Solana validators have voted in a proposal aimed at decreasing the latency of consensus “votes” — which could speed up transactions on the blockchain.

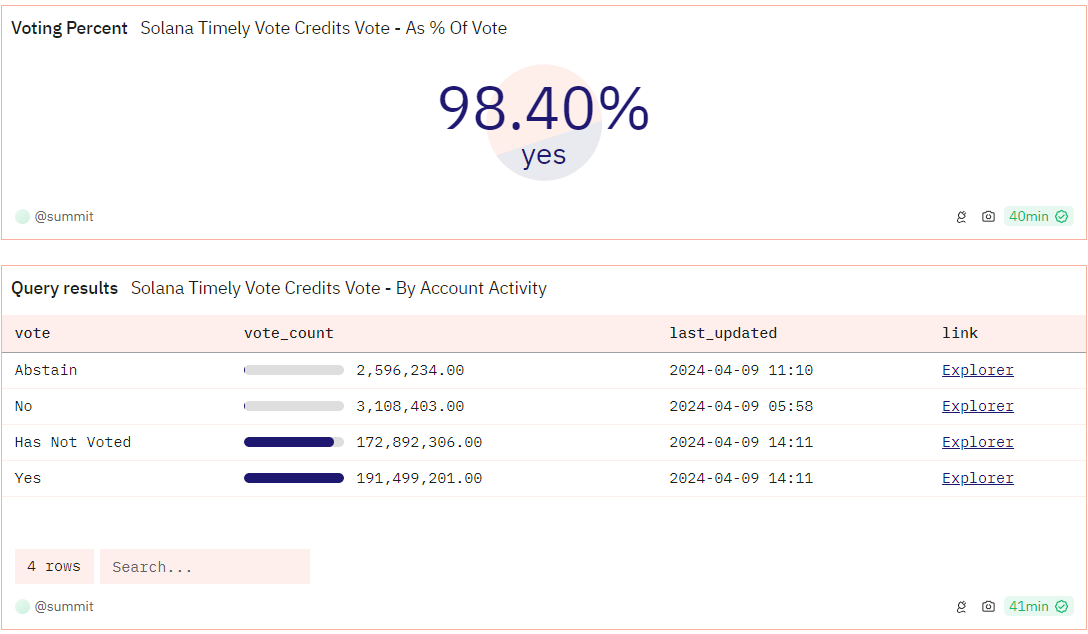

The proposal calls for a “Timely Vote Credits” mechanism on Solana and was passed on April 9 with 98% votes in favor.

It would change how validators are incentivized to make “votes” — a key part of Solana’s consensus mechanism that confirms transactions.

Solana Timely Vote Credits voting results. Source: Dune Analytics

According to Solana Labs, up until now, validators are given a flat one vote credit whenever they submit a consensus vote on a block that becomes finalized by the network.

Over time, validators have found they can maximize earnings by delaying their votes just long enough to ensure they’re voting on the correct fork — at no penalty.

The proposal, floated on March 14 by “zantetsu” from Solana validator Shinobi Systems, would implement a variable number of vote credits that are awarded for votes — with more credits given to votes that have less latency.

“This will discourage intentional ‘lagging,’ because delaying a vote for any slots decreases the number of credits that vote will earn,” Solana Labs explained.

Solana users have raised concerns with the vote credit system in the past. Source: Reddit

Currently, Solana Compass shows the blockchain is producing approximately 1,000 “non-vote,” or user transactions per second and nearly 2,000 “vote” transactions per second.

It’s not yet known what the impact of the new mechanism will be, as it’s expected to be implemented sometime after Solana’s v1.18 upgrade slated this month — which includes patches to fix priority fees and network congestion issues on the chain.

Source: Austin Federa

Meanwhile, Solana has been battling a string of failed transactions which has been blamed on an “implementation bug” from QUIC, a Google-developed data transfer protocol that loops all nodes in on the current state of the network.

A bug fix — which involves a reconfiguration for QUIC — is now slated for April 15 , should no additional issues come about in testing.