With only 10 days left until the much-awaited halving , Bitcoin is still trading above the $70,000 psychological level, bolstering bullish long-term price predictions from market analysts.

Following the halving, Bitcoin ( BTC ) price could appreciate over 160% to reach a cycle top of above $150,000, according to a research report by Bitfinex analysts, shared with Cointelegraph.

“Using a straightforward regression model, we predict a 160% post-halving price surge in the next 14 months, taking the price to between $150,000 - $169,000.”

Bitcoin fell 2.2% in the 24 hours leading up to 11:50 am UTC, to trade at $70,694. The world’s first cryptocurrency is up over 7.5% on the weekly chart, according to CoinMarketCap data.

BTC/USDT, 1-month chart. Source: CoinMarketCap

However, the analysts note that there is more built-up selling pressure, as opposed to previous cycles, due to Bitcoin hitting a new all-time high before the halving, for the first time in crypto history.

While this is a sign of confidence for Bitcoin bulls, it could also introduce significant selling pressure, as 1.87 million BTC, or 9.5% of the circulating supply, was bought above the $60,000 mark. The analysts noted:

“This underscores the active engagement of Short-Term Holders at higher prices, reflecting evolving ownership dynamics amidst market activity and institutional influence through spot ETFs. Increased entity movement suggests a shift in the cycle towards the gradual distribution of dormant supply and profit-taking.”

However, Bitcoin prices could see a sharp decline during the halving period due to the Federal Reserve’s quantitative tightening, which is removing liquidity from markets. Arthur Hayes , the co-founder of BitMEX, wrote in an April 8 blog post:

“That is why I believe Bitcoin and crypto prices in general will slump around the halving [...] It will add propellant to a raging firesale of crypto assets.”

Bitcoin ETFs amass 4.28% of circulating BTC supply

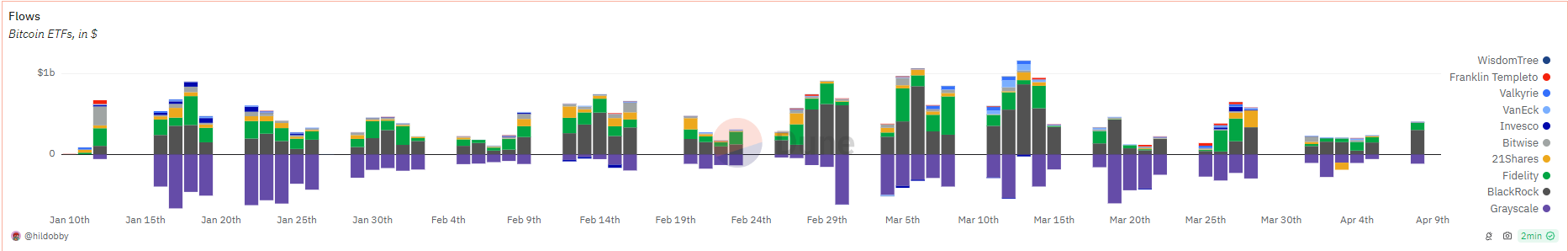

The inflows from the United States spot Bitcoin exchange-traded funds (ETFs) have been a significant part of Bitcoin’s price rally.

By Feb. 15, the Bitcoin ETFs accounted for about 75% of new investment in the world’s largest cryptocurrency as it surpassed the $50,000 mark, according to CryptoQuant research.

Since their launch, the Bitcoin ETFs amassed over 841,900 BTC, worth $59.2 billion, which represents 4.28% of the Bitcoin’s circulating supply.

With the accumulation pattern of the past two weeks, the Bitcoin ETFs are set to absorb 2.6% of Bitcoin supply per year, according to Dune .

Bitcoin ETF Flows chart. Source: Dune

Bitcoin ETFs amassed over $500 million worth of net inflows last week, with a total of $286 million worth of daily net inflows on April 8, during this week's first trading day, according to Dune data.