Why the US Presidential Election May Matter for Bitcoin Price

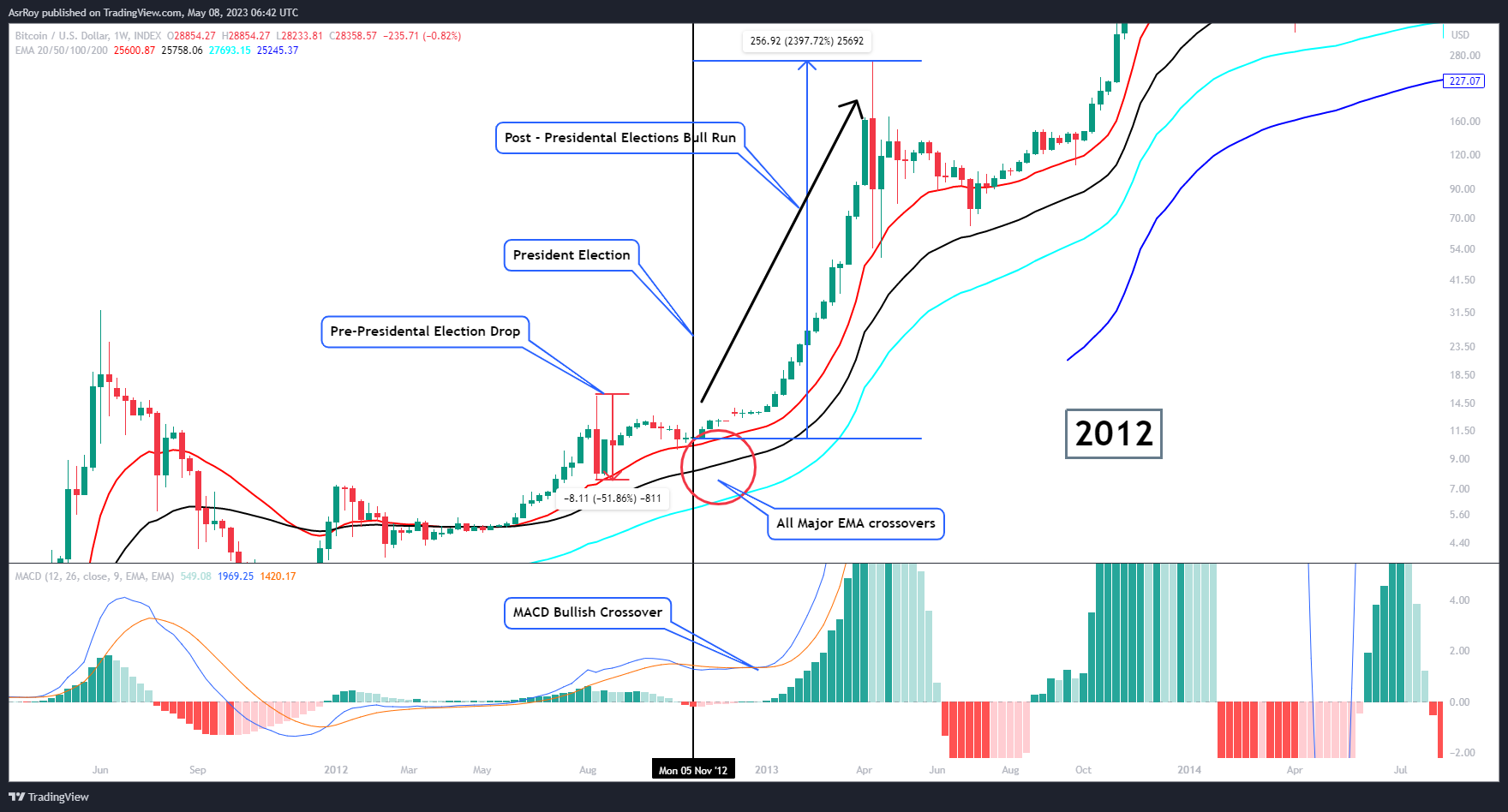

Crypto analyst Aditya Siddhartha links one of the most significant Bitcoin (BTC) uptrends that occurred in 2012 to the US presidential election.

Сидхарта noted , that Bitcoin's 2012 bull run was preceded by a significant 52% price drop. However, after the bullish MACD crossover and all the major exponential moving average (EMA) bullish crossovers, the market started to gather momentum, starting an upward march.

In 2012, the MACD and EMA indicators provided positive signals, boosting investor confidence and fueling a surge in demand for BTC. This led to a bull run after the presidential election, with the price of Bitcoin increasing by an impressive 11,800%.

Similarly, in 2016, the price of Bitcoin fell 41% before the presidential election. After the bullish MACD crossover and all major bullish EMA crossovers, the market gained momentum, leading to a new uptrend.

READ MORE:

How Exchange Traded Funds Can Manipulate Bitcoin PriceAfter the election, the price of Bitcoin rose by 2,800%, which was driven by increased demand from investors and growing awareness of Bitcoin's potential as a store of value and digital asset.

