical trading patterns and can be considered characteristic behavior, not an anomaly.”

Traders refocus on post-halving BTC price action

Frustration with the lack of sustained upside following the launch of the spot Bitcoin exchange-traded funds (ETFs) has led market commentators to soften their BTC price expectations.

With the block subsidy halving event just over two months away, popular opinion now suggests that Bitcoin will only gather bullish momentum again months afterward.

Here's the road map

March - May - BTC has a slight up tick from halving FOMO.

May - Sept - BTC chills out

Sept - Oct - BTC starts its incline

Nov - Jan - ALT season

Feb - Apr - BTC blow off top

Now until Forever - Any random ALT can go 10x; good luck

— Cobra Crypto (@CobraCrypto) February 1, 2024

Until then, familiar levels should continue to make up the landscape.

“My theory on Bitcoin remains the same,” Michaël van de Poppe, founder and CEO of MN Trading, wrote in one of his most recent post on X (formerly Twitter).

“I'm still expecting a range-bound trend between $38-48K as I've been mentioning for ~2 months. Probably a correction in the short-term after which a slight pre-halving rally to $48K seems likely.”

![]()

BTC/USD annotated chart. Source: Michaël van de Poppe/X

While the halving is eagerly anticipated thanks to its impact on BTC supply dynamics, in the background, the ETFs are beginning to remove coins from the market at what is calculated to be ten times faster than new supply per day.

Indeed, the top 2 bitcoin ETFs are enabling the buying of ˜9k BTC a day, which is 10x more than total mining supplies per day, and in 3 months (after the halving) that'll be 20x more. The ETFs are a huge deal. https://t.co/IfgloPh23m

— Tuur Demeester (@TuurDemeester) January 29, 2024

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.