Crypto exchange Coinbase’s Ethereum layer-2 blockchain Base has seen its total value locked (TVL) surge by over 13.2% in the past week to surpass $4 billion for the first time as its 30-day transactions beat out Ethereum and its top rival Arbitrum.

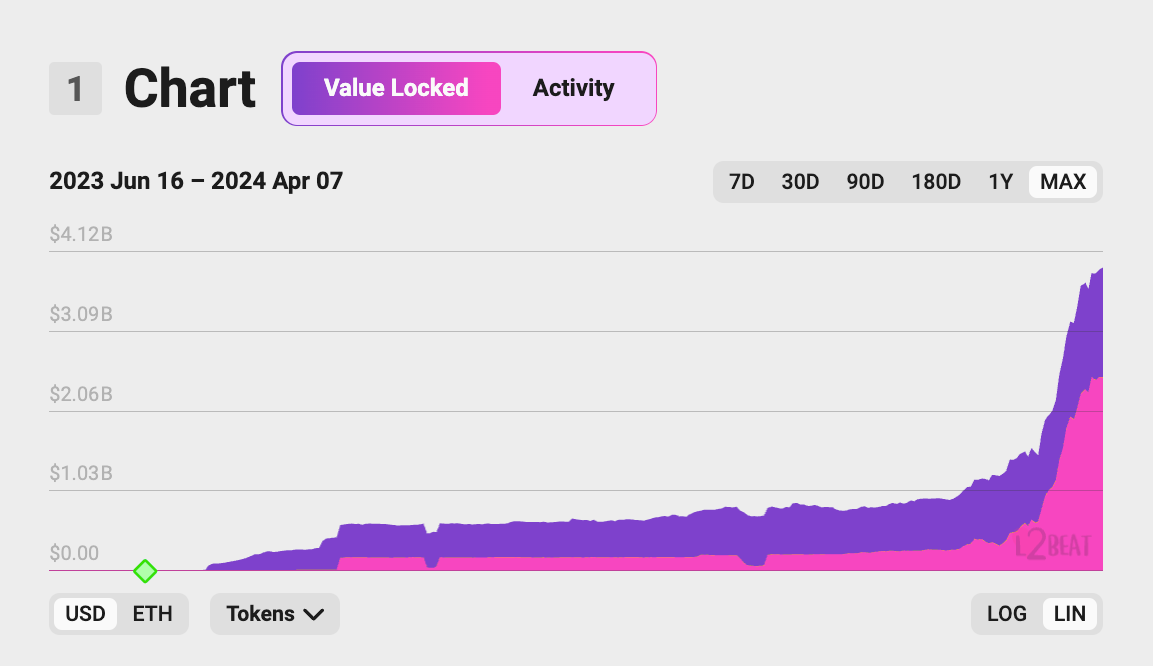

L2BEAT data updated on April 7 shows Base’s total TVL at $4.15 billion, including $1.45 billion of canonically bridged value — assets locked on Ethereum to be represented on Base — and $2.7 billion in natively minted assets.

Base is the third largest Ethereum layer 2 by TVL, beating fourth-place rival Blast by around $1.4 billion and $3.5 billion behind the second-place Optimism and $14.6 billion behind leader Arbitrum.

Base’s total TVL chart with the split between canonically bridged funds (purple) and natively minted (pink). Source: L2BEAT

Base is the only layer 2 of the top 5 by TVL to have posted a gain in the past week. Starknet saw the biggest TVL loss at 10.2%, while Optimism was down 9.1%, Arbitrum declined 5.5% and Blast shrunk 2.4%.

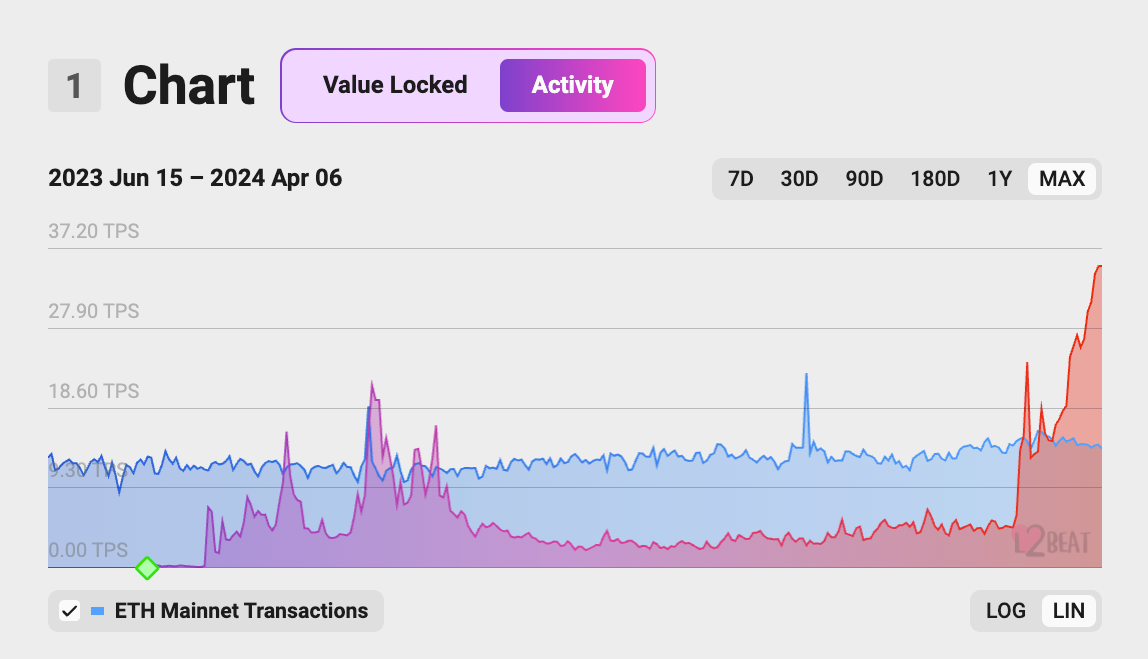

The Ethereum scaler’s TVL bump comes amid an activity surge that’s seen its 30 day transaction count hit 50.34 million, surpassing Arbitrum's 40.1 million and Ethereum's 37.9 million.

Base’s average daily transactions per second (TPS) jumped by 29.7% over the week and over the past day has averaged 35.19 TPS — ahigher than the combined TPS’ of rival layer 2 Arbitrum and Ethereum, which saw respective scores of 16.61 and 13.91.

Base’s TPS (red) has consistently outstripped Ethereum (blue) for over two weeks. Source: L2BEAT

Meanwhile, Base has been one of the main beneficiaries of recent memecoin activity . Base nwhere its meme token market capitalization has reached over $1.6 billion, an over 13% jump over the last day, according to CoinGecko.

Base’s popularity has, however, also attracted scammers, as the network saw an 18-fold increase in successful phishing scams from January to March — with $3.35 million stolen last month.

Ethereum has focused its development efforts on improving the blockchain’s ability to process layer-2 transaction data, as exampled by its March 13 Dencun update , which has lowered layer 2 transaction fees.

Meanwhile, layer 2’s like Base could gain further from Ethereum’s shortcomings, with VanEck analysts estimating the network’s scaling ecosystem would hit a $1 trillion market capitalization by 2030.