The frequency of Bitcoin ( BTC ) reaching higher support price levels as well as the "lack of immediate froth" in the derivatives markets suggests that its price is unlikely to retrace down to $50,000 any time soon, according to a crypto analyst.

Senior analyst at digital asset fund UTXO Management, Dylan LeClair, explained in an analyst note on April 7 that if Bitcoin's rises back into the $70,000-$75,000 price range, it will put significant pressure on short positions.

"As we've consolidated, an increasing amount of short liquidations are building from 70-75k," he stated.

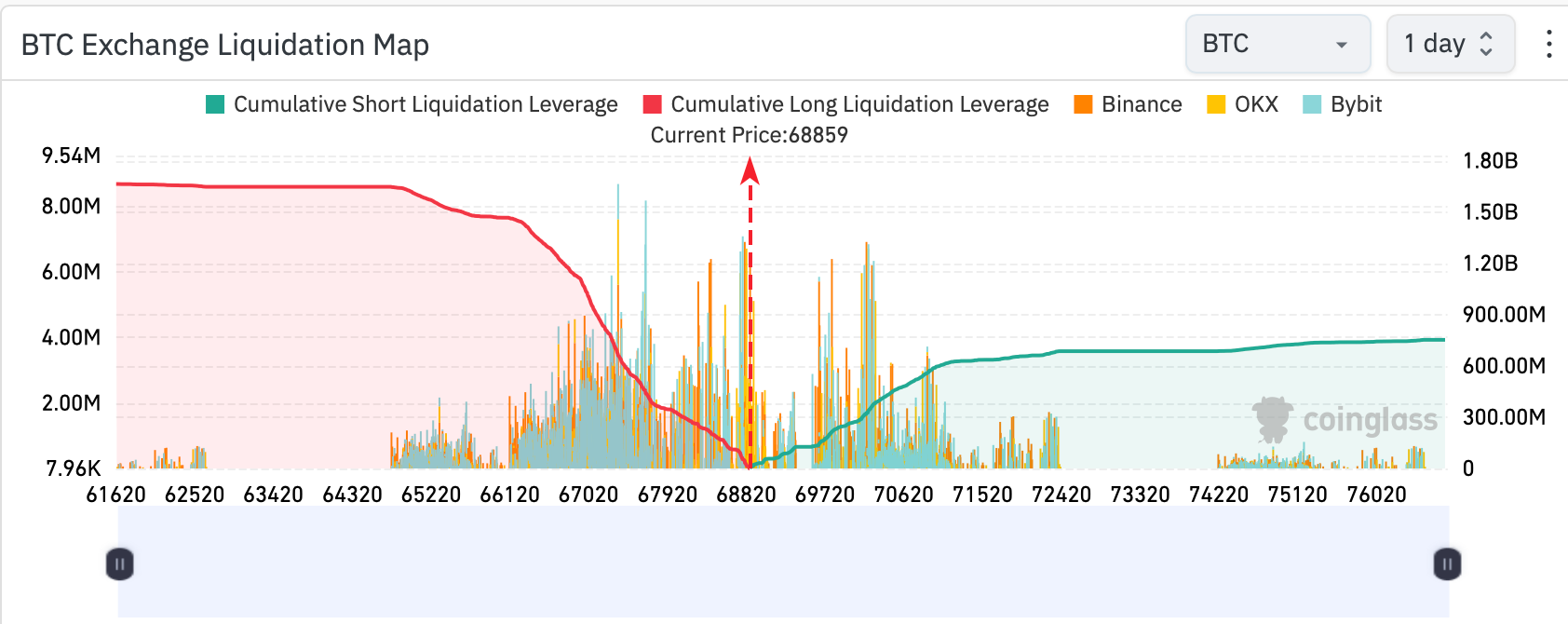

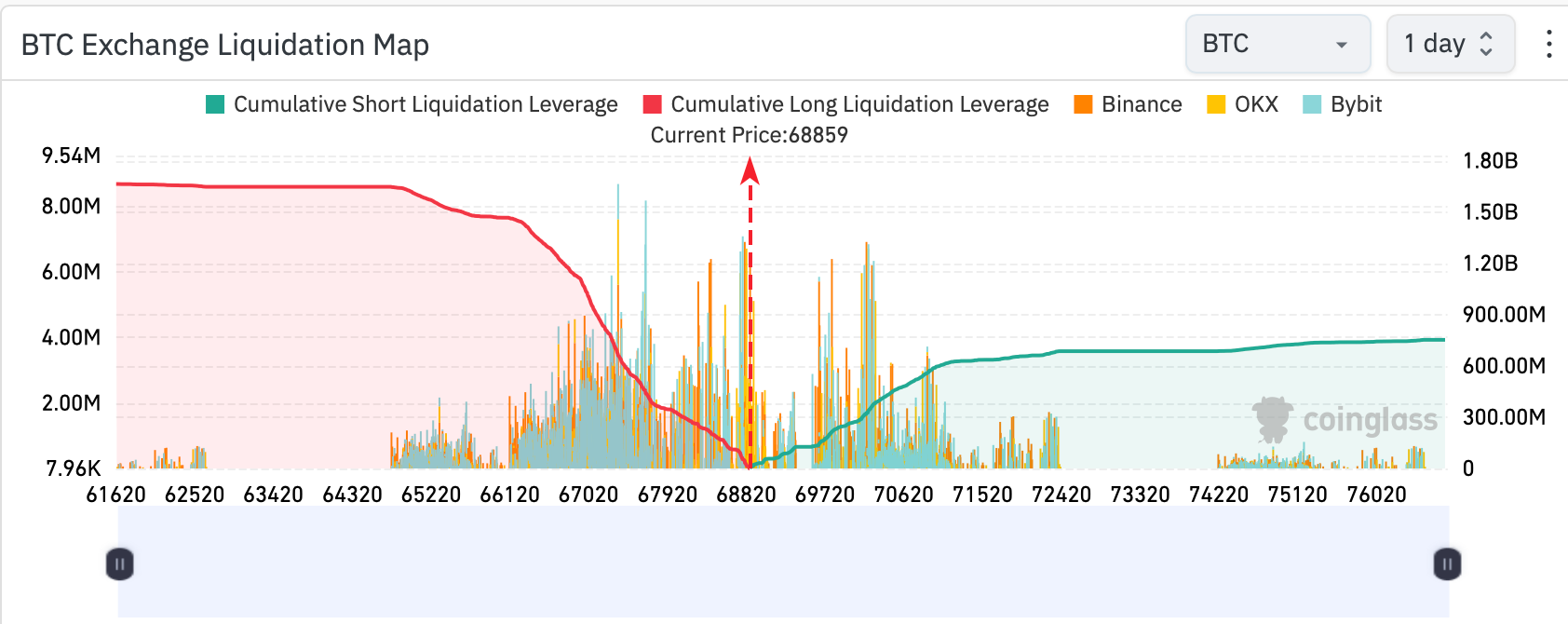

If Bitcoin’s price rises to $70,000, approximately $174.17 million will be liquidated, as per CoinGlass data.

Bitcoin liquidation map. Source: CoinGlass

Should it reach the upper boundary of LeClair's range, hitting $75,000, around $271.92 million worth of short positions would face liquidation.

LeClair explained although a decline Bitcoin's price to $50,000 – which equates to a 27% decrease – could trigger substantial liquidation of long positions, he doesn't foresee it, considering the recent price shifts and the increasing support levels.

“While there is a large cluster of longs that could be taken out at ~50k, given the structure of higher lows and the lack of immediate froth in the derivatives landscape currently, I find it pretty unlikely we revisit that level,” he stated.

"Not impossible of course," he added. Bitcoin's price last dipped below $50,000 on Feb. 13, hitting $49,725.

He backed up his claims by citing the recent development by global asset manager BlackRock updating its Bitcoin exchange-traded fund (ETF) prospectus on April 5, adding five big Wall Street firms as new authorized participants.

New members include ABN AMRO Clearing, Citadel Securities, Citigroup Global Markets, Goldman Sachs and UBS Securities

Prominent crypto traders are speculating over Bitcoin's price ahead of the halving event, which is just 13 days away, set for April 20. This event occur every four years, and will cut miner block rewards by 50%, from 6.25 BTC to 3.125 BTC.

Cointelegraph recently reported that Bitcoin's price has risen around 658% since the last Bitcoin halving in 2020. If historical chart patterns were to repeat, Bitcoin’s price would reach $434,280 per coin by the 2028 halving if it performs similarly to the current cycle.

In an April 7 post, crypto trader Rekt Capital told his 443,000 followers that the market is roughly one-third into the "bull market" phase.

Source: Rekt Capital

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.