Matrixport: ETH volatility looks cheap relative to BTC volatility

Matrixport stated on the X platform that based on market predictions, there is only a 7% chance that the US SEC will approve an Ethereum spot ETF this week. The derivative market predicts that by the end of this week, ETH's volatility will reach +/-4.8%. Historically, ETH's trading volume has been on average 30% higher than BTC's trading volume, but recently ETH's trading volume has been even lower, despite it usually being a higher beta asset. Since the beginning of the bull market, this has not been the case. Nevertheless, compared to BTC volatility, ETH volatility appears to be cheap.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

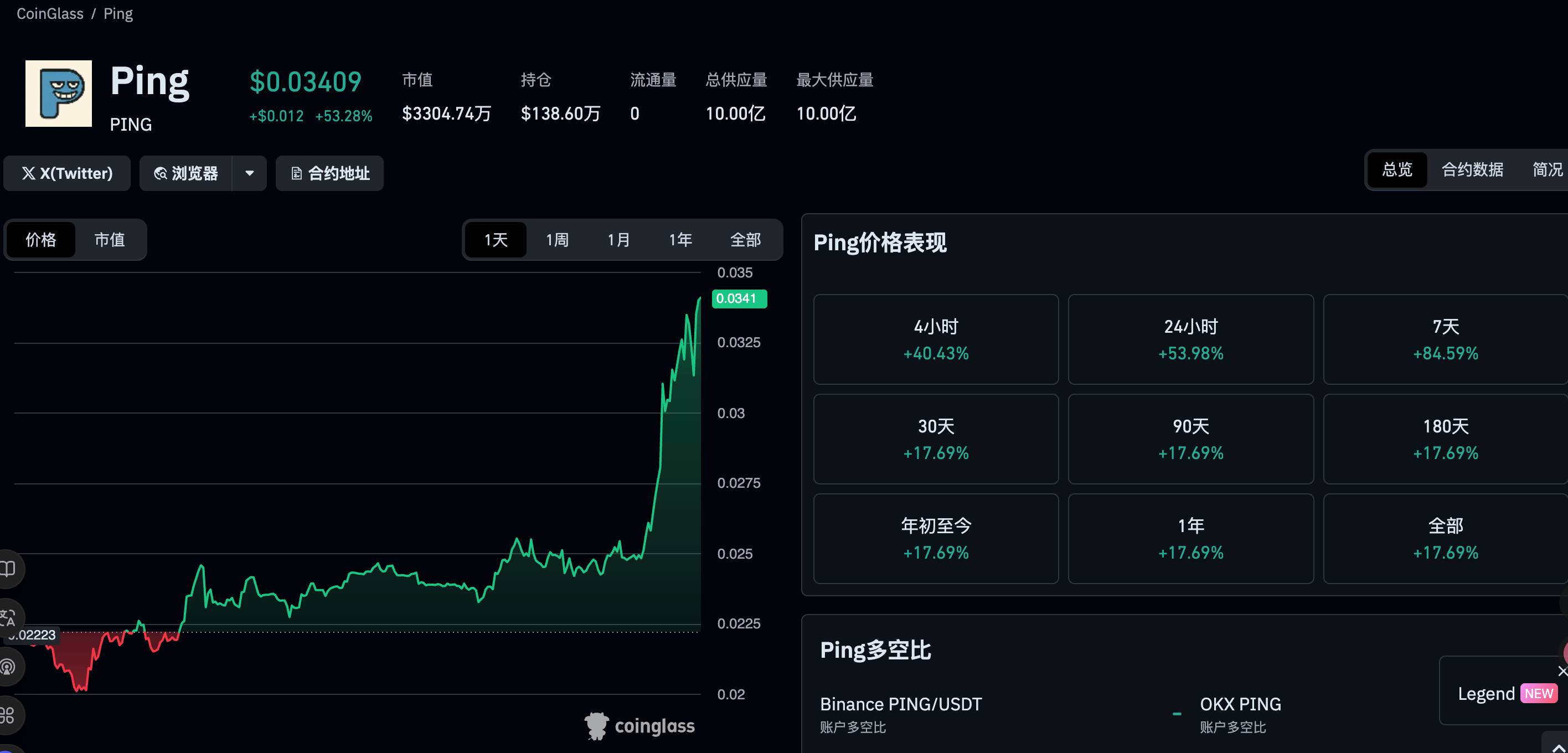

$PING rebounds 50%, a quick look at the $PING-based launchpad project c402.market

c402.market's mechanism design is more inclined to incentivize token creators, rather than just benefiting minters and traders.

Crypto Capitalism, Crypto in the AI Era

A one-person media company, ushering in the era of everyone as a Founder.

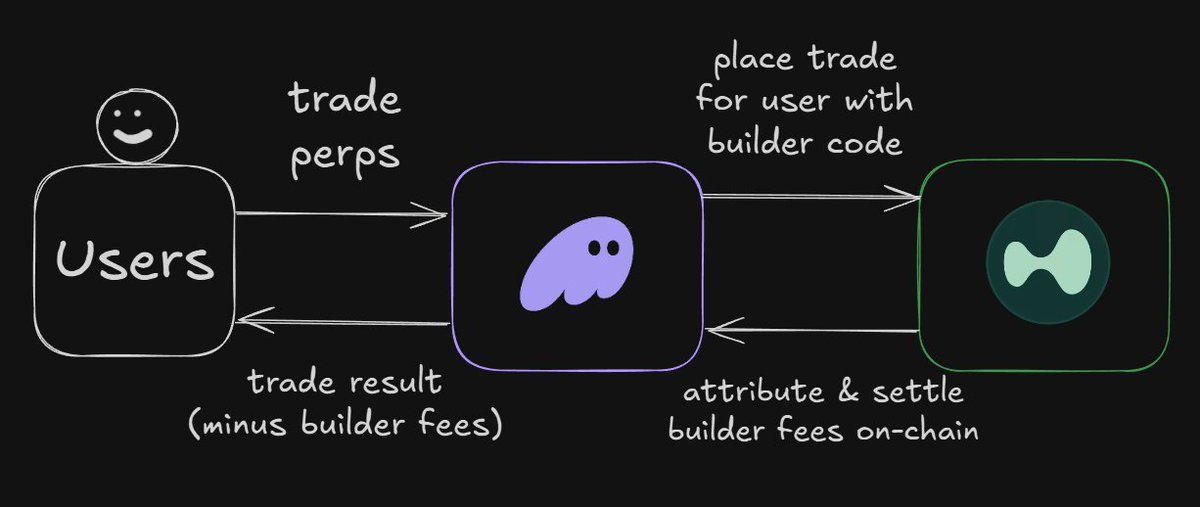

Interpretation of the ERC-8021 Proposal: Will Ethereum Replicate Hyperliquid’s Developer Wealth Creation Myth?

The platform serves as a foundation, enabling thousands of applications to be built and profit.

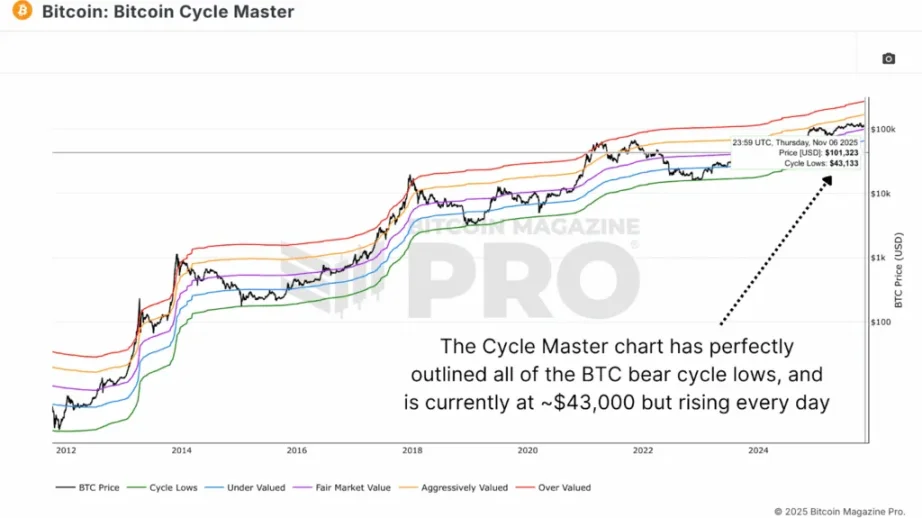

Data shows that the bear market bottom will form in the $55,000–$70,000 range.

If the price falls back to the $55,000-$70,000 range, it would be a normal cyclical movement rather than a signal of systemic collapse.