This is a developing story, and further information will be added as it becomes available.

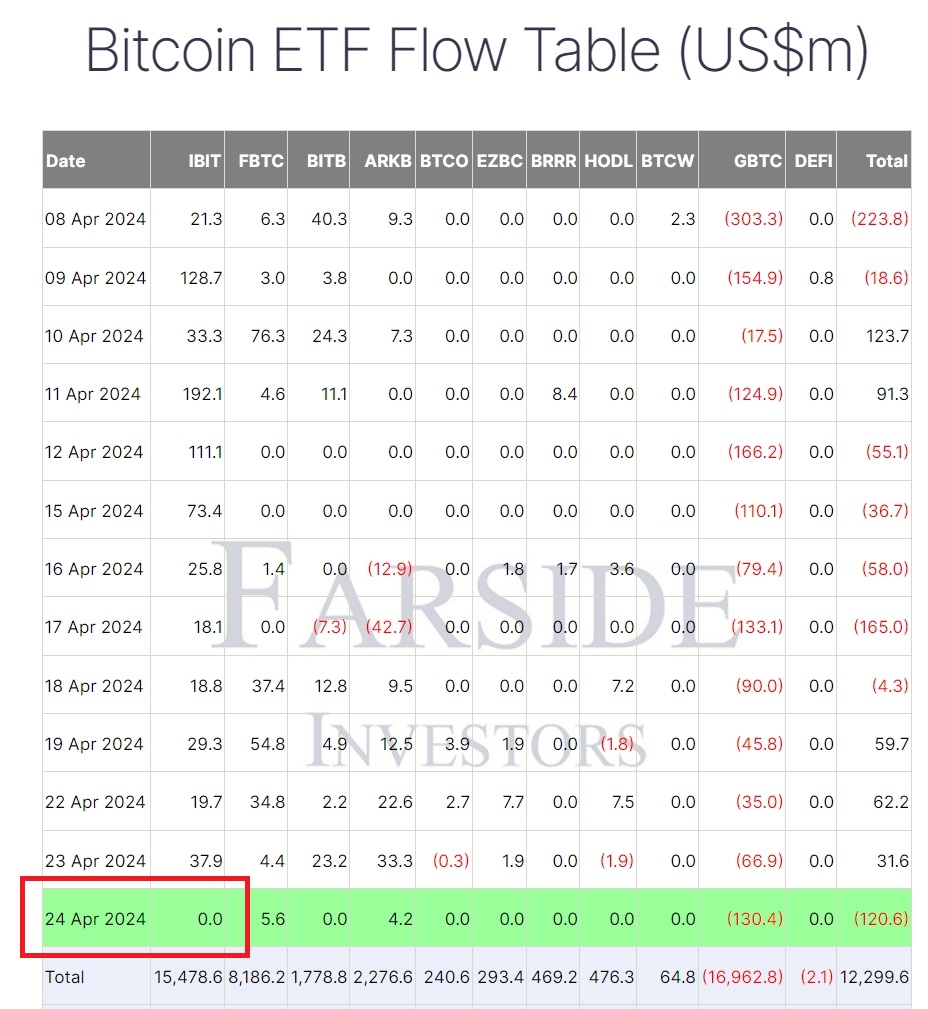

BlackRock iShares Bitcoin Trust (IBIT) has notched its first day of $0 in inflows since Bitcoin ETFs were introduced in the United States in January.

Ever since its launch on Jan. 11, IBIT has consistently attracted investments worth millions of dollars daily — racking up nearly $15.5 billion in just 71 days. The 71-day-long inflow streak ended for BlackRock on April 24 after it recorded $0 of inflows.