Bitcoin Struggles at $51K as These Altcoins Decline the Most (Market Watch)

FIL is among the few larger-cap alts that have produced substantial gains in the past day.

Bitcoin tried its hand at taking down the $52,000 level yesterday but failed in its tracks and has been pushed down by a grand.

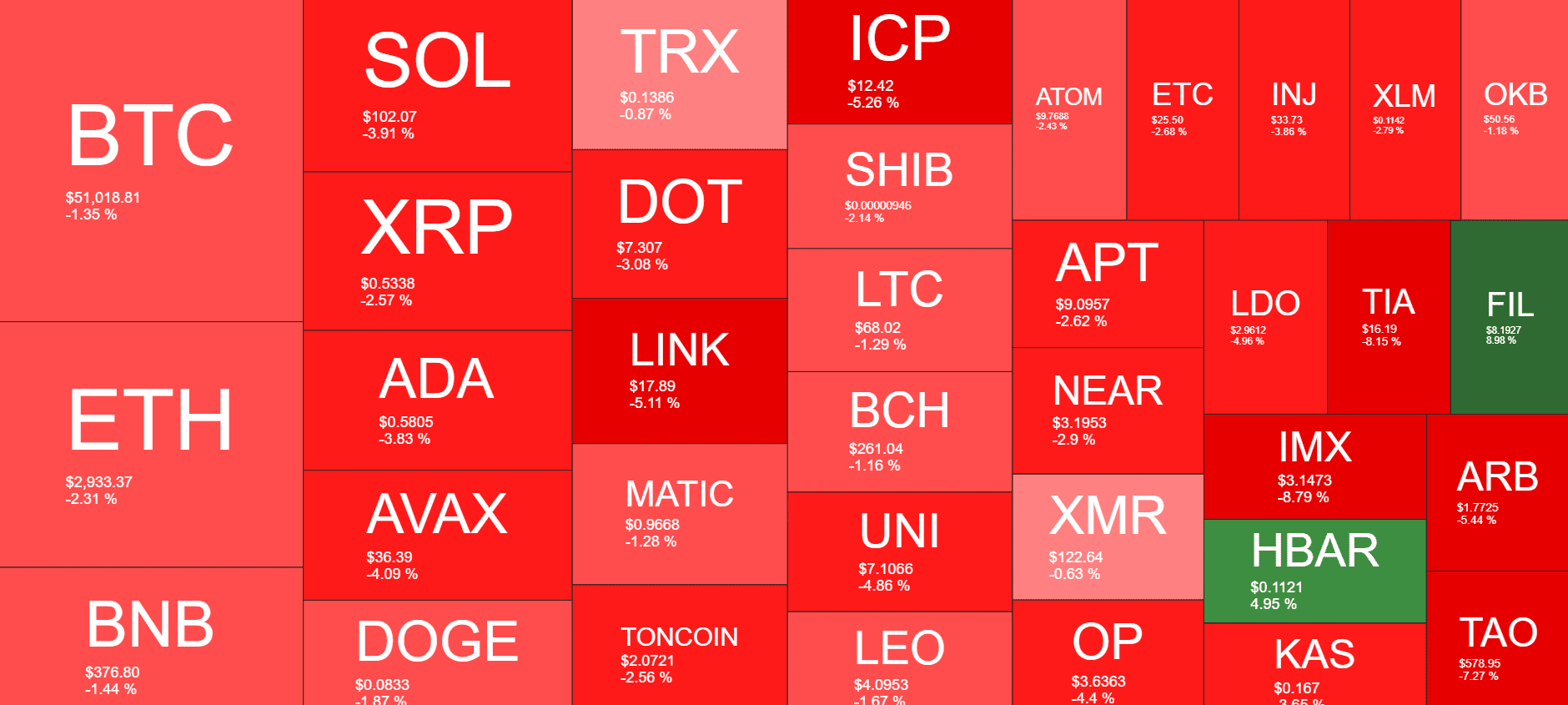

Most altcoins have retraced even more in the same timeframe, with LINK, UNI, and ICP leading the adverse trend.

