The Next 24 Hours Could Signal If Bitcoin Is Heading To 52,000

👇1-9) New risks are emerging, and Bitcoin could decline from our projected range of 52,000 to 55,000. Previously, we have pointed out various market structure data points for why this might occur. As we pointed out yesterday, Bitcoin miner revenues are falling short, which could signal that Bitcoin’s fair value is quite a bit lower.

👇2-9) Bitcoin has made two lower highs (red) after its all-time high on March 15. This signals upside momentum exhaustion. Chart-technically, Bitcoin also has established a well-defined downward trend. Our Bitcoin target of 52,000/55,000 remains valid (see video), and the next 24 hours could decide if the downward momentum accelerates.

Bitcoin making lower highs, the downtrend channel could target 52,000

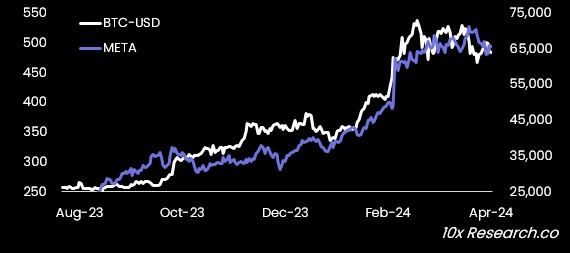

👇3-9) In October 2021, near the previous Bitcoin peak, Facebook rebranded to ‘Meta’ and projected a multi-quarter capex cycle required to build interconnected digital spaces or, in short, ‘the metaverse.’ The stock would decline -70% until Zuckerberg slashed capex in November 2022 – near the bottom of the Bitcoin bear market. The stock subsequently rallied +450% from the lows.

👇4-9) Although the metaverse was closely related to the crypto universe at the time, Facebook (or Meta) just announced another multi-quarter capex cycle for AI. While, at this point, AI is not related to crypto, Facebook’s underperformance in 2022 was a drag for the Nasdaq and risk assets, and last night’s earnings call, where Zuckerberg announced the new capex forecasts, could also prove to be a drag on the Nasdaq.

Bitcoin making lower highs, the downtrend channel could target 52,000

👇5-9) The stock fell -13% during the earnings call as the capex trajectory spooked investors. Considering Facebook’s close correlation with Bitcoin, breaking its uptrend could signal headwinds for the broader tech space.

👇6-9) Other companies might be compelled to announce major capex projects, which could cause tech stocks to correct. As Bitcoin is closely correlated to the Nasdaq, this could also impact Bitcoin prices.

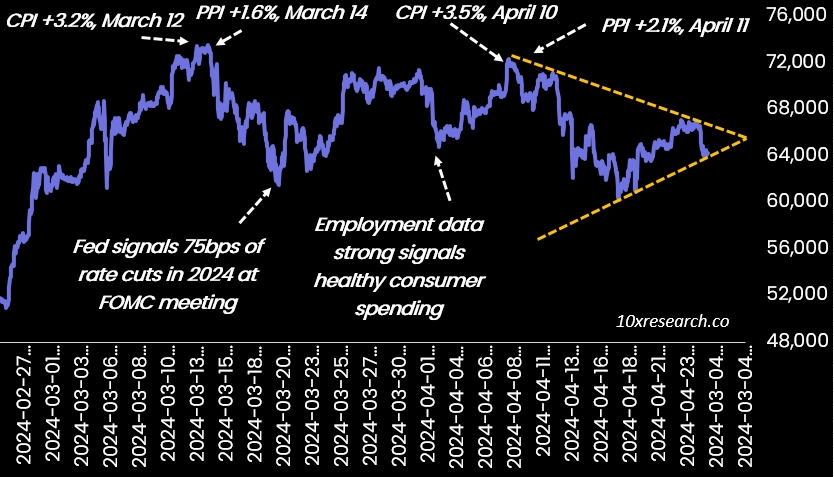

The important of macro for Bitcoin

👇7-9) However, macro remains the largest risk for Bitcoin. Bitcoin peaked when CPI and PPI data points became stronger – both in March and April- while the rebound started on March 20 when Fed Chair Powell signaled that the central bankers were still expecting three rate cuts.

👇8-9) A higher ISM (prices paid) and a spike in treasury yields in early April caused another mini-correction. Every rally was knocked down by higher inflation or stronger growth data points.

👇9-9) Previously, we have pointed out various risk factors, from declining crypto trading volumes to a compressing funding rate and the disappearing Bitcoin ETF inflows. Macro has become the most significant headwind, and Bitcoin’s price action confirms this. If tech companies suddenly signal a downtrend, the Bitcoin correction could become steeper and longer than most expect.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETFs are being launched in clusters, but coin prices are falling. Can ETF approval still be considered good news?

On one hand, Vanguard has opened Bitcoin ETF trading, while on the other hand, CoinShares has withdrawn its applications for XRP, Solana Staking, and Litecoin ETFs, highlighting a significant divergence in institutional attitudes toward ETFs for different cryptocurrencies.

ADP employment data "unexpectedly weak", is a Federal Reserve rate cut imminent?

Glassnode Report: Current Structure Strikingly Similar to Pre-Crash 2022, Beware of a Key Range!

Coinglass report interprets Bitcoin's "life-or-death line": 96K becomes the battleground between bulls and bears—Is the ETF capital withdrawal an opportunity or a trap?

Bitcoin's price remains stable above the real market mean, but the market structure is similar to Q1 2022, with 25% of supply currently at a loss. The key support range is between $96.1K and $106K; breaking below this range will increase downside risk. ETF capital flows are negative, demand in both spot and derivatives markets is weakening, and volatility in the options market is underestimated. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.