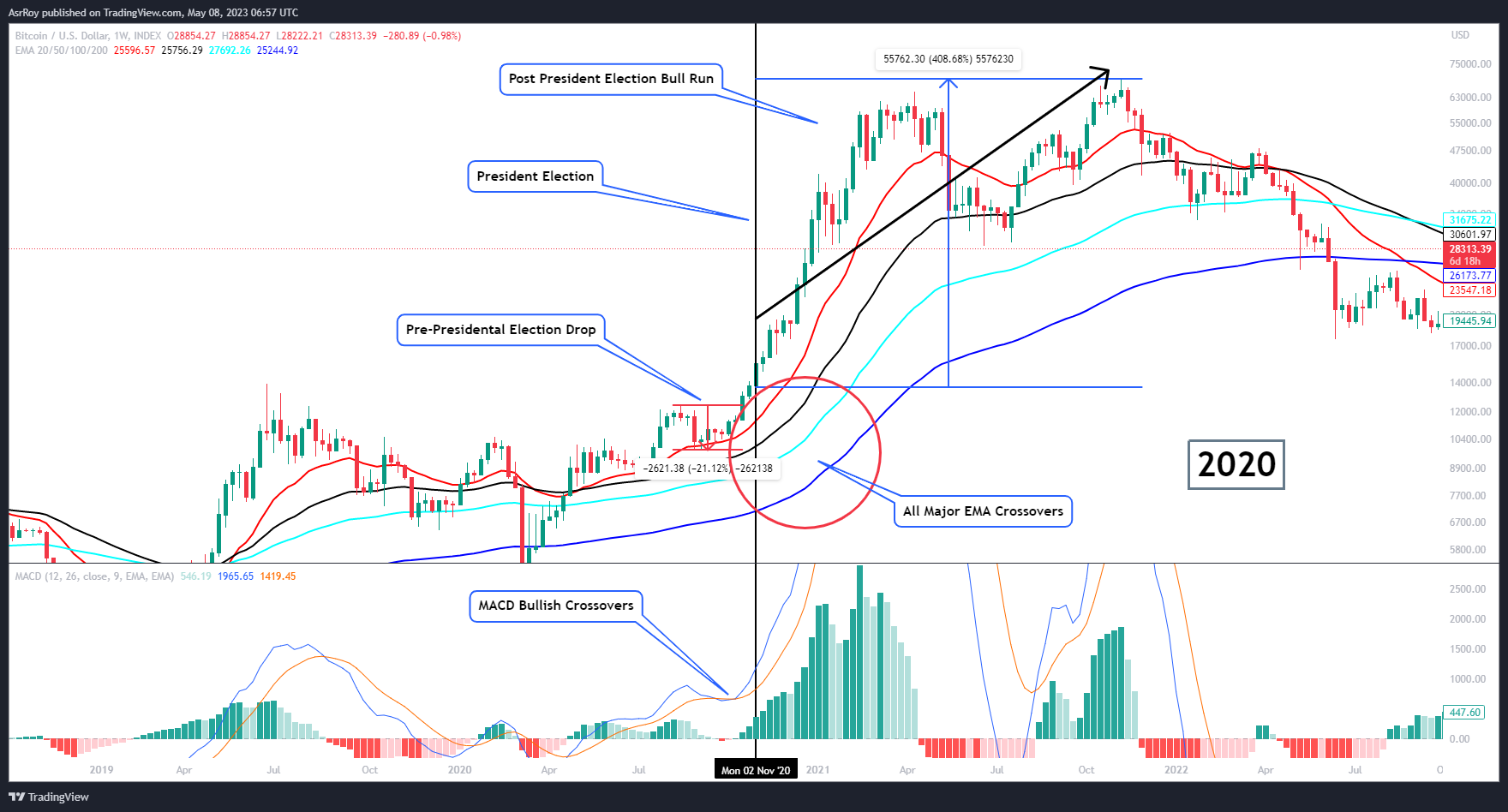

In 2020, Bitcoin saw a 22% drop before the presidential election, which was largely due to the uncertainty surrounding the election results and their potential economic impact. After the election, however, the price of Bitcoin saw a 410% increase.

After the elections scheduled for this year, the analyst predicts that the MACD bullish crossover and all major EMA bullish crossovers will once again signal positive market movements, increasing investor confidence and demand for Bitcoin. He expects that after the election, the price of Bitcoin could rise to the $180,000-$200,000 range.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve officials divided on December rate cut, at least three dissenting votes, Bitcoin's expected decline may extend to $80,000

Bitcoin and Ethereum prices have experienced significant declines, with disagreements over Federal Reserve interest rate policies increasing market uncertainty. The mainstream crypto treasury company mNAV fell below 1, and traders are showing strong bearish sentiment. Vitalik criticized FTX for violating Ethereum’s decentralization principles. The supply of PYUSD has surged, with PayPal continuing to strengthen its presence in the stablecoin market. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

"Sell-off" countdown: 61,000 BTC about to be dumped—why is it much scarier than "Mt. Gox"?

The UK government plans to sell 61,000 seized bitcoins to fill its fiscal gap, which will result in long-term selling pressure on the market.

A $500,000 lesson: He made the right prediction but ended up in debt

The article discusses a trading incident on the prediction market Polymarket following the end of the U.S. government shutdown. Star trader YagsiTtocS lost $500,000 by ignoring market rules, while ordinary trader sargallot earned more than $100,000 by carefully reading the rules. The event highlights the importance of understanding market regulations. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Vitalik's "Can't Be Evil" Roadmap: The New Role of Privacy in the Ethereum Narrative

While the market is still chasing the ups and downs of "privacy coins," Vitalik has already placed privacy on the technical and governance roadmap for Ethereum over the next decade.