It is expected that after the U.S. stock market opens tonight, there will be a net inflow of approximately 6,018 Bitcoins into the ETF custody address

PANews reported on March 27 that on-chain analyst Yu Jin tweeted that the net inflow of ten Bitcoin spot ETFs on March 26 was US$417.98 million. It is expected that after the US stock market opens on March 27, the ETF custody address will have a net inflow of approximately 6,018 Bitcoins. Among them, Grayscale (GBTC) experienced a net outflow of approximately 3,058 Bitcoins, while the remaining nine ETFs had a total net inflow of approximately 9,076 Bitcoins, led by Fidelity (FBTC) and BlackRock (IBIT), which together had a total inflow of 6,354 Bitcoins. Currently, ten BTC spot ETFs hold a total of approximately 825,040 Bitcoins. The difference between the Bitcoin holdings of BlackRock (IBIT) and Grayscale (GBTC) is less than 100,000. According to the current trend, BlackRock's holdings may exceed Grayscale in half a month.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Barcelona Football Club criticized for signing a $22 million sponsorship deal with crypto company ZKP

Swedish payment giant Klarna's first stablecoin, KlarnaUSD, has been launched ahead of schedule

Bitcoin OG opens 5x ETH short position worth $15.04 million

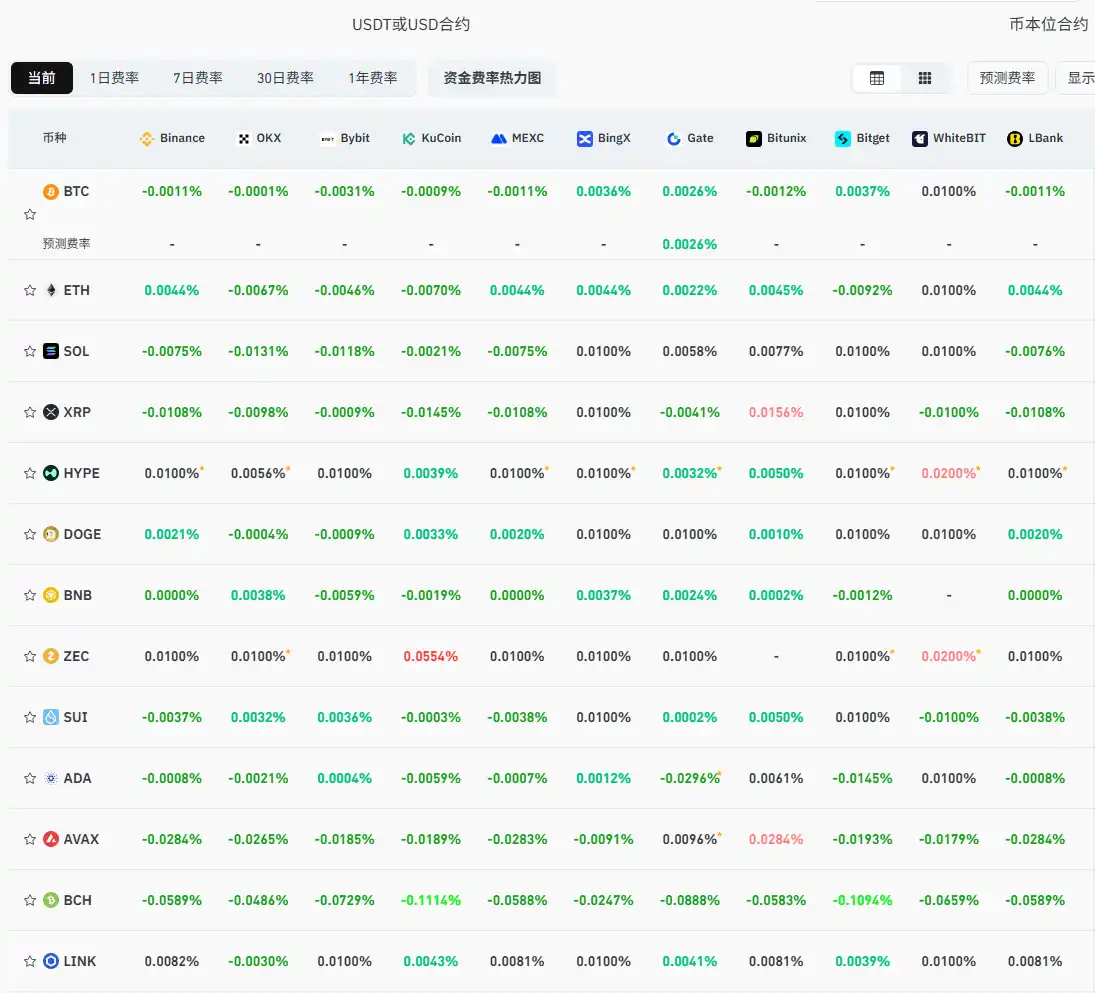

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish