PEPE, WIF, SHIB Drop Hard as BTC Struggles to Maintain $69K (Market Watch)

SHIB has slumped by more than 5% in the past day, while PEPE is down by 8%.

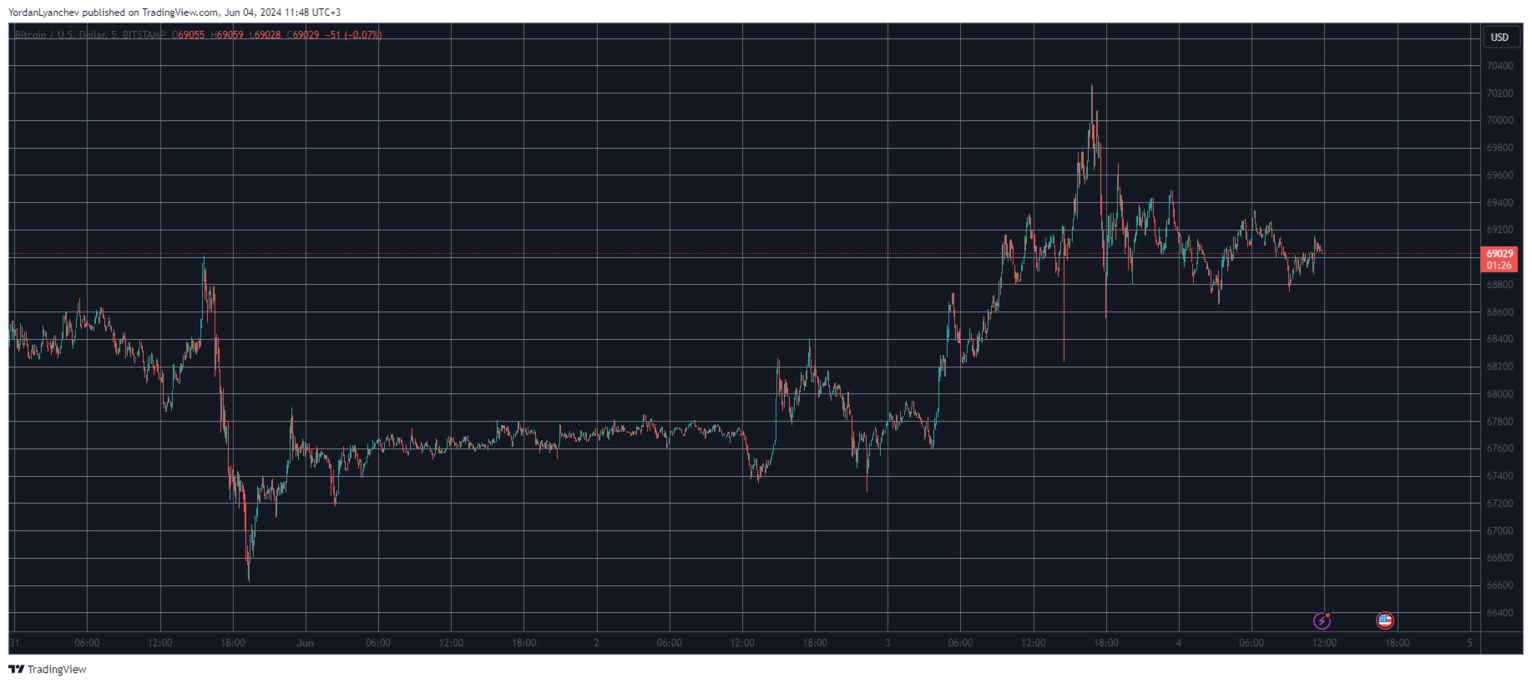

Bitcoin’s price faced some enhanced volatility in the past 24 hours as it popped to $70,200 but was violently rejected there and pushed down to $69,000.

