ARK Invest — one of the issuers of a spot Bitcoin ( BTC ) exchange-traded fund (ETF) in the United States — has sold some major cryptocurrency-related stocks for the first time this year.

On Feb. 14, ARK dumped 214,068 Coinbase (COIN) shares and 119,394 Robinhood (HOOD) shares from its ETFs, according to a trade notification seen by Cointelegraph.

The trading firm offloaded 152,600 Coinbase shares from the ARK Innovation ETF (ARKK) alone, with an additional 31,459 and 30,009 being sold by the ARK Fintech Innovation ETF (ARKF) and the ARK Next Generation Internet ETF (ARKW), respectively. The entire sale netted $34 million, based on Coinbase's closing price of $160.4 on Wednesday, according to TradingView.

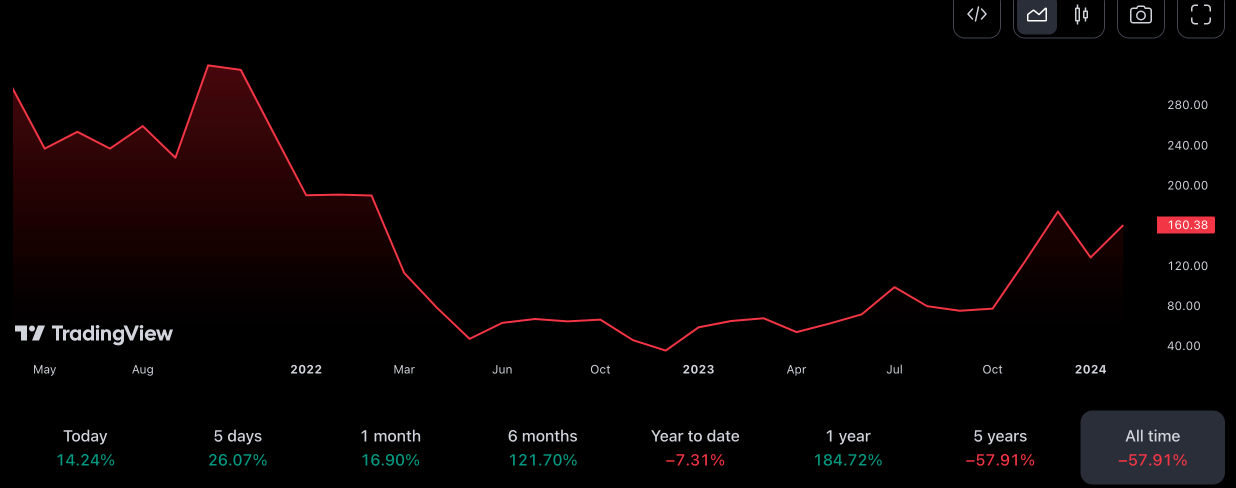

ARK’s latest Coinbase sale comes as COIN broke its 2024 highs, surging above $160 for the first time since pre-Bitcoin ETF days in early January.

The Coinbase stock is inching closer to breaking its previous high of $173 set in November 2023. Before that, the previous high was posted in September 2021 at roughly $320, according to data from TradingView.

![]() Coinbase (COIN) all-time price chart. Source: TradingView

Coinbase (COIN) all-time price chart. Source: TradingView

Additionally, ARK’s ARKW fund has sold 119,394 Robinhood shares, which the firm was actively accumulating before . The sale totaled around $1.5 million, based on HOOD’s closing price on Feb. 14.

According to the firm, ARKW sold HOOD to comply with Rule 12d3-1, which prohibits ETFs from acquiring more than 5% of the value of its total assets in the securities by a registered investment adviser, broker, dealer, or underwriter.

Previously, ARK bagged 42,129 HOOD shares for around $490,000 on Feb. 13 and 120,020 Robinhood shares for $1.3 million on Feb. 7.

