‘BTC will have to hit $79K’: At-home miners brace for the Bitcoin halving

Using ASIC warmth for home heating can make mining worth the cost, some say

The per-block rewards paid to bitcoin miners are set to be cut in half, from 6.25 to 3.125 BTC, later this month. The network’s fourth halving event presents a headache for even the best-resourced mining firms, but it could make thin margins even thinner for those running mining setups at home.

For miners, the formula is simple: If the halving drives up bitcoin’s price, their investment pays off. Otherwise, small miners could be left with dormant ASICs, energy bills and little chance of breaking even.

Read more: How the halving could impact bitcoin’s price

Some at-home miners laid out the stakes in the r/BitcoinMining subreddit.

“I personally need it at 70k for my operation to break even after halving,” one poster wrote. Another said BTC would need to reach $79,000 to break even, and $140,000 to recapture their current profit margin.

“ Mining isn’t really worth it these days and especially after the halving,” they wrote .

There are other complicating factors besides price for DIY miners. One variable is Bitcoin’s hash rate, which has grown at an increasing rate throughout the network’s history. The hash rate is essentially a measure of the amount of competition to mine Bitcoin blocks. Elevated electricity prices where miners live can make things more difficult, particularly as power grids in the US and elsewhere buckle under demand for compute-intensive AI.

Read more: 20% of bitcoin network hash rate could go offline after halving: Galaxy

Individual miners have very low odds of successfully mining bitcoin by themselves. Many opt to join mining pools which coordinate and share rewards among several miners, while also charging varying fees. This is all besides the fact that the prices of miners vary, and more-efficient ASICs are released over time.

At-home miners can punch these variables into online mining calculators to try measuring their chances of profit, but some have given up hope altogether. Several forum posters have encouraged prospective miners to gradually purchase bitcoin over time instead, a process known as dollar cost averaging.

Two miners told Blockworks that using mining rigs for home heating was one avenue for making at-home mining profitable. ASIC miners emit heat as they run, and some Bitcoiners have developed means of capturing this heat and circulating it through their homes.

Read more: Why most bitcoin mining stocks are down amid a persistent crypto rally

“It makes one so much less price sensitive when you can mine AND eliminate a natural gas bill,” Canada-based at-home miner Antoine Desjardins, who produces heat from bitcoin mining, said in a direct message.

Ndgo, a pseudonymous miner who has published calculations on at-home mining profitability to their X page, told Blockworks that miners need to make use of ASIC heat for at-home mining to make sense in the long run.

But those already in the mining game likely won’t be deterred by the halving , ndgo added.

“People have been planning for the halving, some since the last halving, many since last summer, [a] few since October-ish,” ndgo wrote. “Everybody knows it’s coming. Should be fine.”

Don’t miss the next big story – join our free daily newsletter .

- bitcoin halving

- BTC

- Mining

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

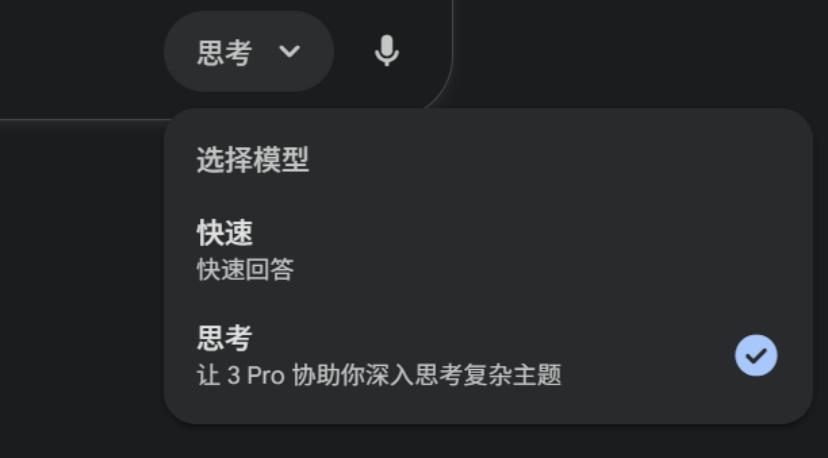

Even Altman gave it a thumbs up: What makes Google Gemini 3 Pro so powerful?

After 8 months of pretending to be asleep, Google suddenly dropped a bombshell with Gemini 3 Pro.

Research Report|In-Depth Analysis and Market Cap of GAIB AI (GAIB)

Debt Leverage Amid the AI Frenzy—The Fuse for the Next Financial Crisis?

If the prospects of AI falter, the financial system may face a "2008 crisis-style" shock.

Bitcoin Surrenders Early as Market Awaits Nvidia’s Earnings Report Tomorrow

Behind the simultaneous sharp decline in the US stock and cryptocurrency markets, investors' fears of an "AI bubble" and the uncertainty surrounding the Federal Reserve's monetary policy are creating a double blow.