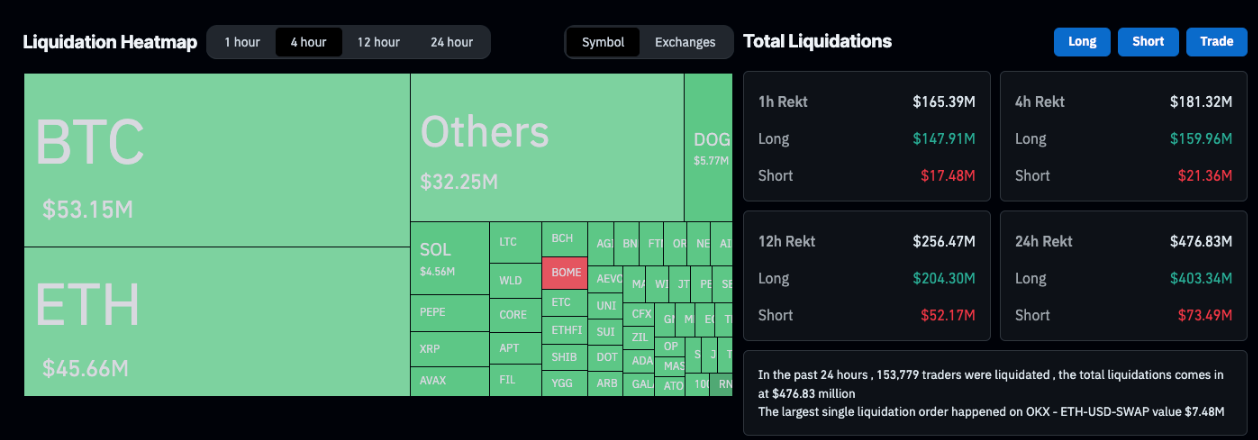

A sudden 5% drawdown in the price of Bitcoin ( BTC ) on Tuesday has seen traders with leveraged exposure to Bitcoin and other cryptocurrencies rack up over $165 million in losses in less than 2 hours.

Bitcoin plunged 5% from $69,450 to as low as $65,970 in less than 30 minutes, in early hours on March 2 UTC, per TradingView data.

Roughly $6 million in long positions on Dogecoin ( DOGE ) and $4 million in Solana ( SOL ) were liquidated, trailing BTC and ETH.

BlackRock’s ETF stood as the best-performing fund with a net inflow of $165.9 million, while Fidelity came in second with $44 million.

However, the inflows were weighed down by Grayscale’s GBTC posting $302 million in outflows, bringing the net daily outflows for all the funds to $85.7 million.

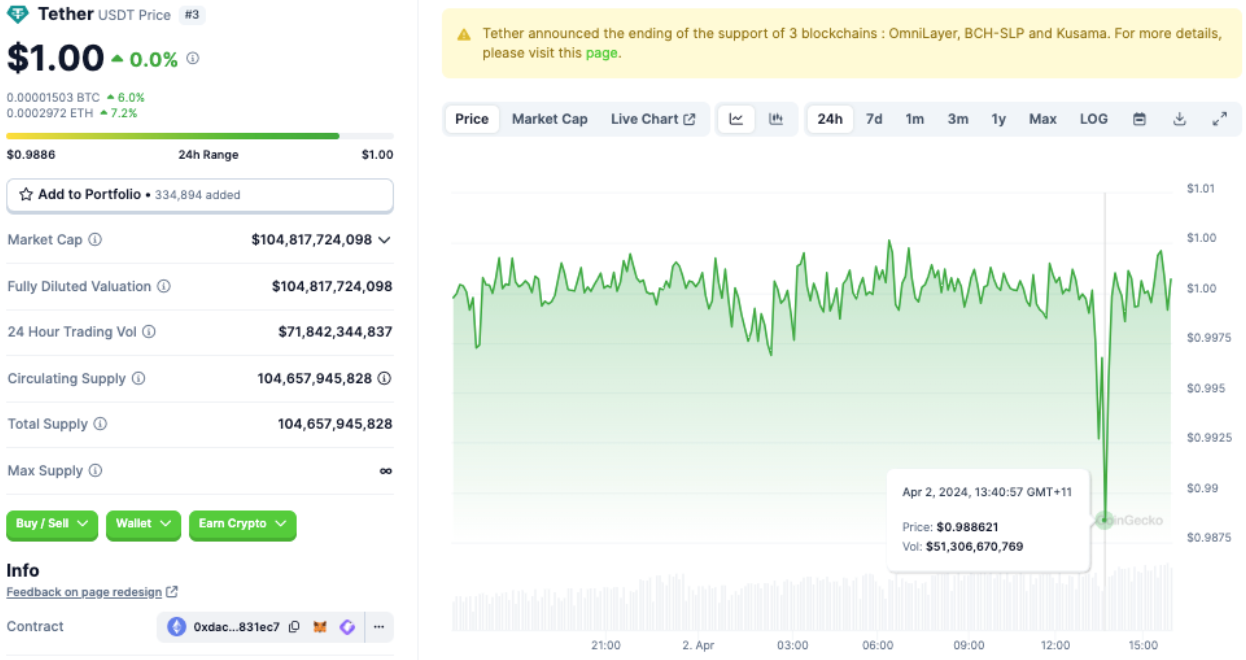

Tether wobbles from its peg

At the same time as the Bitcoin flash crash, the value of the U.S. Dollar-pegged stablecoin Tether ( USDT ) also wobbled around 1%, briefly falling from its $1 peg to $0.988, according to data from CoinGecko and Google Finance.

Cointelegraph contacted Tether but did not receive an immediate response.