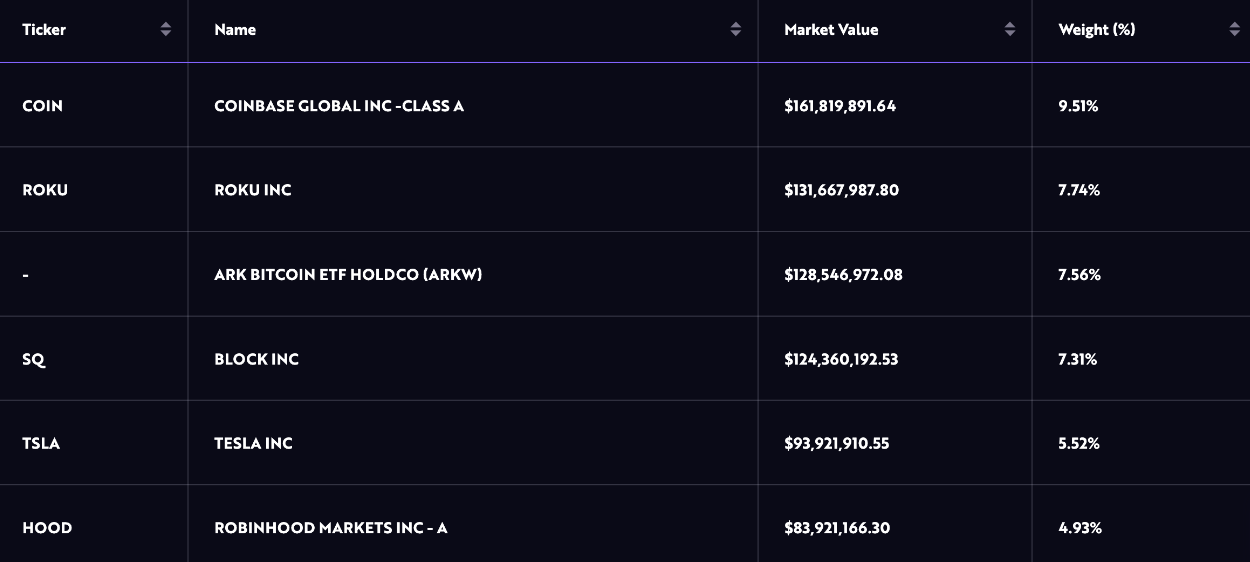

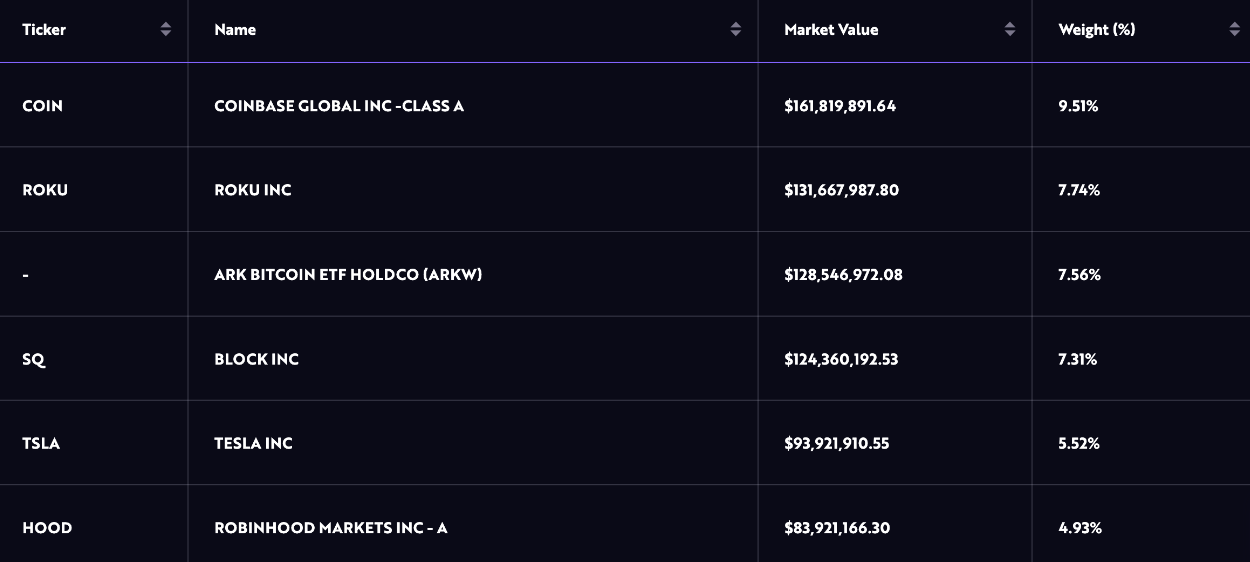

As of Feb. 15, ARKW’s top holdings include Coinbase, Roku (ROKU), ARK Bitcoin ETF, Block (SQ), Tesla (TSLA) and Robinhood. Coinbase and Roku account for 9.5% and 7.7% of the fund’s allocations, while the ARK Bitcoin ETF makes up 7.6%.

![]() Top six holdings by the ARK Next Generation Internet ETF (ARKW). Source: ARK

Top six holdings by the ARK Next Generation Internet ETF (ARKW). Source: ARK

The news comes amid ARK’s spot Bitcoin ETF continuing to increase its Bitcoin exposure. On Feb. 15, the ARK 21Shares Bitcoin ETF (ARKB) bought another 1,960 BTC, more than ARKB held on its first day of trade, or just 1,625 BTC.

ARK’s spot Bitcoin ETF has so far allocated a total of 24,925 BTC, worth $1.3 billion at the time of writing, according to Bitcoin’s price on the CoinGecko website.