Bitcoin ( BTC ) rebounded to $69,000 on April 10 as whales “bought the dip” on fresh United States macro data.

Bitcoin whales 'buy the dip' post-CPI as BTC price gains 3.6%

BTC price trajectory reverses upward despite a "hot" CPI print, with Bitcoin buyers almost managing to reclaim $70,000.

Whales vote with their wallets on hot CPI

Data from Cointelegraph Markets Pro and TradingView showed a BTC price recovery taking shape after local lows of $67,482 on Bitstamp.

These had accompanied the release of the U.S. Consumer Price Index (CPI) print for March, which came in narrowly above expectations at 3.5% year-on-year.

Earlier, market observers had eyed deliberate posturing by whales, with analysis suggesting that they were helping drive down price in order to buy the CPI event.

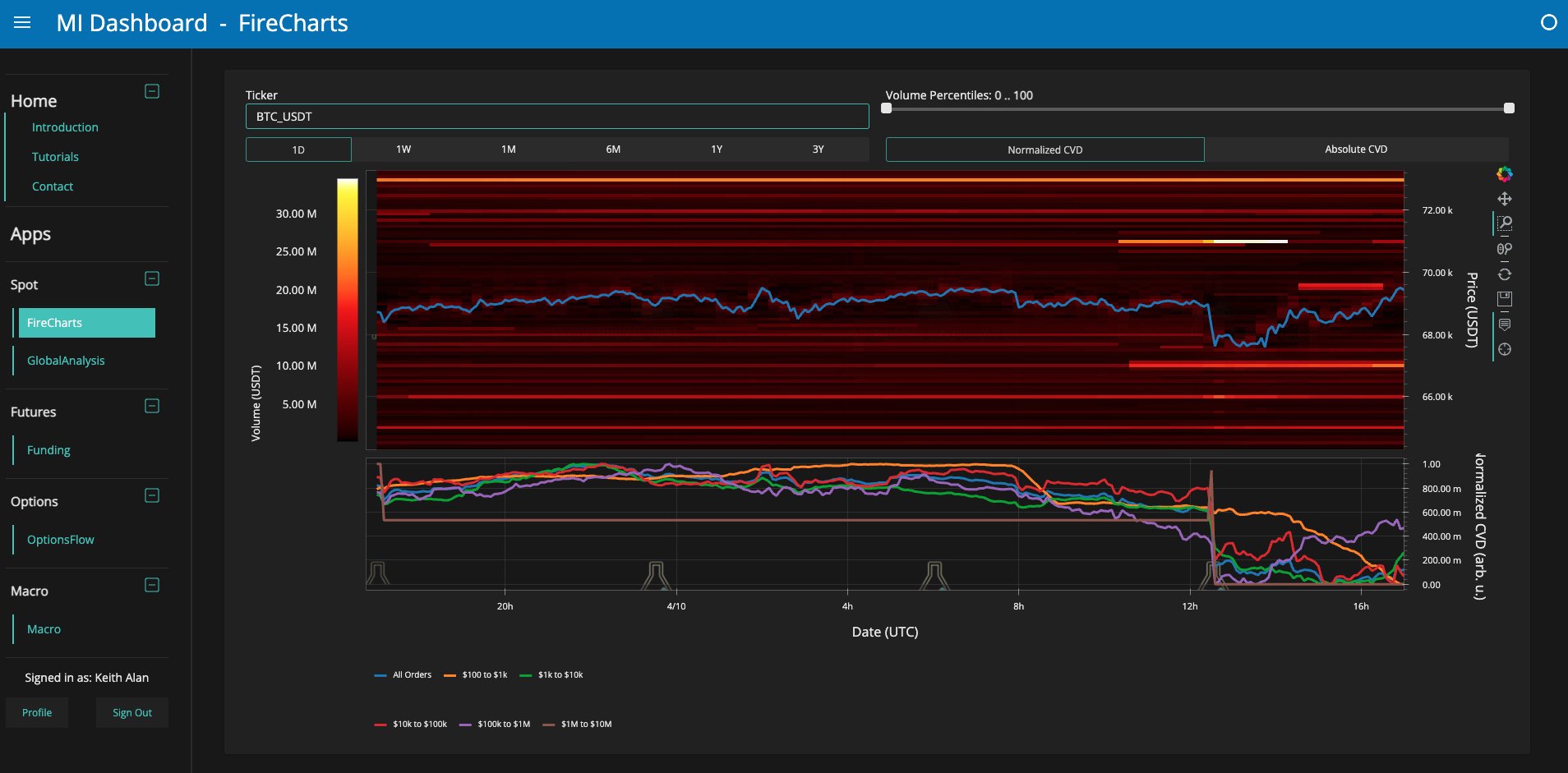

This ultimately became reality, with trading resource Material Indicators capturing increased buying on largest global exchange Binance.

“FireCharts binned CVD shows that purple whales bought the BTC dip,” it confirmed in part of a post on X (formerly Twitter), referring to one of its proprietary trading indicators.

BTC/USD thus circled its daily opening level at around $69,100 at the time of writing.

“And just like that, Bitcoin is back above $69,000, and the daily candle is green again,” popular trader Jelle continued in part of his own response.

Fellow trader Daan Crypto Trades meanwhile noted that the dip below $68,000 had closed a new “gap” in CME Bitcoin futures markets which had appeared over the weekend thanks to out-of-hours volatility.

Bitcoin ETFs cling to unbroken inflows

The U.S. spot Bitcoin exchange-traded funds (ETFs) continued their slow grind.

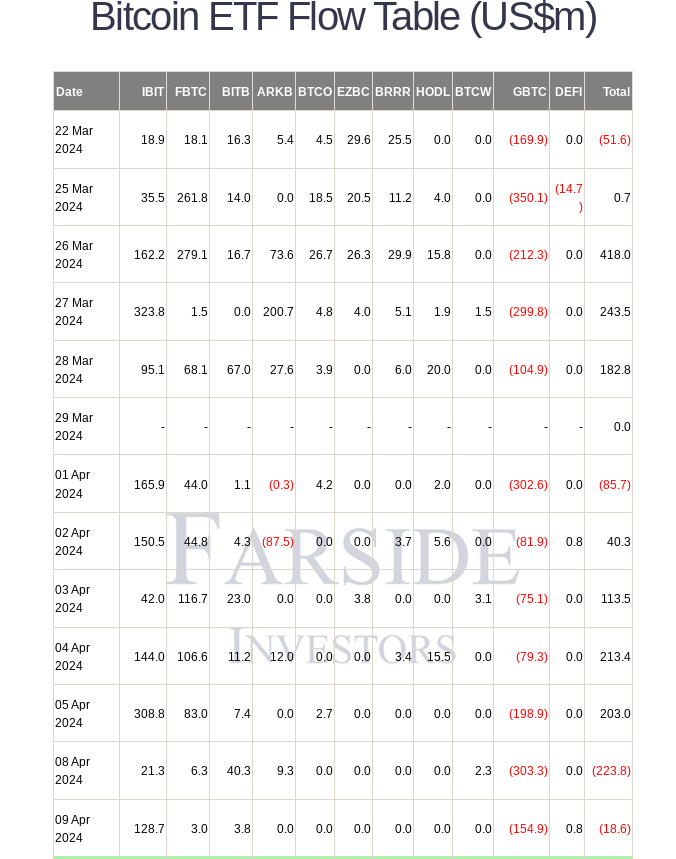

The two largest products by assets under management from BlackRock and Fidelity Investments both saw modest inflows on April 9, avoiding a “red” day of net flows to continue their unbroken green streak, as confirmed by data from sources including United Kingdom-based investment firm Farside .

April 9 as a whole, however, ended with aggregate $18.6 million outflows thanks to the impact of the The Grayscale Bitcoin Trust (GBTC), which shed $155 million.

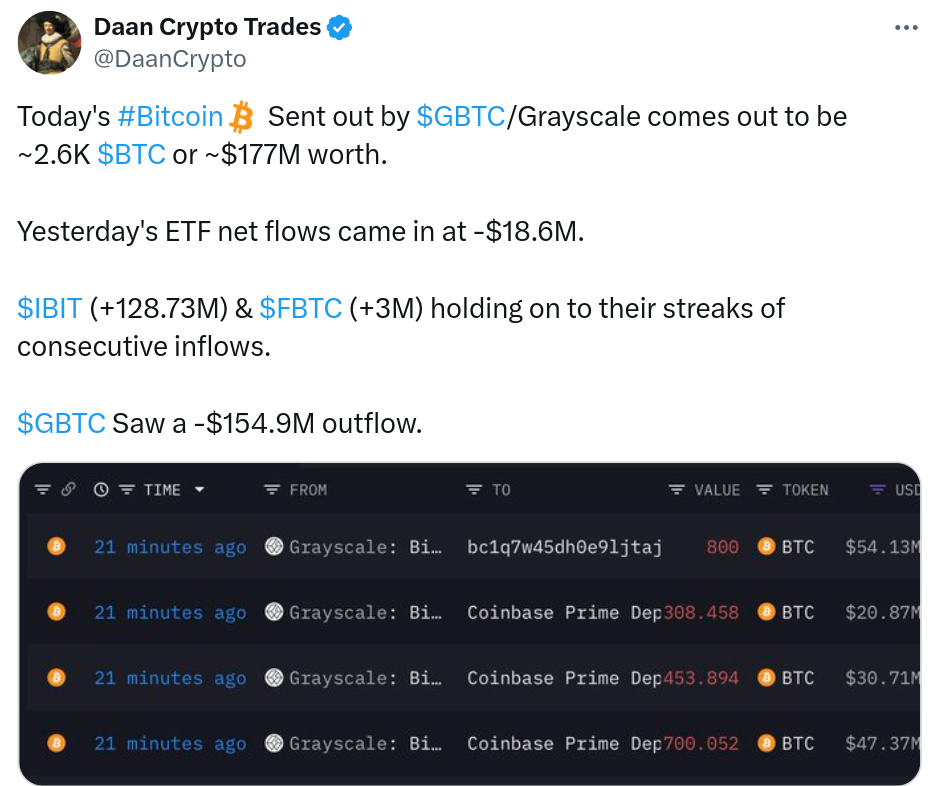

GBTC meanwhile saw outflows of around 2,600 BTC ($180 million) on April 10, per the latest data from crypto intelligence firm Arkham shared on X by Daan Crypto Trades.

As Cointelegraph reported , Hong Kong currently plans to allow spot Bitcoin ETFs, fast-tracking their approval process.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025