Chainlink (LINK) Skyrockets 16% Daily, Bitcoin (BTC) Returns to $43K (Market Watch)

SOL, ICP, and IMX have followed LINK closely on the way up.

After a few days of consecutive declines, Bitcoin has finally reversed its price trajectory and has tapped $43,000.

Most altcoins are also well in the green today, with SOL reclaiming $100, ADA and AVAX shooting up by 4-5%, and LINK exploding by 16%.

BTC Back to $43K

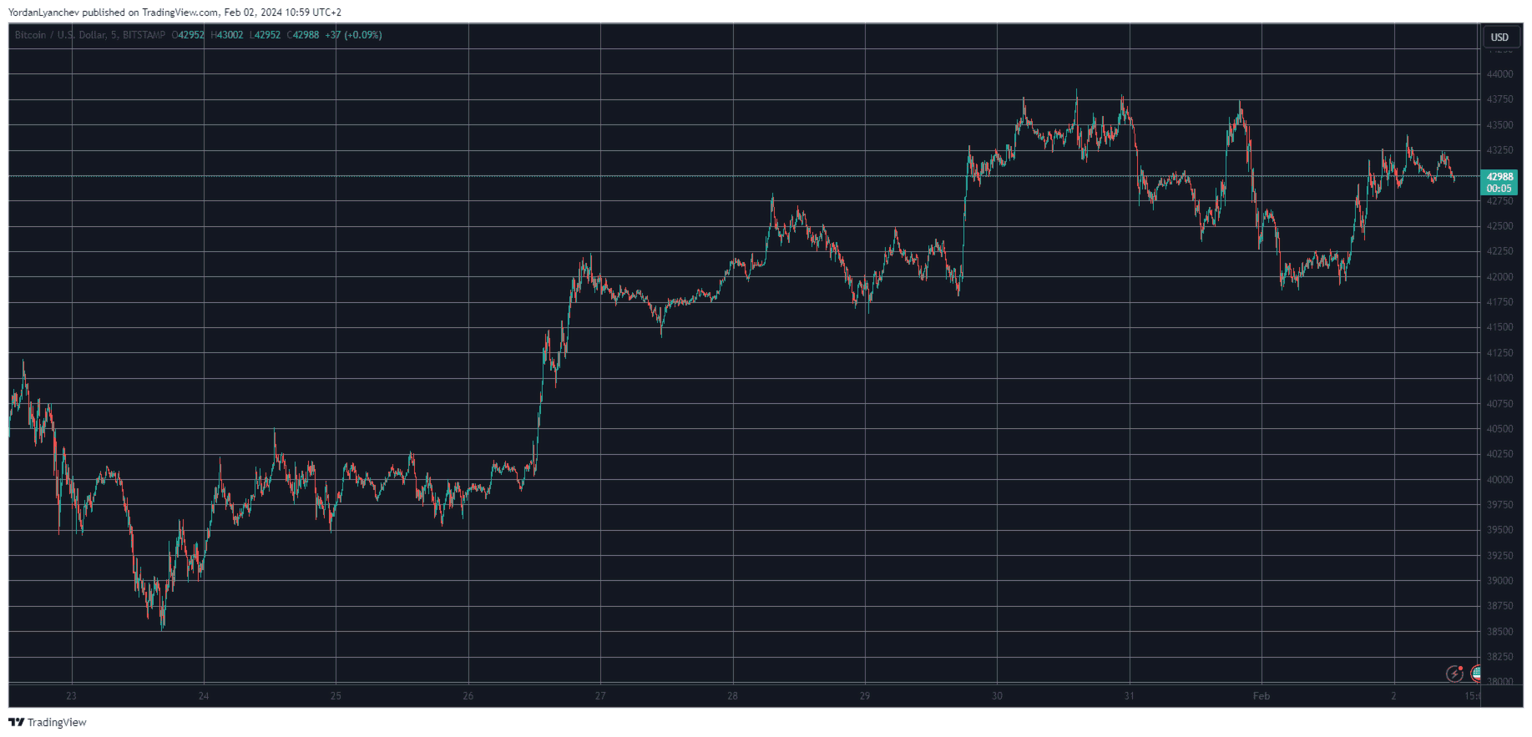

The primary cryptocurrency went on the offensive after the local bottom charted last Thursday when it dumped to $38,500. It quickly returned to $40,000 and kept climbing over the weekend to $42,000.

After a brief hiatus, the asset started gaining traction once again at the start of the current business week. This culminated with a price surge to $43,750 on a few occasions, including such an attempt registered on Wednesday.

However, that was short-lived and BTC quickly retraced by nearly two grand. This came amid the latest US Fed announcement regarding its monetary policy. Nevertheless, BTC didn’t stay down for long and pumped above $43,000 hours ago.

As of now, the cryptocurrency trades around that level with a 2% daily increase. Its market capitalization has climbed above $840 billion, while its dominance over the alts stands at 51.1% on CMC.

LINK Steals the Show

Most altcoins slid yesterday but have turned green today. Ethereum and Binance Coin have gone above $2,300 and $300, respectively, after similar 2% increases. Solana has returned to $100 following a notable 5.5% daily jump.

AVAX and ADA have gained similar percentages, followed by Tron, Polkadot, Polygon, and others. Chainlink has stolen the show with a massive 16% surge. Consequently, LINK now trades at around $18. More impressive gains come from the likes of ICP and IMX.

The cumulative market capitalization of all crypto assets has gained $30 billion overnight and is back to $1.650 trillion on CMC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.

Tether: The Largest Yet Most Fragile Pillar in the Crypto World

In-depth Analysis of the Ethereum Fusaka Upgrade: Core Changes and Ecosystem Impact