QCP Capital: BTC call option demand rises, ETH risk reversal remains -4%

According to Wu, QCP Capital noted that since the rebound on Friday and over the weekend, there has been a bullish follow-up in volume and interest. BTC risk reversals are now positive, meaning that call options are more expensive than put options. Demand for BTC September expiration call options with strike prices of $75,000 and $100,000 has risen again, and BTC forward yields are back above 10%. However, ETH has not shown the same positivity, with risk reversals still at -4%, possibly due to concerns that the SEC will not approve VanEck and Ark21's ETH spot ETFs by the May 23 and 24 deadlines.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SOL treasury companies and ETFs hold over 24.2 million SOL, worth approximately $3.44 billion.

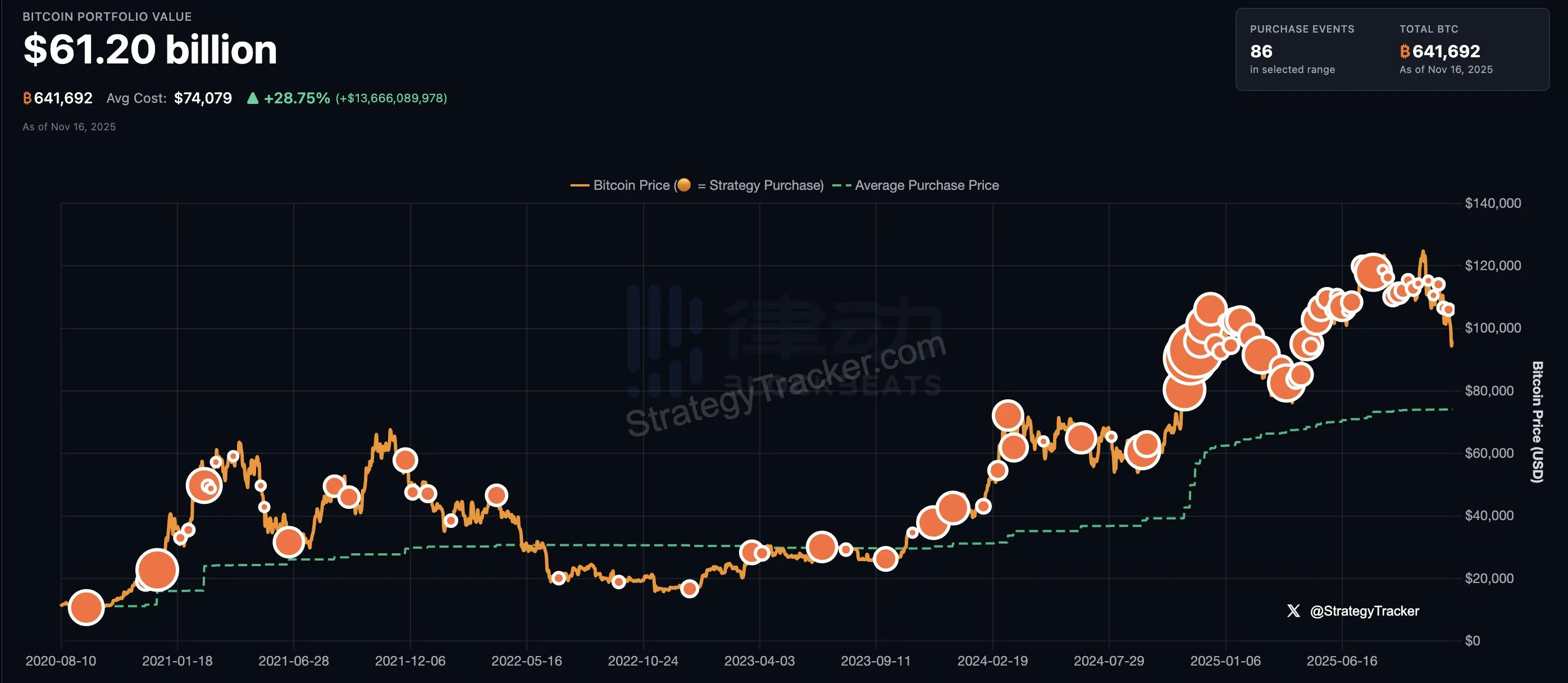

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC purchase

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC purchase