Bitwise Chief Investment Officer: A portfolio of BTC and ETH can yield greater returns and less downside volatility than investing solely in BTC

ChainCatcher news, according to CryptoPotato, Bitwise Chief Investment Officer Matt Hougan stated that a properly diversified BTC and ETH portfolio can yield greater returns and less downside volatility than investing solely in Bitcoin.

Hougan provided three reasons why this might be a good idea. First is for diversification of investments. As predicting the future of cryptocurrencies is difficult, holding shares in both major assets can provide investors with protection in case one asset falls out of favor or consumes the other over time; secondly, the inherent differences between Bitcoin and Ethereum make choosing between them challenging. While Bitcoin aims to be a "better currency", Ethereum strives to become a "programmable currency" capable of enabling stablecoins and DeFi among other blockchain applications; finally, historical performance of these two assets indicates that they perform best when balanced within an investment portfolio.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

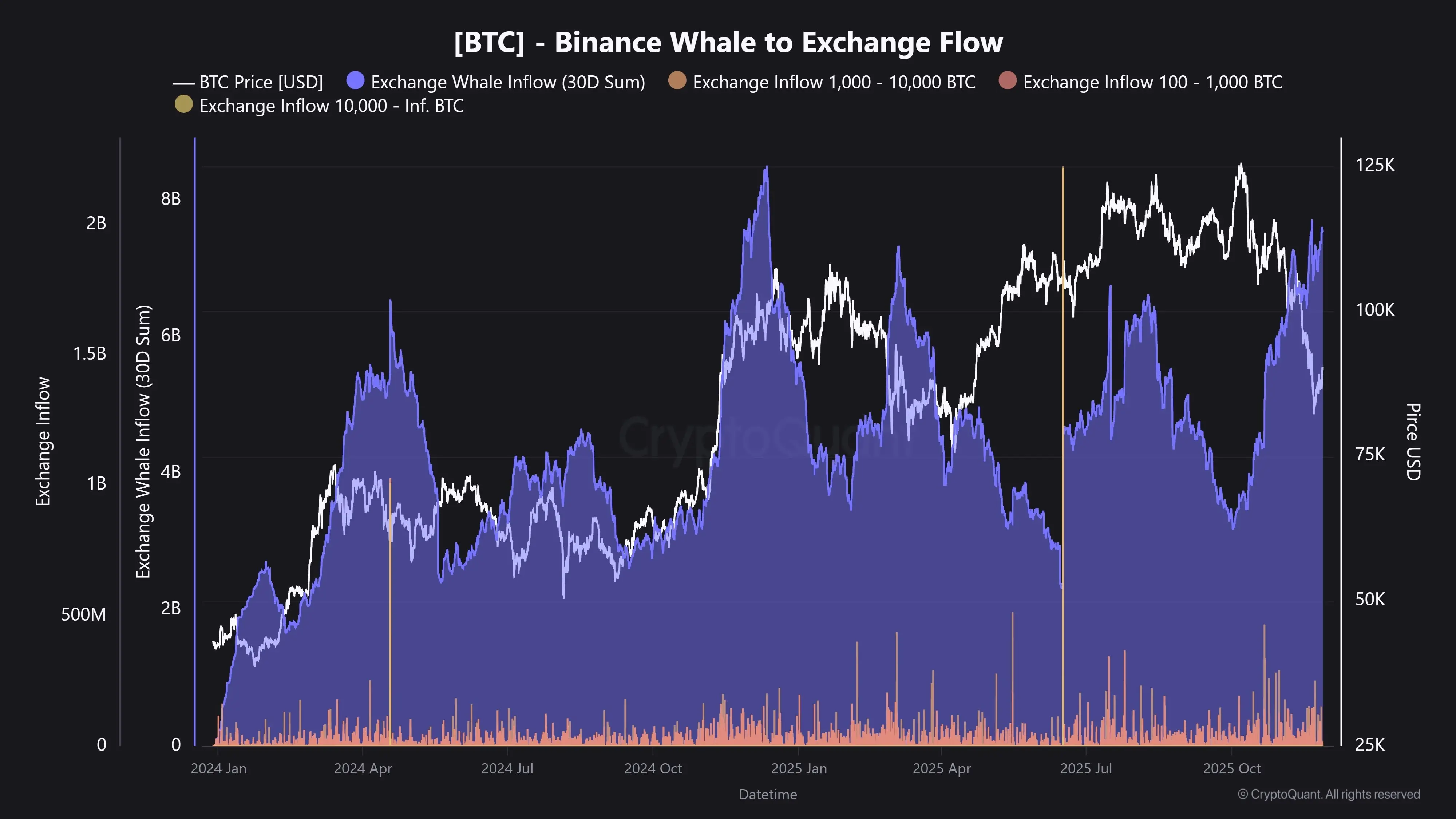

CryptoQuant: Whales have deposited approximately $7.5 billion worth of BTC to a certain exchange in the past month

Today, BTC options with a notional value of $13 billion expire, with the max pain point at $98,000.