$500 Million in Liquidations as BTC Dumps to $66K, DOGE and SHIB Plummet Double Digits

More than 150,000 traders have been liquidated in the past day.

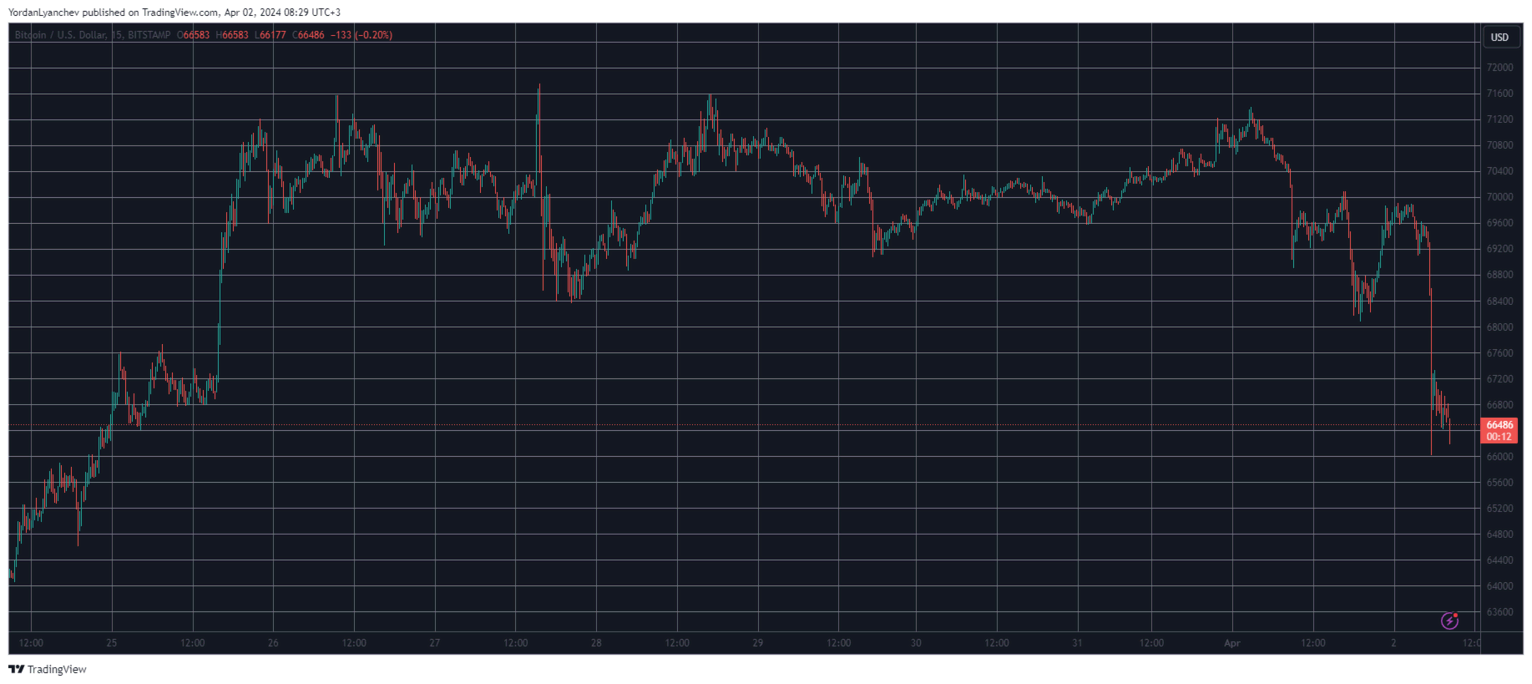

After a few days of sideways trading, Bitcoin’s price has headed straight south, with a massive plunge that has pushed it to a 9-day low of $66,000.

The altcoins are in an even worse position, with several double-digit price losers, such as Dogecoin, Shiba Inu, Bitcoin Cash, and Avalanche.

CryptoPotato reported yesterday morning BTC’s price movements, which were quite sluggish. The asset had calmed over the weekend and stood primarily around $70,000 after failing to overcome the $71,000 level.

The landscape first changed during the trading day when Bitcoin slipped slightly to under $68,500. It managed to recover the losses in the following hours, but things took another turn for the worse during the Tuesday morning Asian trading session.

In a matter of a few hours, the cryptocurrency slumped by four grand and dumped to a 9-day low of $66,000. Despite recovering some ground since then, BTC is still more than 5% down on the day and is at around $66,500.

The altcoins’ situation is even worse, though. Dogecoin, Avalanche, Shiba Inu, and Bitcoin Cash have slumped by double digits in the past day. BCH’s price drop is particularly interesting as it comes just ahead of its second halving, which has been delayed a few times already.

ETH, BNB, SOL, ADA, TON, XRP, and DOT are also deep in the red. These massive price fluctuations have led to a high number of wrecked traders – over 150,000, according to CoinGlass.

The total value of liquidated positions is just over $500 million on a daily scale, with the single-largest one taking place on OKX. It involved the ETH-USD-SWAP trading pair, and it was worth $7.5 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?