Bitcoin ( BTC ) saw fresh volatility at the March 27 Wall Street open as analysts said that short liquidations were now long overdue.

BTC price nears 2-week highs as volatility clears Bitcoin sell orders

Bitcoin's old 2021 all-time high proves to be a magnet as bulls' latest charge is cut off near two-week BTC price highs.

Bitcoin takes sell-side liquidity before fresh dip

Data from Cointelegraph markets Pro and TradingView tracked BTC price action as it hit its highest levels in nearly two weeks — $71,754 on Bitstamp.

A sudden correction then saw BTC/USD drop $1,300 in minutes, going on to total more than 4% as bulls fought to flip the key $69,000 zone to support.

The latest data covering flows for the United States spot Bitcoin exchange-traded funds (ETFs) remained encouraging.

After net inflows of more than $400 million the day prior, Wall Street trading began with a modest 1,300 BTC ($91 million) outflow from the Grayscale Bitcoin Trust (GBTC).

The figures, from crypto intelligence firm Arkham, were uploaded to X (formerly Twitter) by popular trader Daan Crypto Trades.

“We're indeed seeing some high volatility as well,” he added in a further post, noting that the local highs had filled a large wall of BTC sell orders.

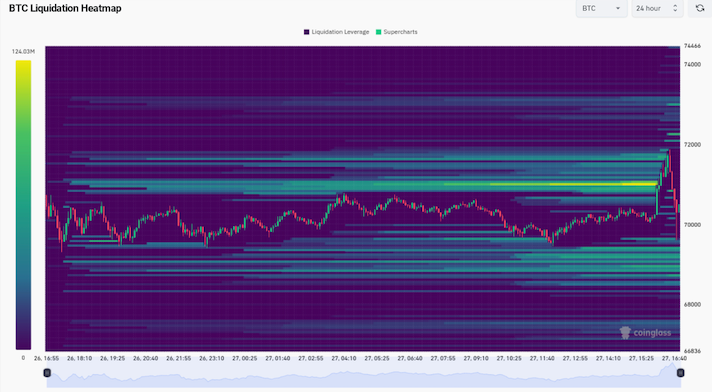

Liquidating short BTC positions was now a key topic of discussion for market observers. The latest data from on-chain monitoring resource CoinGlass showed bids thickening around $69,000 — a potential safety net should the market reverse.

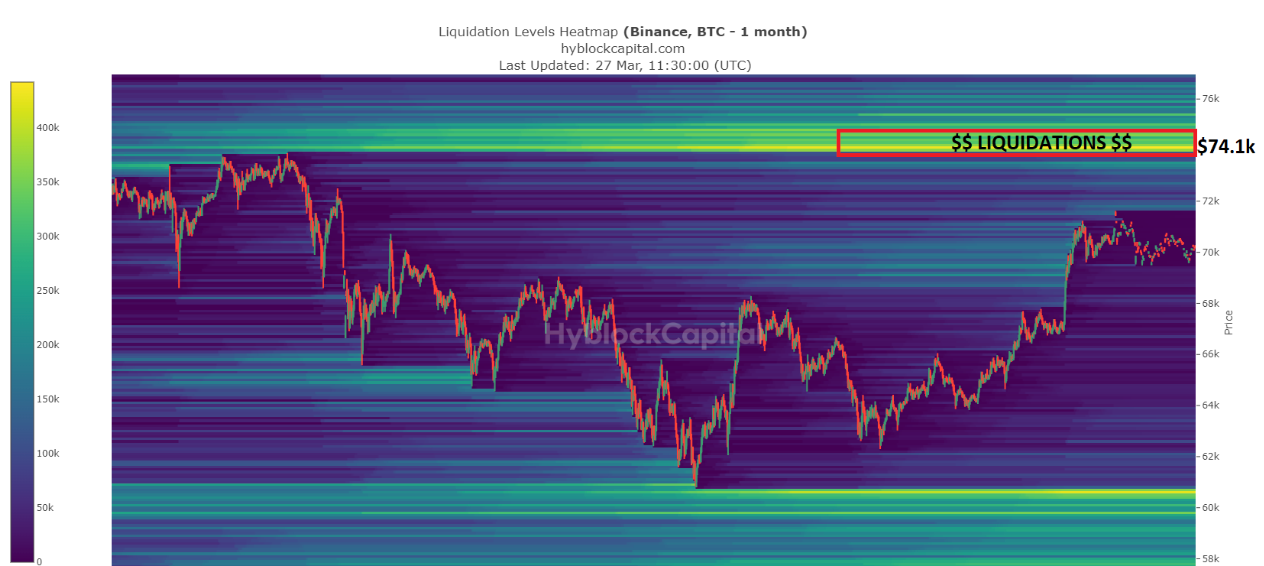

Further out, fellow trader CrypNuevo hoped for an attack on the final band of shorts around recent all-time highs at $74,000.

“Mid term: Liquidity at both sides but more likely to go for the upside liquidations at $74.1k because they're closer from current price,” he reasoned in part of an X post.

$69,000 remains key point on the BTC price map

With $68,500 coming back into play at the time of writing, popular trader Crypto Ed was among those calling for calm.

That price, he said in his latest YouTube video released on the day, would form a potentially suitable long entry and would not constitute a major corrective move.

“Not really sure if this next move is really a big one — $73,000 maybe,” he suggested about where BTC/USD could go thereafter.

A further correction could then set in before attacking the all-time highs.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After Pectra comes Fusaka: Ethereum takes the most crucial step towards "infinite scalability"

The Fusaka hard fork is a major Ethereum upgrade planned for 2025, focusing on scalability, security, and execution efficiency. It introduces nine core EIPs, including PeerDAS, to improve data availability and network performance. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.