SEC Gives Preliminary Nod to Ethereum ETFs, Trading Set to Start Soon

The U.S. Securities and Exchange Commission (SEC) has tentatively approved at least three of the eight asset managers planning to introduce spot Ethereum ETFs.

These ETFs are expected to start trading next Tuesday, according to a Reuters report . The approval is contingent on the applicants submitting their final offering documents to regulators by the end of this week. One source mentioned that all eight ETFs are likely to launch simultaneously.

Most of the firms had introduced spot Bitcoin ETFs in January, concluding a decade-long conflict with the SEC, which had previously rejected these products due to concerns about market manipulation.

However, the agency had to approve the ETFs following a court ruling in favor of digital asset manager Grayscale Investments, despite issuing warnings about their high risk.

READ MORE:

SEC’s Closed-Door Meeting Thursday Could Determine Ripple’s FutureThe launch of these ETFs was one of the most successful in the history of the ETF market, with the nine new products accumulating approximately $6.6 billion in assets within the first three weeks of trading, according to Morningstar Direct data. By the end of June, the ETFs had seen a net inflow of $33.1 billion.

At the time of writing Ethereum is trading at $3,430 after a 5.86% surge in the past 24 hours and is up 13.75% on the weekly chart.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

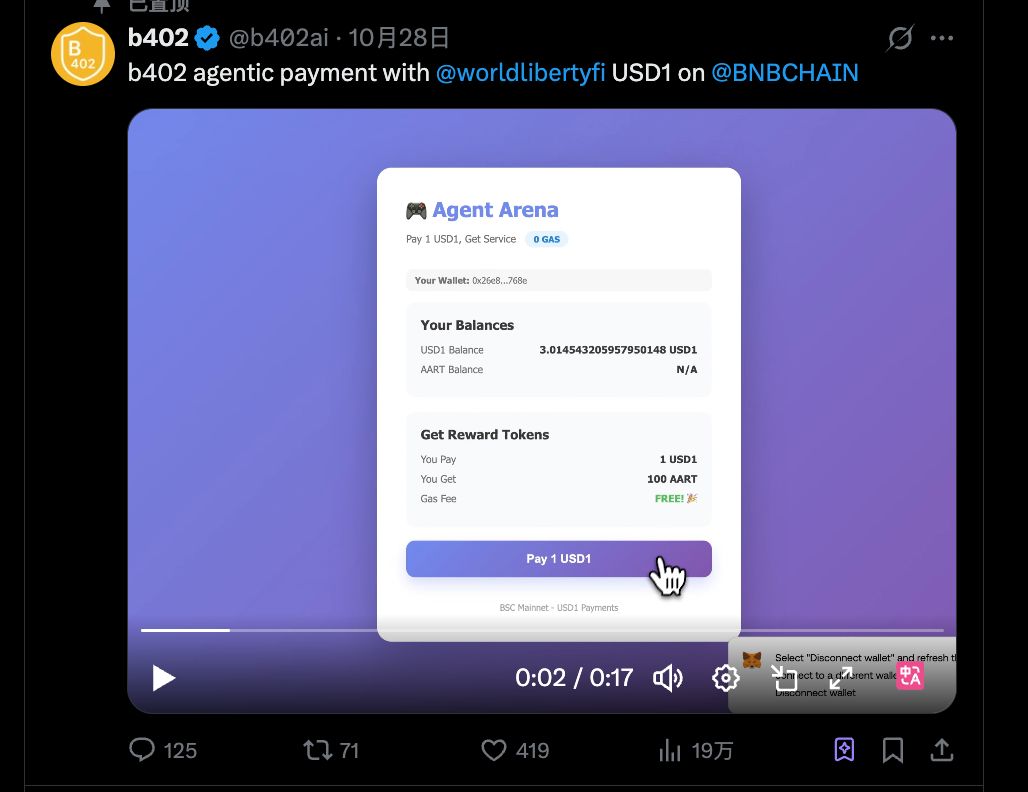

Interpretation of b402: From AI Payment Protocol to Service Marketplace, BNBChain's Infrastructure Ambitions

b402 is not just an alternative to x402 on BSC; it could be the starting point for a much bigger opportunity.

Shutdown Leaves Fed Without Key Data as Job Weakness Deepens

Institutional Investors Turn Their Backs on Bitcoin and Ethereum

Litecoin LTC Price Prediction 2025, 2026 – 2030: Can Litecoin Reach $1000 Dollars?