Bitcoin Whales Buy the Dip, Signaling Potential Bullish Momentum

Large crypto holders are aggressively purchasing Bitcoin amid market dips, as new data from CryptoQuant shows.

In 2024, Bitcoin withdrawals from exchanges have reached unprecedented rates. Over 46,000 BTC, worth more than $2.6 billion, have been moved off exchanges on July 5, indicating a shift towards long-term holding.

This trend suggests optimism for Bitcoin’s price. Whales are betting on a future rise, even as many investors sell in panic, favoring long-term investment over short-term volatility.

Significant outflows from spot and derivatives exchanges indicate a reduction in risk exposure. Moving Bitcoin to private wallets points to a strategy focused on stability and future gains, potentially reducing market volatility.

The increased activity from whales, despite recent price drops, is a positive indicator for Bitcoin’s future. Observing these significant investors betting on a price increase is promising for the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who is rewriting the US dollar? The real battlefield of stablecoin public chains

Stablecoins are no longer just "digital dollars," but rather the "operating system" of the dollar.

Canton token CC to be listed, US CPI may be absent for the first time

Subscribe with one click to stay updated on the most noteworthy industry events and major project developments in the coming week, and keep your finger on the pulse of the market anytime, anywhere.

Trump's "Bitcoin Superpower" Plan: America's Monetary Hegemony Is Entering a New Crypto Phase

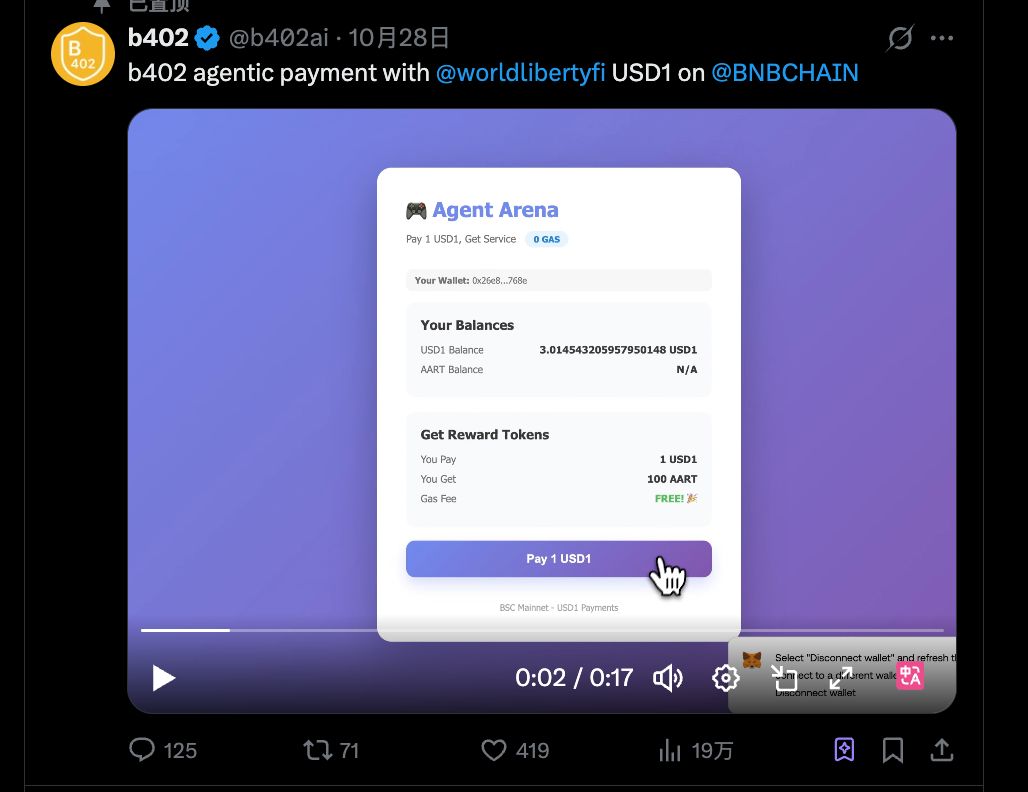

Interpretation of b402: From AI Payment Protocol to Service Marketplace, BNBChain's Infrastructure Ambitions

b402 is not just an alternative to x402 on BSC; it could be the starting point for a much bigger opportunity.