Bitcoin ( BTC ) plugged intraday lows at the March 22 Wall Street open despite lower outflows from the Grayscale Bitcoin Trust (GBTC).

Bitcoin bulls fail to catch a break as BTC price weakness defies a slowdown in GBTC offloading.

Bitcoin ( BTC ) plugged intraday lows at the March 22 Wall Street open despite lower outflows from the Grayscale Bitcoin Trust (GBTC).

Data from Cointelegraph Markets Pro and TradingView tracked limp BTC price performance as $63,000 returned to the radar.

The largest cryptocurrency failed to hold higher levels, which resulted from an earlier rebound , with its old 2021 all-time highs at $69,000 staying unchallenged.

The day’s flows into and out of the United States spot Bitcoin exchange-traded funds (ETFs) began promisingly. GBTC saw just $96 million in outflows, per initial data from crypto intelligence firm Arkham — less than a third of the tally at the start of the week.

So far, every day this week has seen net outflows from the spot ETFs — a unique time in their short history.

Analyzing current BTC price action, popular trader Skew suspected deliberate moves to undermine bullish momentum.

“Looks like someone is trying to force a cascade here again during weak price action,” he commented in a post on X (formerly Twitter) about spot order book data from the world’s largest exchange by volume, Binance.

Skew added that it was “pretty clear” that certain traders were selling into price.

Fellow trader Crypto Tony joined those calling for a reclaim of $69,000 in order to ensure upside continuation.

“All eyes on the weekly close,” trader Jelle continued.

Adopting a characteristically optimistic take on the market, Jelle outlined the upside potential if Bitcoin were able to flip the current range to support.

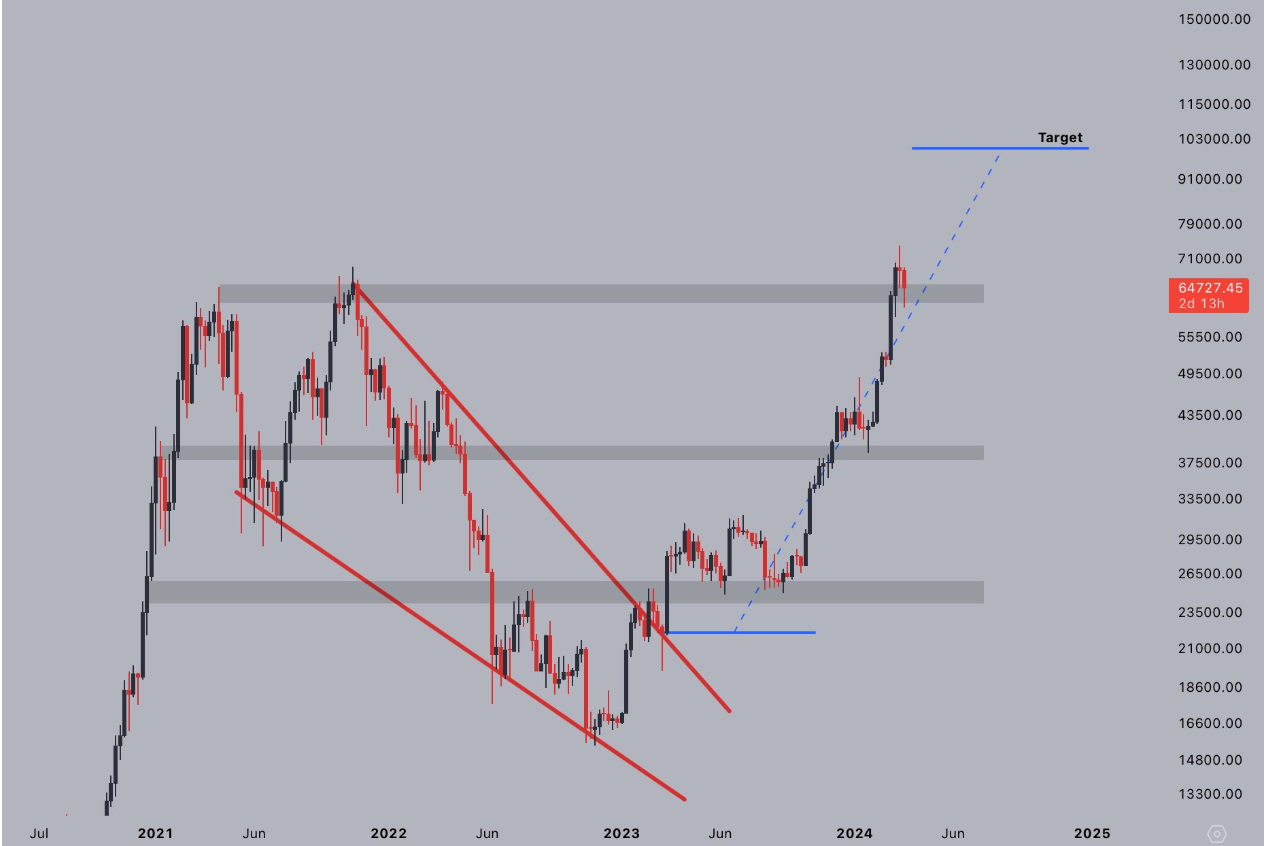

“If Bitcoin successfully flips this zone for support, there is very little standing in the way of price making its way towards the target of this falling wedge: $100,000,” he told X followers.

Eyeing downside, meanwhile, trader and analyst Rekt Capital drew comparisons to Bitcoin’s 2016 bull market.

Then, he noted, the period immediately before the block subsidy halving produced marked downside.

“Recently, Bitcoin has also produced a long downside wick on its Pre-Halving Retrace,” he explained .

“Bitcoin will need to continue to maintain these current highs to avoid a 2016-like fate where the initial reaction was strong but short-lived.”

The next halving event is currently due to hit in mid-April .

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes