Bitcoin ( BTC ) headed lower at the March 14 Wall Street open after United States macro data offered a fresh inflation headache.

PPI boosts "higher for longer" Fed rate bets

Data from Cointelegraph Markets Pro and TradingView tracked a swift BTC price descent from all-time highs to $71,200.

This took a matter of hours, with a rebound yet to kick in at the time of writing, leaving BTC/USD up to 3.3% down on the day.

U.S. Producer Price Index ( PPI ) numbers for February appeared not to help matters, this coming in above expectations to underscore the persistent nature of elevated inflation.

PPI joined both jobless claims and the Consumer Price Index (CPI) print from two days prior in reinforcing a problematic landscape for the Federal Reserve.

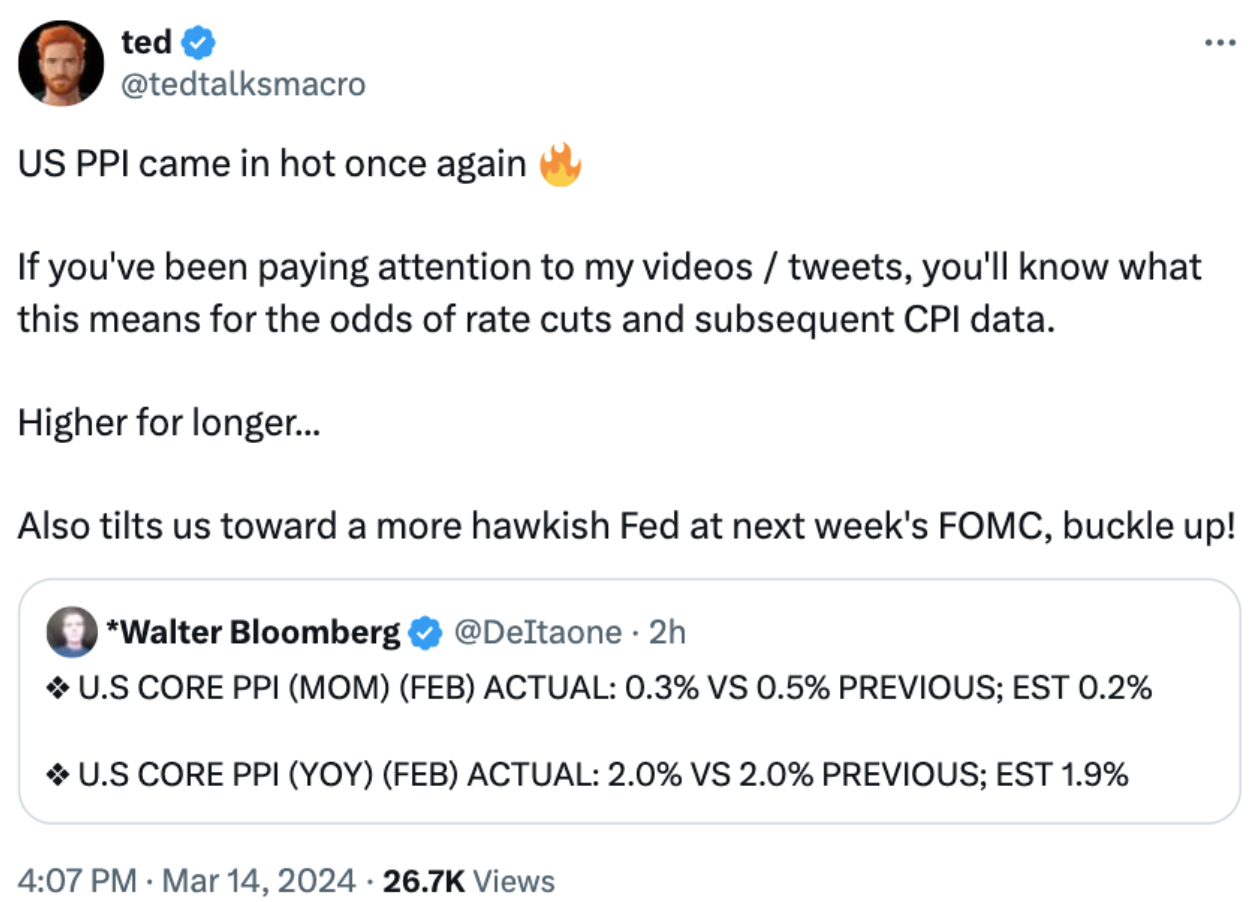

Reacting on X (formerly Twitter), financial commentator Tedtalksmacro predicted that the Fed would keep interest rates “higher for longer” on the back of the data.

The next meeting of the Federal Open Market Committee (FOMC), due to take place on March 20, was already slated not to produce a rate cut .

“One thing I will say, although I believe macro to be secondary to institutional flows / clarity on crypto on what's driving this market right now,” he acknowledged in part of a further post.

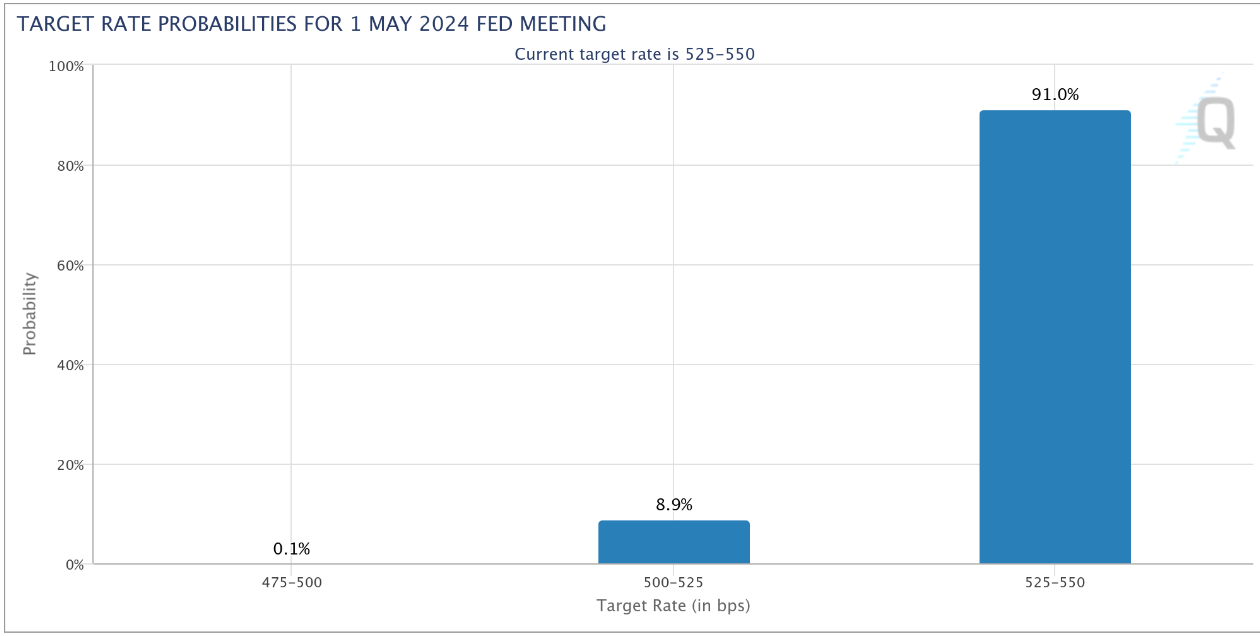

According to the latest estimates from CME Group’s FedWatch Tool , odds of a rate cut at the subsequent FOMC meeting in May stood at just 6.2% at the time of writing.

"Price discovery awaits" Bitcoin beyond key area

Considering the broader picture for BTC price action, popular trader and analyst Rekt Capital maintained an air of calm.

All-time highs, he suggested, were classic battlegrounds for both upward and downward volatility, and needed time to “resolve” before trend continuation.

“Whenever Bitcoin breaks it old All Time High, price doesn't just enter an uninterrupted uptrend,” he told X subscribers alongside an illustrative chart.

“Historically, $BTC has experienced lots of upside & downside volatility around old ATHs. But once that volatility resolves itself... Price Discovery awaits.”