Ripple Plans to Launch Dollar-Linked Stablecoin to Enter $150 Billion Stablecoin Market

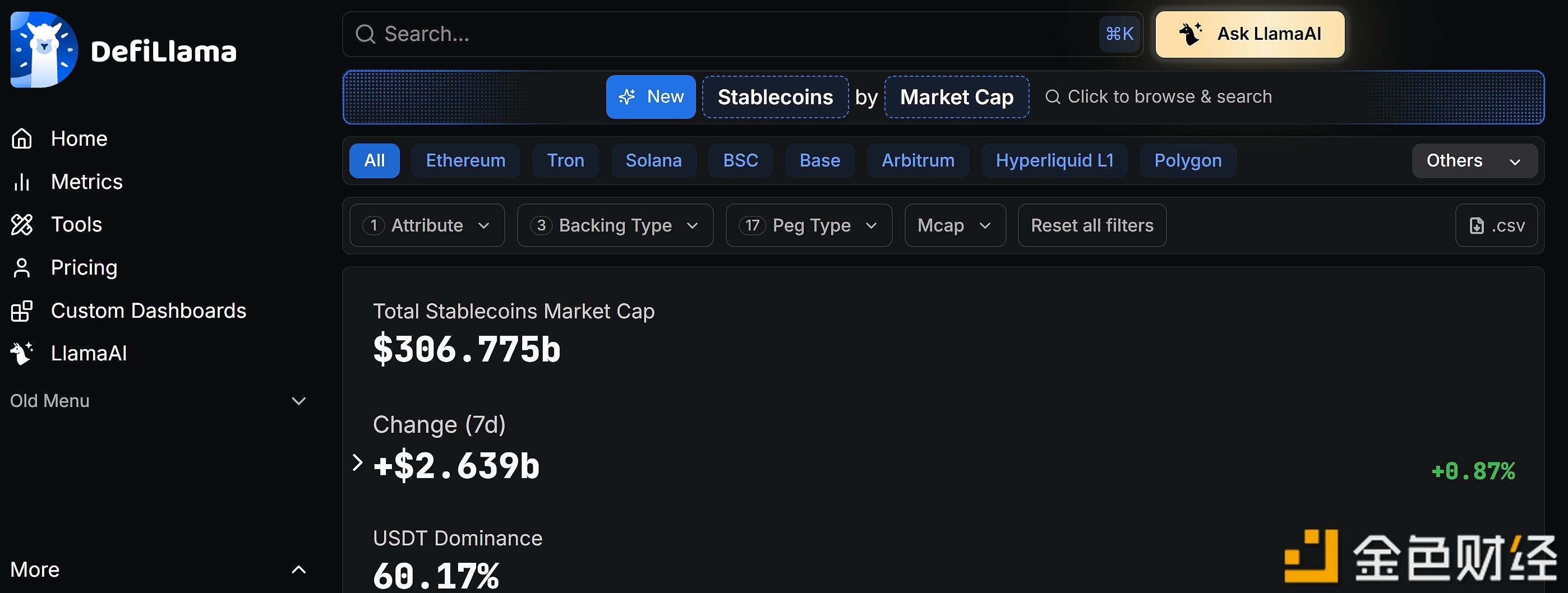

Enterprise crypto solutions provider Ripple recently announced plans to launch a stablecoin pegged to the U.S. dollar, marking Ripple's entry into the stablecoin market, which is currently valued at approximately $150 billion and is expected to expand dramatically over the next few years. The stablecoin, which will be fully backed by U.S. dollar deposits, short-term U.S. government bonds, and similar cash equivalents, is designed to meet the growing demand for reliable and secure digital assets.Ripple plans to launch the stablecoin initially on the XRP Ledger (XRPL) and Ethereum (ETH) blockchains, with the possibility of expanding to other platforms in the future.

Monica Long, President of Ripple, emphasized the importance of stablecoins in providing stability and accessibility to the cryptocurrency market, especially after the recent banking crisis. She emphasized that for traditional institutions, especially in the U.S., stablecoins are essential as a conduit in and out of the U.S. Long expressed great enthusiasm for Ripple's role in meeting the market's needs by launching its stablecoin. She emphasized the company's commitment to providing trust and utility to users while meeting regulatory considerations. As anticipation grows for the release of Ripple's stablecoin, industry observers are focusing on how it will impact the broader cryptocurrency landscape. Regulatory approvals will play an important role in setting the timeline for the stablecoin's release.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Honeypot Finance launches multi-chain and CEX asset transfer features to simplify liquidity management