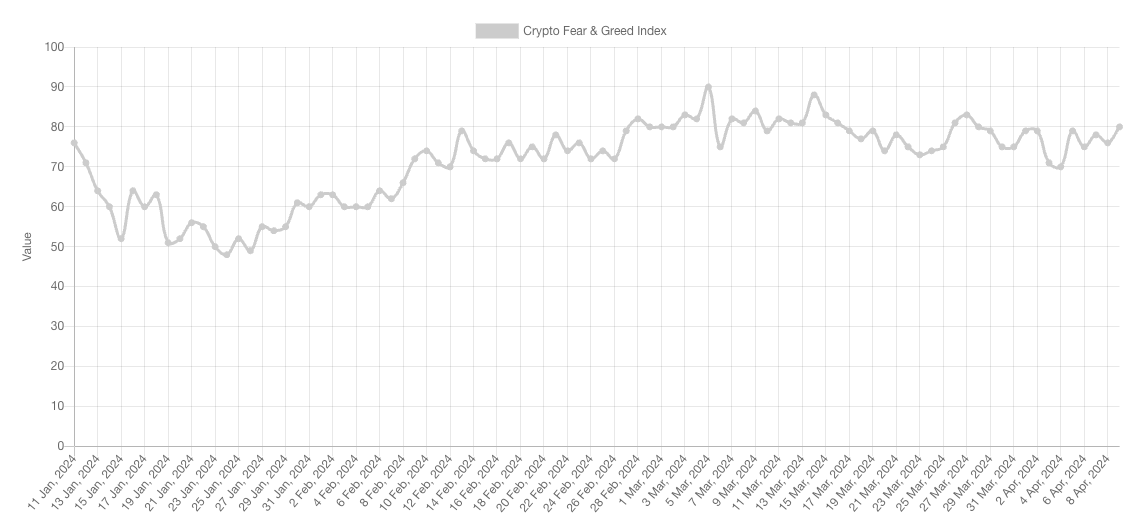

The Bitcoin halving this month, combined with a “bag of tricks” from the Federal Reserve and Treasury, will “add propellant to a raging firesale of crypto assets” and depress the crypto market for weeks, says BitMEX co-founder Arthur Hayes .

In an April 8 blog post , Hayes wrote he believed the Bitcoin halving would “pump prices in the medium term” but warned crypto prices “directly before and after could be negative.”

“The narrative of the halving being positive for crypto prices is well entrenched. When most market participants agree on a certain outcome, the opposite usually occurs,” he wrote.

Hayes believed the halving is also timed for when “dollar liquidity is tighter than usual” and outlined his theory on how the United States Federal Reserve and Treasury policies impact the markets .

“That is why I believe Bitcoin and crypto prices in general will slump around the halving [...] It will add propellant to a raging firesale of crypto assets.”

“Could the market defy my bearish inclinations and continue higher? Fuck yeah,” he wrote. “I’m perennially long as fuck crypto, so I welcome being wrong.”

Hayes noted the second half of April will be a “precarious period for risky assets” as U.S. tax payments remove liquidity, the Fed starts Quantitative Tightening (QT), decreasing the money supply, and the Treasury’s General Account (TGA) — basically the government’s checking account — is yet to be used, Hayes wrote.