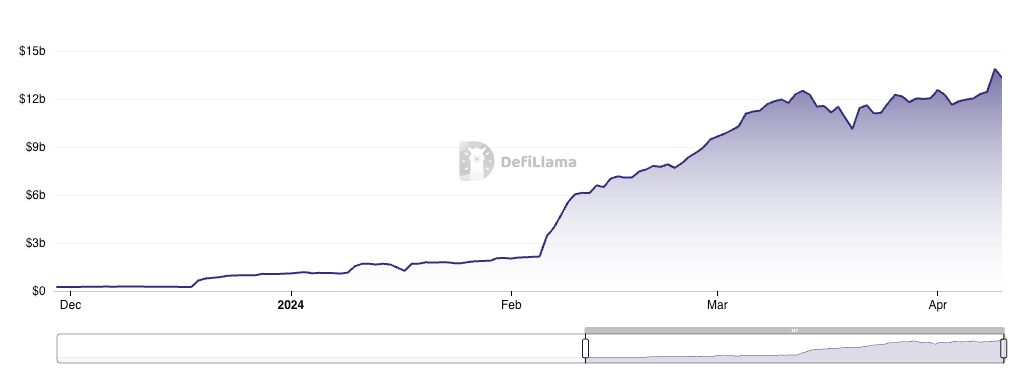

Ethereum restaking protocol EigenLayer, which touts over $13 billion in assets, has launched onto the blockchain’s mainnet — but some key features are still to come and will go live sometime this year.

EigenLayer announced the launch in an April 9 blog post but added in-protocol payments to operators from actively validated services (AVSs) — such as apps and cross-chain bridges — are yet to come.

A mechanism called slashing — when validators get their staked crypto taken from them if they don’t do their job correctly — is also still on the way.

Both will come “later this year” after the EigenLayer marketplace has time to “develop and stabilize,” the protocol said without disclosing a timeline.

As of today, restakers can now delegate their restaked ETH balance to Eigenlayer operators who in turn operate AVSs.

“So there’s still no restaking rewards?” Galaxy Digital vice president of research Christine Kim rhetorically asked in a responding X post.

The promise of restaking protocols such as EigenLayer is to allow users to earn rewards for restaking their already-staked Ether ( ETH ) tokens — which are 1:1 representative tokens tied to ETH staked in a protocol such as Lido or Rocket Pool.Coinbase analysts last week said restaking could increase earnings but “can also compound risks” as the same funds could be shipped around to multiple protocols, which could create complex security and financial issues.

Alongside its mainnet launch, EigenLayer also released a data availability service EigenDA, the first AVS to launch on the protocol aiming to help other blockchain apps store transaction data.

Other AVSs, however, will have to register with EigenLayer and cannot fully deploy right now.

In a separate X post, Galaxy’s Kim said she didn’t understand “why everyone’s hyped about this [EigenDA] news, 99% of getting restaking right depends on the economics, balancing risk with reward.”

“There’s still no risk (ie, slashing) or reward (ie, AVS payouts) live on [EigenLayer] SO there’s no restaking really happening yet [in my opinion],” she added.

EigenLayer has a total value locked of $13.33 billion, according to DefiLlama.