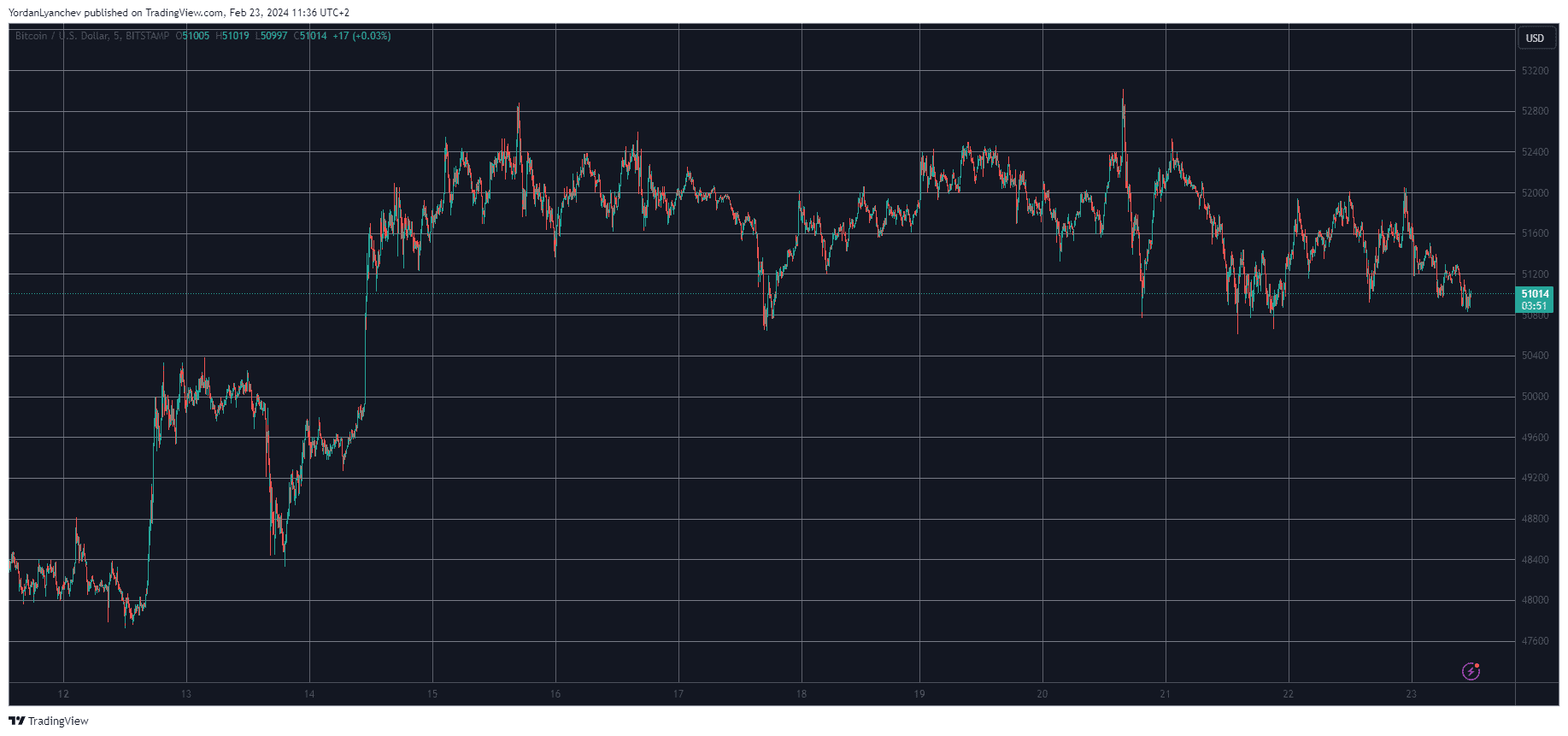

BTC Fails at $52K

Bitcoin had a highly favorable few weeks until the start of this one, in which it soared by more than ten grand and charted a new multi-year high at $53,000. The past seven days or so were a lot less eventful as the asset has remained in a tighter range.

In fact, aside from that push to $53,000 a few days back, the cryptocurrency has been predominantly trading between $51,000 and $52,000.

The latest attempt to overcome the latter came yesterday, but the bears were quick to intercept the move and pushed it south by a grand. This volatility has led to an overall number of $125 million in liquidations in the past day.

As of now, Bitcoin still struggles to remain above $51,000. Its market capitalization has declined to $1 trillion, and its dominance over the alts is down by 1% in the past week or so to 49% on CG.

Alts See Red

Most altcoins charted impressive gains yesterday, but the landscape is entirely different today. Ethereum, for instance, went as high as $3,000, but a 2.5% decline since then has pushed it down to $2,930.

Ripple, Cardano, Dogecoin, Binance Coin, Polkadot, and Toncoin have also seen similar declines in terms of percentages.

Solana is close to breaking below $100 after a 4% daily drop. Chainlink, Uniswap, and IC have decreased by around 5% each to $18, $7.1, and $12, respectively.

Filecoin is among the few exceptions, having surged by over 6% in the past 24 hours.

The total crypto market cap has seen more than $30 billion gone overnight and is down to $2.040 trillion on CG.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?