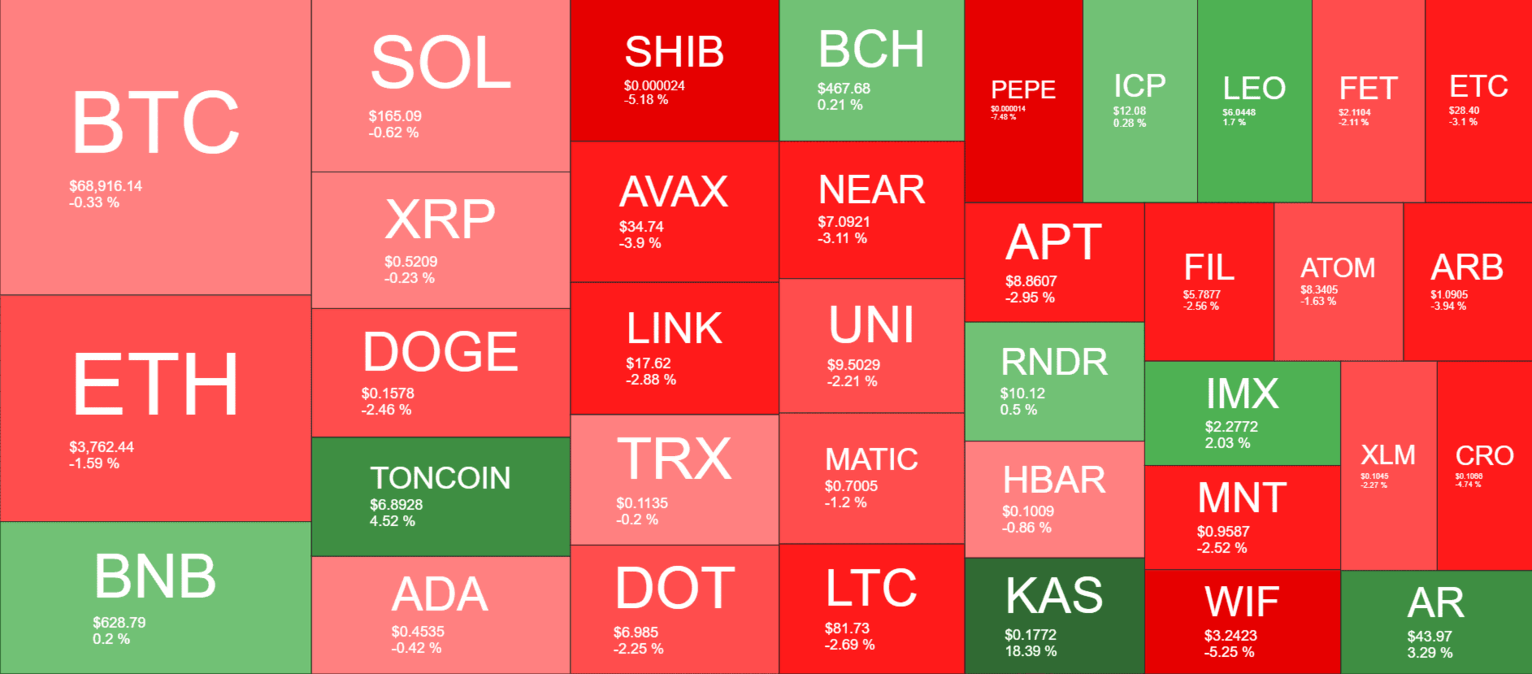

The altcoins are mostly in the red, while KAS skyrocketed by 19% and now trades close to $0.18

BTC Shaky at $69K

The primary cryptocurrency had a fluctuating end of the previous business week in which it attempted to overcome $69,000 but was stopped there by the bears. Moreover, the subsequent rejection saw the asset slump to $66,600, which became a multi-day low.

The bulls finally stepped up at this point and didn’t allow any further pain. Just the opposite, BTC bounced off and spent most of the weekend trading sideways at around $67,500.

It all started to change on Monday when bitcoin started a leg up that drove it to just over $70,200 for the first time in about a week. However, as it happened during the previous such attempt, BTC was stopped and it pulled back by nearly two grand.

Since then, the cryptocurrency has been shaky at around $69,000. Its market cap is just over $1.360 trillion, while its dominance over the alts has increased to 50.4% on CG.

Meme Coins in Retreat

Most of the larger-cap alts have turned red today, aside from TON, which has gained 4.5% and trades close to $7. ETH has slipped by 1.5% and is now close to breaking below $3,750, while SOL, XRP, ADA, TRX, MATIC, and UNI are with minor losses.

Shiba Inu, Avalanche, Chainlink, and NEAR have all dropped by 3-5%. More losses come from meme coins like Pepe (-7.5%) and WIF (-5%).

On the other hand, KAS has skyrocketed by 18% and now trades close to $0.18.

The total crypto market cap has shed samo value since yesterday but still remains north of $2.7 trillion on CG.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This year's hottest cryptocurrency trade suddenly collapses—should investors cut their losses or buy the dip?

The cryptocurrency boom has cooled rapidly, and the leveraged nature of treasury stocks has amplified losses, causing the market value of the giant whale Strategy to nearly halve. Well-known short sellers have closed out their positions and exited, while some investors are buying the dip.

Showcasing portfolios, following top influencers, one-click copy trading: When investment communities become the new financial infrastructure

The platforms building this layer of infrastructure are creating a permanent market architecture tailored to the way retail investors operate.

Ripple raised another $500 million—are investors buying $XRP at a discount?

The company raised funds at a valuation of $40 billions, but it already holds $80 billions worth of $XRP.

CoinShares: Net outflow of $1.17 billion from digital asset investment products last week.