Options worth $2.33 billion are due to expire today

Golden Finance reported that Greeks.live data showed that on April 19, 22,000 BTC options were about to expire, with a Put Call Ratio of 0.64, a maximum pain point of US$65,000, and a nominal value of US$1.4 billion. 300,000 ETH options are about to expire, the Put Call Ratio is 0.42, the biggest pain point is $3,125, and the nominal value is $930 million. The crypto market once again encountered a major correction this week. Bitcoin and Ethereum once fell below $60,000 and $3,000 respectively. Shorts achieved the largest and most lasting victory this year. However, the IVs of all major periods continued to decline, mainly due to the sharp decline in call option prices. The halving expectations on Saturday were no longer able to support the market. ETF capital inflows have slowed recently and market sentiment has been sluggish. Despite today's rebound, the whale's operations still indicate a lack of confidence in the market outlook. The bull market needs the support of more capital inflows after the halving.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

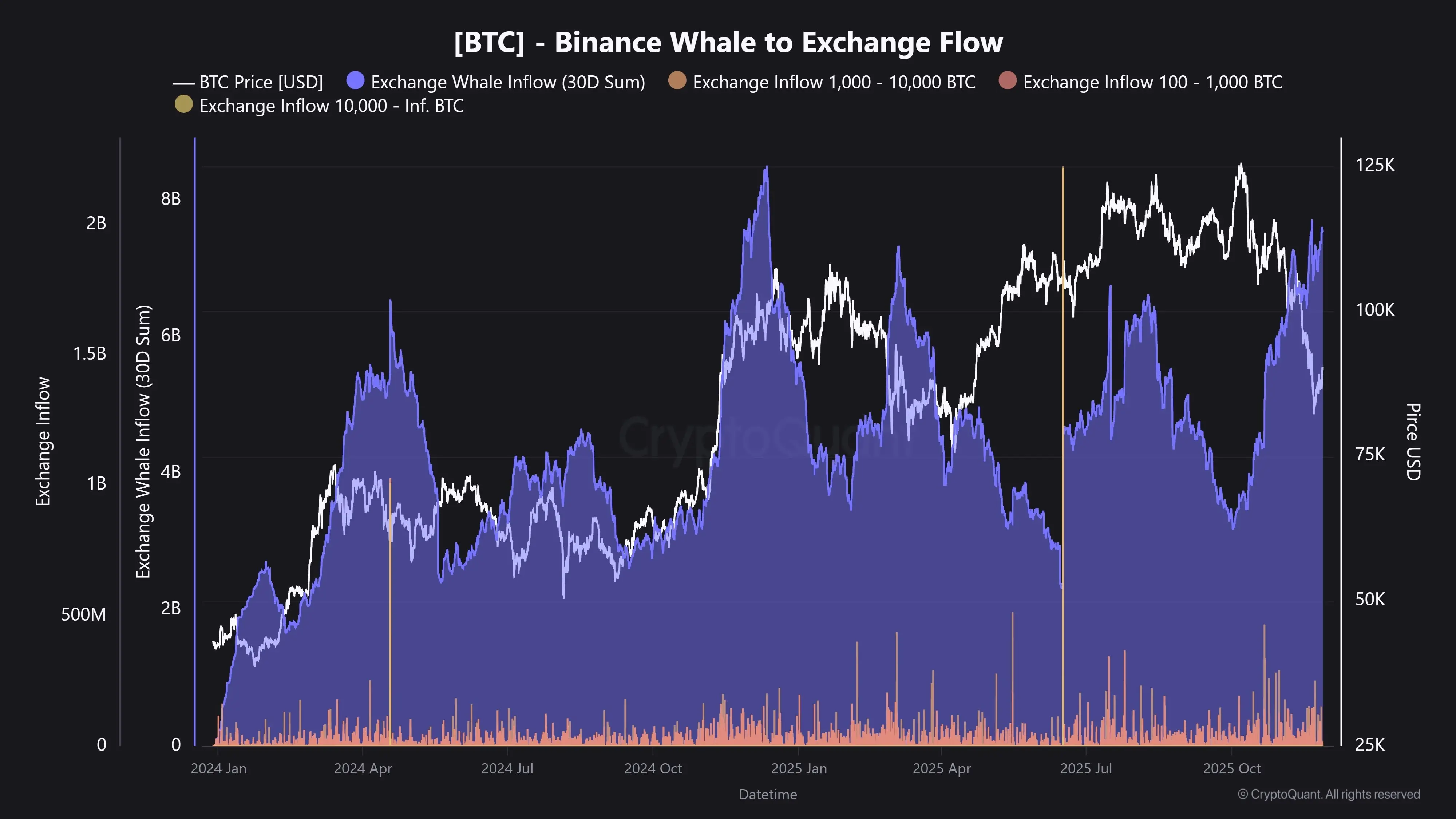

CryptoQuant: Whales have deposited approximately $7.5 billion worth of BTC to a certain exchange in the past month

Today, BTC options with a notional value of $13 billion expire, with the max pain point at $98,000.

CME Group: BrokerTec EU market is now open for trading, all other markets remain suspended