Bitcoin ( BTC ) fell into the Feb. 2 Wall Street open as United States unemployment data produced a surprise surge.

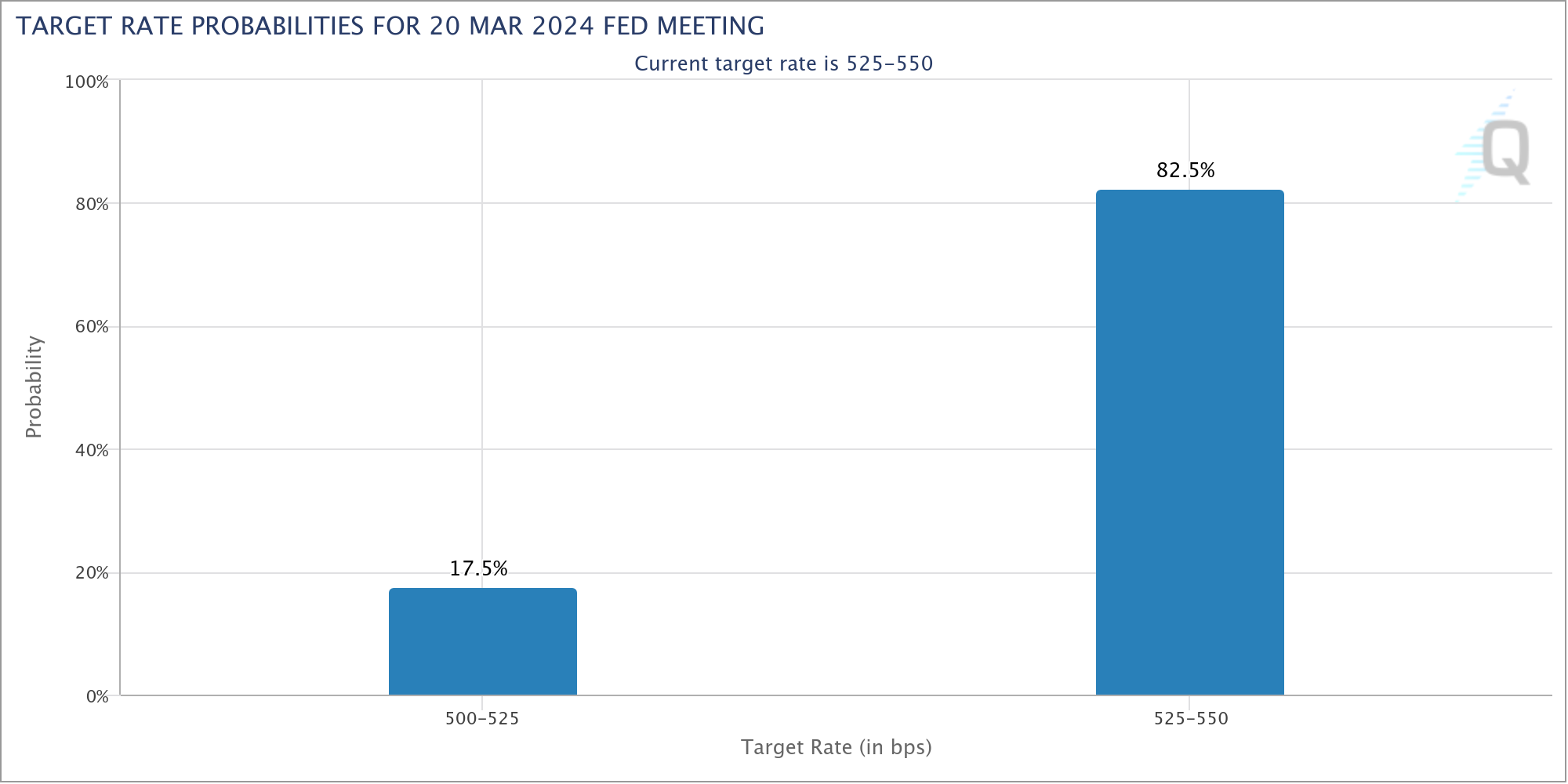

Markets slash odds of March Fed rate cut

Data from Cointelegraph markets Pro and TradingView tracked a $500 hourly candle dip on Bitstamp.

Bitcoin reacted immediately to U.S. nonfarm payrolls , which came in at nearly double estimates for January 353,000 versus 185,000 expected.

Sellers gained control as the numbers suggested that restrictive economic policy was not hurting the economy as much as assumed. Interest rates could thus stay higher for longer, depriving risk assets — including crypto — of liquidity.

On Jan. 31, the Federal Reserve unanimously opted to keep rates at previous levels, while Chair Jerome Powell sought to dispel rumors that cuts could come in March.

The jobless data furthered that narrative, with markets discounting the odds of a cut before May.

Per data from CME Group’s FedWatch Tool , the odds of the move occuring in March stood at 17.5% at the time of writing versus 45% earlier in the week.

“After all of the doom gloom after last month's NFP data about how revisions would push the December figure lower, the reality is that the December numbers were revised up to +333k from +216k,” Caleb Franzen, founder of Cubic Analytics, responded on X (formerly Twitter).

“Those who doubt the economy continue to get it wrong.”

In his own reaction, financial commentator Tedtalksmacro was optimistic beyond the immediate short-term effects of the employment miss.

“Wouldn't be surprised if crypto is back at the highs in a few hours,” he wrote in an X post.

“Strong employment data is good data long-term, it's just that the market got too far out in front when pricing cuts - wake up call now…”