CPI cools down, increasing the likelihood of a Fed rate cut

Jinshi data news on June 12th, the unadjusted core CPI annual rate in the United States for May recorded 3.4%, lower than the expected level of 3.5%, marking the lowest level since April 2021. Short-term interest rate futures in the United States surged after inflation data was released, with traders expecting an increased possibility of a Fed rate cut.

After the data was released, spot gold rose nearly $12 in the short term, now trading at $2325.5 per ounce. Futures for the three major US stock indexes continued to rise, with Dow futures up by 0.6%, SP 500 index futures up by 0.7%, and Nasdaq futures up by 0.88%.

The yield on two-year US Treasury bonds fell to 4.693%, reaching its lowest level since April 5th.

Interest rate futures currently imply a probability of around 70% for a Fed rate cut before September, while market expectations put the likelihood of a November Fed rate cut of 25 basis points at 100%.

Following the release of CPI data, Bitcoin saw a short-term increase of 1.97% and a daily gain of 3.5%, temporarily trading at $69,212 USD; Ethereum briefly surpassed $3600 USD and is now trading at $3623 USD with a daily gain of 2.75%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

Summarizing the "holistic reconstruction of the privacy paradigm" from dozens of speeches and discussions at the Devconnect ARG 2025 "Ethereum Privacy Stack" event.

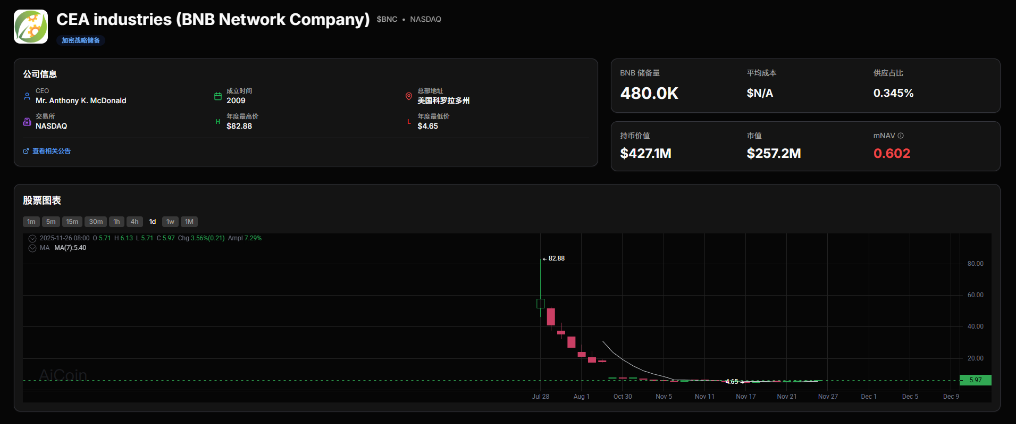

Shareholder Revolt: YZi Labs Forces BNC Boardroom Showdown

Halving Is No Longer the Main Theme: ETF Is Rewriting the Bitcoin Bull Market Cycle

The Crypto Market Amid Liquidity Drought: The Dual Test of ETFs and Leverage