Bitcoin ( BTC ) worth nearly $10 billion has left crypto exchanges since the United States launched spot exchange-traded funds (ETFs).

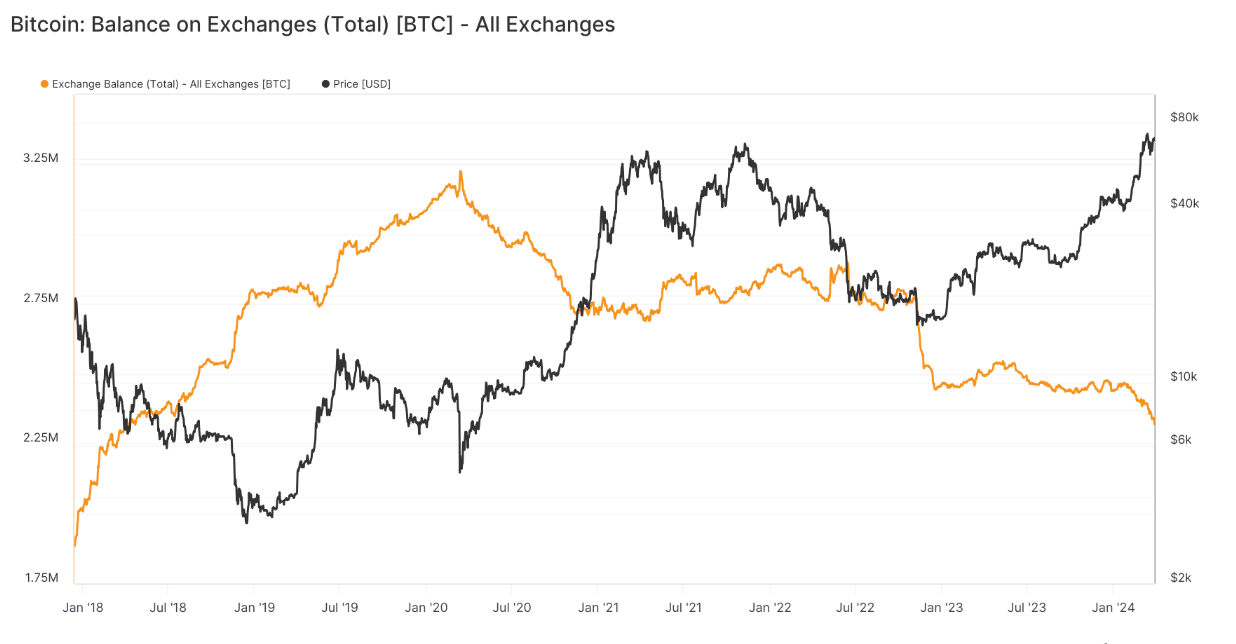

Data from on-chain analytics firm Glassnode shows that since Jan. 11, exchanges are down over 136,000 BTC.

BTC exchange trends show no signs of profit-taking

Bitcoin supply dynamics continue to sway in bulls’ favor as exchanges see mass withdrawals this quarter.

The U.S. spot Bitcoin ETFs have been trading less than three months, but in that time, around $9.5 billion worth of BTC has been withdrawn from major trading platforms.

As of March 28, the exchange tracked by Coinbase held a combined 2,320,458 BTC — the lowest balance since April 2018.

The trend shows no sign of slowing. Glassnode shows that on March 27 alone, withdrawals totaled more than 22,000 BTC ($1.54 billion) — the third-largest daily tally of 2024.

Bitcoin balance on exchanges. Source: Glassnode

Analyzing market flows, meanwhile, J.A. Maartunn, a contributor to on-chain analytics platform CryptoQuant, flagged a giant transfer of stablecoin USD Coin (USDC) to Coinbase, the largest U.S. crypto exchange.

This, he noted, was the largest such inbound transfer in history.

“$1.4B USDC just moved into Coinbase. Is strong buying pressure incoming?” he queried in part of an accompanying post on X (formerly Twitter).

USD Coin (USDC) inflows to exchanges. Source: Maartunn/X

Bitcoin halving optimism grows

The ETFs’ long-term impact on the available BTC supply — and hence price — is an increasingly hot topic among market observers.

As Cointelegraph reported , several sources now predict that a major “squeeze” in supply — demand outpacing the BTC available for sale — will make itself felt within the next six to twelve months.

ETF buying alone already represents a much larger buying force than the “new” BTC unlocked each day by miners.

After the upcoming block subsidy halving event in mid-April, that ratio will increase even more, as the BTC supply expands by just 3.125 BTC per newly-mined block.

"The biggest Halving in Bitcoin’s history is just days away," Charles Edwards, founder of quantitative Bitcoin and digital asset fund Capriole Investments, wrote in part of his latest market commentary .

"For the first time, Bitcoin will become harder than gold, with half its supply growth rate. Pent up institutional demand via the ETFs, a programmatic supply squeeze from the Halving and Bitcoin taking the title as the world's hardest asset. There's a lot to look forward to in April."

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.