10x Research: It is expected that the bull market will continue, and if GBTC selling increases, it may face a deeper adjustment

On March 6th, 10x Research (founded by Markus Thielen) posted on social media that they expect the Bitcoin bull market to continue without any major macro events affecting market liquidity (such as interest rate hikes or stock market adjustments). The significant drop last night may lead to price consolidation in the next 1-2 weeks. 10x Research stated that this incident was foreseeable. In cryptocurrency, the highest returns occur at the end of a mid-cycle peak or cycle, but volatility is also extremely high at this time. Last night, an unknown wallet address created in 2010 sold a large amount of Bitcoin near historic highs. However, this may not be the only secret seller. Some attribute January's Bitcoin price drop to FTX creditors selling $1 billion worth of Grayscale's GBTC. In mid-February, a bankruptcy judge approved Genesis' request to sell nearly $2 billion worth of GBTC (and other crypto assets). Due to a significant increase in GBTC sales over the past five trading days, this fund outflow may have started impacting the market. If this is indeed the case, it will take several days and the market might face deeper adjustments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

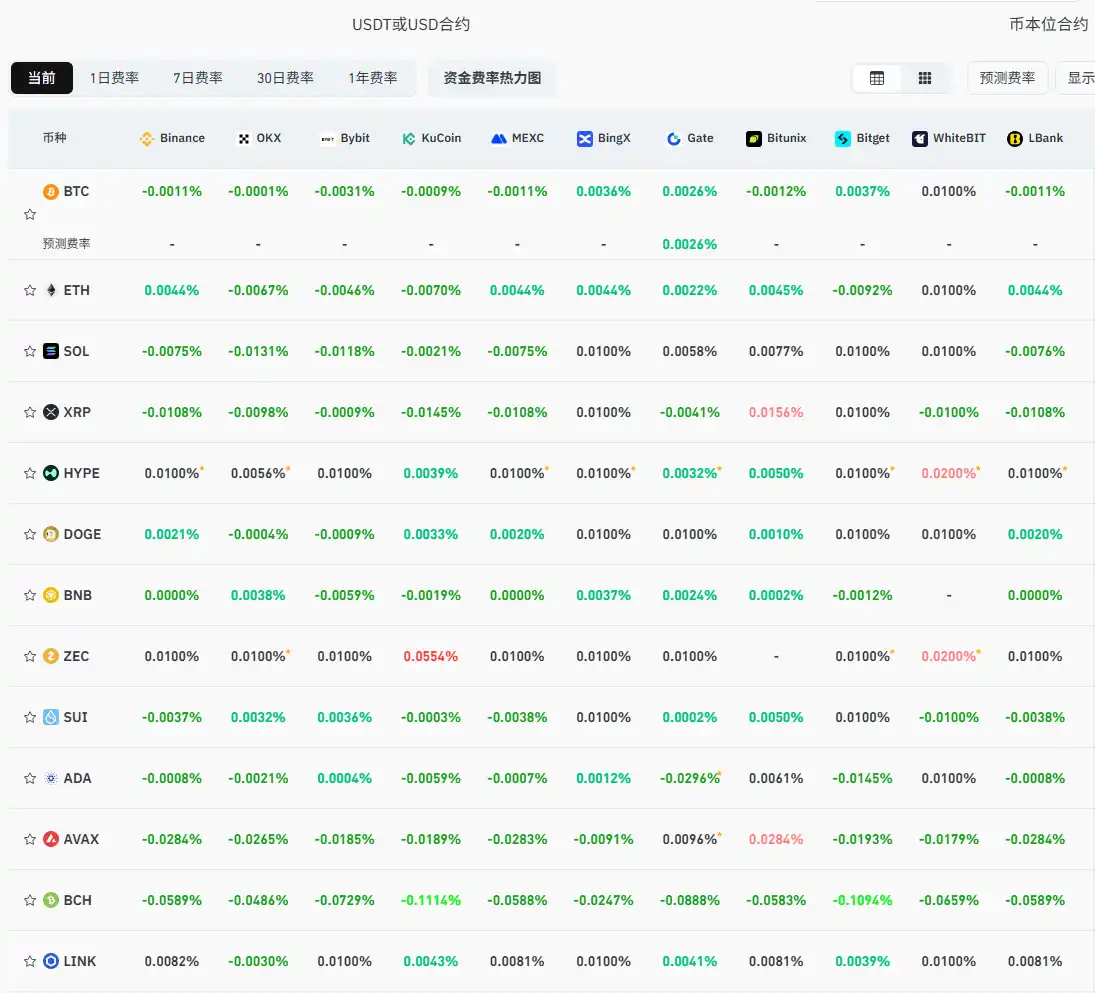

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish

The Crypto Fear Index rises to 28, escaping the "Extreme Fear" zone

Analyst: The current macro environment is similar to the pandemic period, and bitcoin still has room to rise

The Hyperliquid team wallet has unstaked 2.6 million HYPE and conducted small-scale selling and transfer tests.